By Jeff Domansky, April 19, 2021

April is National Financial Literacy Month in the US, and we can all forget about the fear of missing out (FOMO) on financial literacy.

It looks like most consumers have a massive fear of financial literacy, according to research from the financial app Cushion.

In fact, 55% of Americans aren’t sure how much money is in their bank account at any given moment — and new data suggests it’s because they’re too afraid to find out.

Stephen Leacock had it right when he wrote in “My Financial Career” in 1905:

“When I go into a bank, I get rattled. The clerks rattle me; the wickets rattle me; the sight of the money rattles me; everything rattles me. The moment I cross the threshold of a bank, I am a hesitating jay. If I attempt to transact business there, I become an irresponsible idiot.”

~ Stephen Leacock, “My Financial Career“

Covid enhanced fear of finances

It looks like little has changed in more than 100 years when it comes to a fear of money. Maybe even more so with the advent of digital payments.

A survey of 2,000 US consumers found 59% often feel an intense anxiety spike just before checking their bank account. For a similar number of people (60%), living through the COVID-19 pandemic has made that moment feel even worse than it did previously.

It’s no surprise that overdraft fees cause stress for 33% of respondents, second only to the number of people who feel similarly towards ATM or bank withdrawal fees (38%).

In fact, on average, respondents lose $48.31 a year in ATM fees and are willing to go up to 16 minutes out of their way to avoid those charges.

$8 million saved by Cushion savings app

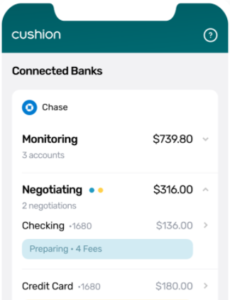

Consumers can fight those bank fees and the stress of financial penalties.

“If you overpay for your electricity or get hit with an overdraft fee, you can do something about it. People tend to shy away from negotiating bills and fees because it can be time-consuming and exhausting. As a result, they leave money on the table,” says Paul Kesserwani, founder and CEO of Cushion. “Most things are negotiable. Banks, retailers, and billers would rather give you money back than lose you as a customer altogether.”

Kesserwani started the Cushion app in 2018 after discovering $400 in fees on his accounts and had to spend days of his time to get the fees reduced. For a small annual fee between $36-$96, the company will use its AI to negotiate a reduction or return of fees. Cushion has saved consumers more than $8 million in bank and credit card fees since launching.

Researchers found 40% of consumers have asked for or demanded a discount from a service provider to save money, compared to only 27% who’ve called to argue over a charge.

So with a little bit of AI help and some gumption, it’s possible to fight back against fees and penalties.

The only thing we have to fear is financial fees

The research turned up a few more interesting facts about financial fees. We’re stressed about them!

For example, Americans are surprisingly confident in their ability to guess their bank account balance off the top of their heads. While only one in five people (19%) bet they’d know their exact bank balance, 84% think they could get within $200 or closer.

How about payments? Only 15% use automatic payments or “autopay” for regular expenses — including twice as many people on semi-monthly income schedules (27%) compared to weekly (14%) and biweekly ones (13%).

When you get paid also seems to affect your fear of finances.

Those on weekly income schedules were most likely to feel anxiety before checking their bank account (80%), followed by those on bi-weekly (65%) and semi-monthly (55%) schedules.

Consumers who get paid weekly worry most about making the minimum payment on their credit cards (68%) compared with the overall average (41%).

“It’s no surprise that employees who get paid weekly are more stressed about their finances right now,” adds Kesserwani. “Most of these folks are paid by the hour with no guarantee that they will make enough money each week to cover their bills. Income volatility, especially during the age of COVID-19, paired with financial and emotional stress inhibits these workers from advocating for themselves, whether it’s against banks, billers, creditors, or otherwise.”

Will that be cash or cashless?

It appears the neo-banks, buy now pay later, and digital bank disruptors are listening to consumer complaints about bank and credit card fees. They’re signing up record numbers of new account holders with their “no fees” pitches, and traditional banks are slow to respond.

There is one note of caution from the Cushion research report regarding the evolving cashless society.

“Regardless of how they get paid, three out of five (66%) agree that if it were possible to do so, they would only use cash for the rest of their lives and never bother with another financial institution again,” the report notes.

Leacock finished his funny financial story with his character immediately withdrawing the funds he just deposited:

“As the big doors swung behind me, I caught the echo of a roar of laughter that went up to the ceiling of the bank. Since then, I bank no more. I keep my money in cash in my trousers pocket and my savings in silver dollars in a sock.”

Thank heavens. You don’t need to deal with bank tellers with your digital bank, just the occasional Bot. The nagging question at the back of my mind these days is, will we fear fintech just as much as banks in the future?

More posts from PaymentsNEXT about digital banking:

Do we need Instacart & DoorDash credit cards?

New banking app hopes to be the One for middle-class Americans

Remaking banking services after the pandemic

LET’S CONNECT