By Jeff Domansky, Feb 26, 2021

The UK fintech business is big for a midsize nation. It contributes $15.5 billion to the UK economy annually and holds around 10% of the global fintech market.

A new report on Britain’s fintech industry, commissioned by the Chancellor of the UK, was released today. It said that the UK’s prominent position could be at risk without more support for the industry by the government.

Oxford University said half a million EU citizens left the UK in 2020, the majority from London. Brexit is a big contributor to this talent loss.

UK chancellor Rishi Sunak has pledged to support the industry and these recommendations in a new budget to be released next week.

Payments leader authored report

The UK government hired respected British entrepreneur Rohinton “Ron” Kalifa, OBE, to carry out an independent review of the fintech industry and how to retain its global leadership.

Kalifa formerly built and led the Worldpay division of RBS (now NatWest Group) as CEO and Vice-Chair. He now serves as Chairman of Network International, a payments group operating in Africa and the Middle East, and Chairman of the British educational technology platform FutureLearn. Kalifa is also a non-executive director of the Bank of England.

His report has got the attention of the industry, government leaders, and Prime Minister Boris Johnson. The industry seems solidly behind many of its recommendations.

UK fintech leadership

The report showed fintech is a strong contributor to the British economy:

- It represents 10% of global market share and $15.5 billion in annual revenue.

- The total tech spend by UK financial services firms was $132.5 billion in 2019.

- UK citizens are digitally active, and 71% now use the services of at least one fintech company.

- Investment in UK fintech reached $4.1 billion in 2020 – more than the next five European countries combined.

Fintech has helped the British economy, consumers, and UK banks jump into the digital age.

Kalifa report recommendations

Kalifa’s report lays out a strategy to help the country’s financial technology firms scale up, access the talent and finance they need, and deliver better financial services for the future.

The recommendations include five critical areas for support:

- introducing a new ‘fintech scale up’ visa route for specialists from around the world

- implementing a ‘scale box’ to provide regulatory support for growing firms

- improving UK listings rules with free float reduction and dual-class shares

- creating a $1.4 billion fintech’ growth fund’ to help firms grow independently as well as expanded R & D credits, enterprise investment schemes, and venture capital trusts

- establishing a private sector-led Centre for Finance, Innovation, and Technology to support national coordination and growth in fintech across the UK.

“Britain has a proud record of starting-up and scaling-up some of the best-known fintech products, but we cannot rest on our laurels. The next powerhouses will not be created by accident,” Kalifa says. “We must continue to nurture our start-up culture, but crucially we must also give our high growth firms the support to become global giants.”

The report recommends new skills training with low-cost, high-quality retraining and “upskills” for adults; embedded work placements for students and kickstarters; and a new visa program to enhance global talent access fintech scale-ups.

National & international strategies

The Kalifa report highlights the growing challenge from overseas competitors in Singapore, Australia, and Canada, where governments invest in capital, skills, and direct support for fintechs. It also highlights Brexit uncertainty the impact of COVID as both challenges and opportunities.

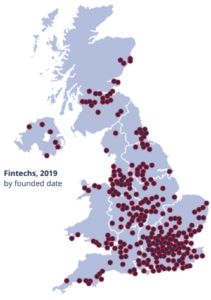

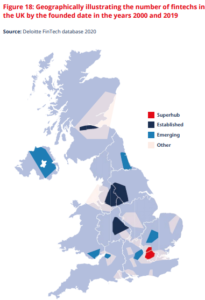

Kalifa encourages government investment to nurture the country’s existing top 10 fintech clusters in London and promotes these critical growth incubators’ interconnectivity.

To improve international competitiveness, the report recommends a global action plan through a “Fintech Credential Portfolio” (FCP) to support international credibility and increase ease of doing business. It also suggests more national cooperation and the launch of an International Fintech Taskforce.

“With the right reforms that encourage entrepreneurialism, investment and make it easy to attract and invest in talent, Britain can usher in a period of dominance that can help us build back better from Covid-19,” Kalifa adds.

Industry supports recommendations

The fintech industry actively supports the recommendations, evident in comments from industry leaders including:

- “The Kalifa review offers a roadmap to achieving this. We welcome the review’s recommendations, including its call to maintain access to the global talent that is so essential to fintech’s success in the UK, and urge government to support its recommendations and help turbocharge this vibrant sector.” ~ Catherine McGuinness, Policy Chair of the City of London Corporation

- “The Fintech Strategic Review sets out a clear vision to keep the UK at the forefront of global fintech, and support the recovery by embracing the digital economy.” ~ Guillaume Pousaz, Checkout.com Founder and CEO

- “It’s great to see the Treasury seeking to support and improve the UK’s position on the world stage as a growth platform for tech companies in financial services. This review, conducted by Ron Kalifa, is a brilliant opportunity to keep modernizing the regulatory environment. This should lead to even more competitive products and better services for consumers, both here in the UK and beyond the borders. ~ Kristo Käärmann, Wise CEO

- “At Monzo, we are proud to be part of an industry that is always working to change finance for the better and give consumers more options. It is why we are supportive of these recommendations which would help the next generation of financial technology companies get off the ground while enabling established companies, like Monzo, to take it to the next level.” ~ TS Anil, Monzo CEO

- “The pandemic has accelerated the adoption of online lending and shown how critical FinTech lenders are in supporting SMEs. We believe this shift is permanent, and the sector will have a vital role to play in the UK’s national recovery.” ~ Lisa Jacobs, Funding Circle Europe Managing Director

This report is a valuable blueprint for the fintech industry, venture capitalists, and government policymakers in developed and developing countries. As US regulators ponder the future for big tech and the fintech future, the Kalifa report should also be required reading.

You can read the executive summary of the Kalifa Review of UK Fintech here or the full report here.

Read more PaymentsNEXT stories on fintech developments:

LET’S CONNECT