Spring still seems far away in many parts of the country, so let’s warm up with the best of this week’s global payments news. Research from CompareCards.com says consumers are still looking for more credit card rates protection. Apple and Goldman Sachs have teamed up with a new iPhone/credit card with money management features. Speaking of millennials, when it comes to credit cards, a new report shows they’re different than the rest of us. Surprised?

Biometrics may be a little slow out of the starting gates in North America, but they are definitely the future of payments. Updated US holiday retail sales were lower than believed, now that data has been analyzed after the US government shutdown. BOPIS is growing fast for merchants with omnichannel sales. DoorDash secures $700 million in new funding and competitors in the delivery business are looking nervous. Walmart e-commerce sales grew 43% in 2018, no doubt getting a closer look by Amazon. All that and more in our latest global payments news roundup.

Consumers want more credit card protection

Ten years after President Barack Obama signed the Credit Card Accountability, Responsibility and Disclosure Act of 2009 (Credit CARD Act), research by CompareCards.com shows consumers want more credit card protection. The act provided some key consumer protections. It limited banks’ ability to increase interest rates on existing credit card balances, required consumers under age 21 to have a co-signer or proof of income, restricted banks’ ability to charge overdraft fees, and increased disclosure requirements. Read more…

Apple and Goldman Sachs to unleash iPhone/card combo

Goldman Sachs has teamed up with Apple to issue credit cards paired with iPhones for improved money management. According to the Wall Street Journal (WSJ), citing people familiar with the matter, the card, which will be linked with Apple’s Wallet app, will allow users to set spending goals, track rewards, and manage balances. This follows on from May 2018, when news filtered out that they were planning to launch this new credit card. Read more…

Pay it down: How millennials’ relationships with credit cards will change retail

In the spring of 2018, omnichannel analytics firm Euclid released a report that revealed that millennials represent $200 billion in spending power and are soon projected to overtake Baby Boomers as the largest generation in the United States when it comes to purchasing. What millennials may not have, though, is a credit card. A 2016 survey by Bankrate.com revealed that only 33% of adults aged 18 to 29 own a card. Read more…

Biometrics drive the future of payments

Although using biometrics to make purchases is still far from the norm in North America, the practice is gaining ground quickly in other countries. In China, biometric payments have even become the norm for many retail events. Last year, Alibaba pulled in a staggering $30.8 billion on Singles’ Day, an amount bigger than Black Friday and Cyber Monday sales combined. In 2018, 60.3% of Singles’ Day customers paid by scanning their fingerprint or taking a selfie. Read more…

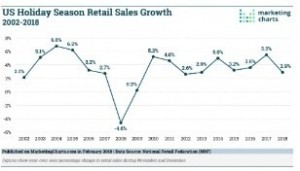

Holiday 2018 data hub (updated): Results recap

By some accounts it was a strong holiday season. But after a delay in reporting its holiday season growth estimates as a result of the government shutdown (which curtailed Commerce Department reporting), The NRF’s figures aren’t quite so heartening for the industry. the figures released last week – about a month later than usual – indicate that retail sales over November and December grew by just 2.9% to $707.5 billion last year, far below the forecast growth rate of 4.3-4.9%. Read more…

BOPIS: State of the Industry

A great point of change in Retail is the evolution of Buy Online Pickup In-Store (BOPIS). Although not all retailers are on board with the new trend, many are, from which we can draw out a few best practices. But even among these top US retailers there is room for growth. For example, out of 300 site visits, we found that 24% of BOPIS orders were NOT ready for pickup even after pickup notifications were sent! S is o, what else do our top 10 US retailers do really well when it comes to BOPIS? Where are they falling flat? Read more…

DoorDash will put an end to old-school delivery – and smaller rivals

Just a couple of weeks after rival Postmates filed to go public, on-demand delivery service DoorDash announced a $400 million Series F, valuing the company at a whopping $7.1 billion. What does the big money mean for the crowded on-demand delivery space? The market is growing as a whole, but there isn’t all that much growth share to go around. DoorDash CEO and founder Tony Xu has said as much. Read more…

Walmart e-commerce sales grow 43%

Walmart e-commerce sales in the quarter grew 43%, just ahead of the 40% year-over-year growth. The company also reiterated the guidance it gave during its investors meeting in October regarding fiscal 2020. The company anticipates comp sales growth of 2.5% to 3%, around 1% at Sam’s Club, and e-commerce growth of about 35% at Walmart US. Read more…

The seven deadly sins of retail

The retail industry of today is a hyperactive and ever-changing environment, ripe with emerging technologies, competition, and an opportunity for those able to navigate through the waters of uncertainty. Retailers today not only need to be able to see through the smoke of change to determine the best path forward but also need to avoid the most common mistakes that have marked the end for past retailers. Here are seven deadly sins to avoid in today’s retail environment. Read more…

LET’S CONNECT