US tax deadlines are near, but our global payments news roundup will give you a welcome distraction. We’ve got a look at worldwide digital commerce trends from 2Checkout, a snapshot of payments industry mergers and acquisitions, highlights of convenience store sales for 2018, and Amazon’s response to the cashless payments bans.

Plus, an overview of the EU payments market, new EU mobile payments fraud regulations, mobile payments and e-wallets in China, Walmart e-commerce growth, identity authentication on your desktop and much more payments news you can use.

2Checkout report highlights 2019 global digital commerce trends

A new report from 2Checkout shows an increase in global digital commerce sales of software, SaaS and online services as well as growth in sales of subscriptions for these products and services. 2Checkout analyzed millions of customer transactions on its global platform between March 2018 and February 2019 to identify several key findings. Read more…

Mergers & acquisitions in the payments industry: a quarterly roundup

Many deals have been closed throughout 2018 in the payments industry and based on the latest events that made headlines in the first quarter of 2019, the ecosystem is more and more looking for consolidation and collaboration. Either we are talking about takeovers or mergers, solution providers have grasped the need for a strong combination of capabilities to fight the current challenges, which now consist of meeting customer expectations, fighting sophisticated fraud, expanding their footprint into new geographies, and innovating. Read more…

Venture fund 500 Startups says there are four new ‘tigers’ for mobile payments

Mobile payments will be the “backbone” for the future of services such as e-commerce, gaming, or ride sharing, according to Edith Yeung, partner and head of China at 500 Startups. On CNBC, she said there were four cities to watch out for in the field of mobile payments: Jakarta, Singapore, Shenzhen/Hong Kong, and Hangzhou. “I think these four cities are sort of the … new four tigers,” Yeung said. Read more…

Amazon exec tells employees that Go stores will start accepting cash to address ‘discrimination’ concerns

Amazon Go stores, which let customers buy items without waiting in checkout lines, will start accepting cash, amid intensifying criticism that the company is discriminating against the unbanked. In an internal all-hands meeting last month, Steve Kessel, Amazon’s senior vice president of physical stores, told employees that the company plans to add “additional payment mechanisms” to its Go stores. Read more…

Convenience store sales up 8.9% to $654.3B in 2018

It looks like things are looking up at the corner convenience store these days according to a recent annual report of the NACS. Convenience stores sales make up 3.1% of US gross domestic product of $20.5 trillion and despite increasing costs, record in-store and fuel sales led to last year’s positive industry growth. Read more…

Europe: a rich and diverse payments market

In France, instant payment has led to many debates for instance in the field of business models, use cases and place in the market in relation with other tools, like payments cards. The situation is very different in other European countries such as in the Netherlands where instant payment appears like “the new normal” thanks to consumers’ habit and the success of iDeal. We can also mention the case of the UK, with Faster Payment, and Northern European countries, more linked to digital uses, which is not yet the case in other markets. Read more…

EU approves laws targeting mobile payment fraud

New EU rules to tackle non-cash payment crimes were approved by the European Council and will become law, with member states given two years to bring national regulations into line. The rules require EU states to recognize, investigate and punish a range of specific offenses related to scams and fraud of non-cash payment systems including mobile payments. Read more…

JPMorgan adds EU instant payments with SEPA

JP Morgan has been offering real-time payment processing opportunities to its customers in the US for over a year. This week, JPMorgan added European instant payment services for its clients with the launch of SEPA Instant in the EU. This makes it the first bank to offer real-time payment services in USD, GBP, and EUR. Read more…

China m-pay users to hit almost 1B by 2023

Mobile payment user numbers in China are expected to top 950 million by 2023, Frost & Sullivan forecast, with potential growth drivers including improved availability in rural areas and increased usage among elderly consumers. The analyst house’s prediction represents strong growth on the 562 million users it reported in 2017. Annual total transaction value is expected to increase from $29.9 trillion in 2017 to $96.7 trillion by 2023. Read more…

Walmart’s US e-commerce revenue grows 40% in 2018

Walmart Inc. posted strong holiday sales for the fourth quarter ending Jan. 31, with e-commerce through Walmart U.S. operations growing 43% during the prior three months compared to the prior year’s fourth quarter. For the full year, the mass merchant’s online sales in the U.S. grew 40%. Read more…

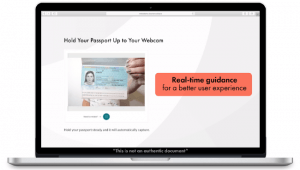

Mitek launches identity verification on desktop

While identity verification using mobile devices is well established, Mitek just upped the game for financial businesses and companies wanting to provide desktop verification for customers as well. Mitek’s mobile auto-capture technology can now be enabled on desktop devices with the same high-quality capture and digital identity verification used by millions of customers around the world. Read more…

LET’S CONNECT