By KC Karnes, April 21, 2021

The fintech industry is having a moment, and it’s likely to last for many years. At the beginning of 2021, Fintech startups recorded ten deals worth $100 million or more compared to three deals in the same period in 2020. In a single week, fintechs announced almost $2 billion in startup funding.

The industry is evolving quickly, and the numbers show the demand and interest from investors and consumers are paying off. Yet even before the pandemic, the adoption of digital and contactless payments was disrupting a historically traditional industry and way of banking.

With all this chatter on what the fintech industry will do next, particularly through mobile technology, the team at CleverTap wanted to know: “What makes a great Fintech app?”

Our in-depth analysis of the top fintech apps unveiled winners in key categories such as App Store Optimization (ASO), key features, colors/logos, marketing, and user retention. Here are four apps to learn from that are gaining momentum and downloads.

App Store Optimization (ASO) has impact

The Fintech industry has traditionally followed the same path. There’s a reason that payment apps feature blues and greens. Blue is a calming, reassuring color, and green represents money, health, and growth. However, just because you’re in fintech doesn’t mean you have to stay within these parameters and follow apps before you. We recommend you forge your own path.

This ‘think outside the box mentality is important when making first impressions, especially in the App Store. According to our research, three-quarters (73%) of new Fintech users churn within a week, so it’s vital to stand out from the crowd.

One example of successful App Store optimization: Cash App. What’s interesting about this app’s approach to enticing users is that it begins even before you visit the App Store. Cash App has designed a dedicated Bitcoin landing page that tells the captivating story of Satoshi Nakomoto, the presumed inventor of Bitcoin, with bold, dynamic colors and illustrations. As you scroll through the story, you learn more about cryptocurrency, and at the end, a clear call-to-action pops up to download the app.

It’s clear that impressions matter here because a good First Impression increases conversions by 35%. Cash App uses its innovative and creative approach across the App Store with a wide range of colors, including the trusted green in the logo. Each image with the preview successfully showcases the app’s features.

For apps that are new to ASO, we recommend A/B testing to analyze how users, both new and existing, feel about the colors you use. Don’t be afraid to test new colors and keep an eye on apps like Cash App to learn from some of the best apps.

User retention matters

All users – new and existing – are integral to an app’s success. While ASO plays a vital role in downloads and conversions, the think outside the box approach should continue throughout the user journey. With app behavior evolving daily, developers must adapt accordingly and demonstrate value regularly to prevent churn.

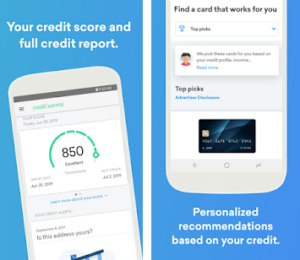

What is one way to demonstrate this value? Offer tools outside your main products like Credit Karma. Going back to 2017, the financial brand, known for short-term loans, proved that free tools could attract millions of users, and it paid off in traffic. That year, more than 30% of Credit Karma users came for the free tools, not its main product.

Even four years later, if you search for either of these tools, Credit Karma ranks number one for both. From the beginning, the company offered tremendous value to the user, even without monetization. Credit Karma identified pain points and answered questions that many people have about their finances.

This clever plan brought in five million monthly visitors from Google in 2017, and the numbers haven’t dropped: as of March 2021, it had 3.3 million App Store ratings. While app ratings are only one metric to monitor, it’s clear that Credit Karma successfully built credibility that resulted in potential upsells. For apps looking to strike a balance, we recommend offering free and paid tools. Bottom line: if you demonstrate value in those first hours or days and align with trends, users won’t hesitate to pay for the full app experience.

Features drive traffic

Like most things in life, bells and whistles can get a user’s attention, but if there is not enough substance to your app, the dropoff rate can be high. Developers must stay ahead of the curve, and innovation is a great way to keep your users’ attention.

You’ve probably heard of Ally Bank, but what about Ally Bank Lab? Launched in 2018, this small team works on special projects relating to new product development and service launches. The group sends representatives to talk to customers and non-customers about their financial goals and plans to help gather critical insights.

This means that Ally Bank can roll out features that customers want and need to meet their financial goals. The experts can make informed decisions on behalf of customers. Here are two app features that that answer those financial needs and showcase value:

- Buckets: Savings account customers can create ten savings goals without extra accounts and earn interest on the total account balance.

- Boosters: This feature does more than offer tips. Surprise Savings analyzes a customer’s spending habits and identifies areas where they could save more.

Customer service should not be viewed only as a service because it’s crucial to success at every customer journey stage. Whether you create a dedicated customer service team like Ally Bank, commission surveys, host virtual focus groups, or all three, customers care about (and rate) every aspect of the app experience.

Marketing & transparency

It’s official: the buy now, pay later (BNPL) movement has reached Americans. More than one-third of US consumers have used this service. Brands like Klarna lead the charge, and marketing has played a role in getting customers on board. However, what happens when a marketing mistake is the reason customers are taking notice of your brand? In the case of Klarna, you own up to it and learn from this mishap.

Last October, customers went to social media to complain about receiving Klarna’s newsletter despite never signing up for or using the service. With millions of monthly active users, this ‘human error,’ as Klarna admitted, left customers not only confused but asking an important question: how did you get my data?

We are all guilty of not always reading the T&Cs or privacy notices, but this does not give apps permission to be irresponsible with customer data. According to Pew Research, almost 80% of US adults are ‘somewhat’ or ‘very’ concerned about how companies use their personal data.

This stat highlights the vulnerability on both sides of the app, which is why brands need to earn a customer’s trust continually. Be transparent about permissions and personal data and how these are used in current and future marketing campaigns. One of the most important things: give customers the opportunity to opt-in and opt-out.

A winning formula

Your brand must serve as a strong resource for customers, both new and existing. You can’t just tread water. The winning formula – onboarding + user retention + features + marketing = fintech success. Everything adds up to success. If you need more inspiration, check out our infographic that visualizes all the essential information and tips on what makes a great fintech app.

KC Karnes is the Head of Content Marketing at CleverTap. With more than a decade of tech marketing experience, KC leads a team of experts specializing in creating dynamic content for global marketers in leading industries such as fintech, e-commerce, and media and entertainment.

Check out these recent fintech stories featured on PaymentsNEXT:

FICO-free TomoCredit Mastercard launches

Payment, Non-bank Lenders Loan More Than Traditional Banks

A Bank for Squares? Dorsey Says Definitely

LET’S CONNECT