By Rob Lincolne, founder and CEO, Paydock, Dec 8, 2020

When Square launched in 2009, they often spoke of the ‘Hidden cost of accepting cash.’ Articulating reconciliation, banking, and administrative inefficiencies (not to mention theft) contemporary thinking at the time referenced the value of non-cash payment solutions to SMEs to help avoid these costs and underpin the business case for non-cash point-of-sale.

As cash displacement continues (cash payments now only 23% of all payments in the UK), the pertinent question can only be, “What is the hidden cost of digital payments?” As with their cash counterparts, inefficiencies and avoidable costs in digital payments erode the bottom line as readily as they do their cash counterparts – yet given their higher overall percentage of payments, the true cost of these issues represents a larger portion of the merchant’s wallet.

The hidden cost of digital payments is often masked by discussions around a ‘single simple processing fee.’ This positioning does not reveal the actual, end-to-end cost of the payments function within an organization. Demystifying the true cost of an online payment and ensuring merchants maximize their profits can be an eye-opening exercise.

Recent customer research from the team at Paydock indicated these hidden costs could include up to 12% of their development resource on payments-related issues and up to 11% of total online revenue on end-to-end administration activity. Compliance overheads such as PCI DSS and other auditing requirements (ISO, GDPR, PSD2.0, etc) can account for costs in excess of 4% of the total cost of internal technical and IT resources.

If a merchant is turning over $30 million annually (which many medium-sized merchants and not-for-profits do), this constitutes a whopping $5.5m organizational drain – every year. Combined with opportunity cost, it is easy to see how a digital payment’s true cost is far more than the advertised “1.5.%”.

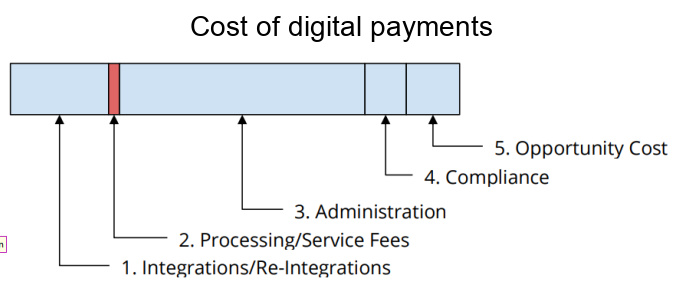

Figure 1.0 below summarizes the typical cost silos in sophisticated payment strategies and we expand each of these pain points in more detail.

Expanding on the above, specialized integrations to CRM or rotations within processing or accounting packages result in an inevitable loss of customers and reference data.

Integrations/Re-integrations

We’ve observed that larger merchants typically introduce one or two new (or optimized) payment methods to their customers every year. This can include increasingly localized and optimized payment methods. For example, Gateway A may support Apple Pay in one country. Further, gateways, processor roadmaps, and priorities may not align in a way that suits the merchant, creating a risk and constraint. In a fast-moving B2C fintech environment, there is a continuous stream of new opportunities – an exhausting and costly game for merchants. How to win with lower cost, yet do so without distracting from core business?

While these are just some of the hurdles and risks that need to be addressed, it’s not uncommon for digital merchants to connect at least one or two new payment APIs on average every year.

It is worth observing that unwiring one service and replacing it with another while ensuring that all internal stakeholders are familiar and comfortable with the new process can be extremely time-consuming, tiring, and expensive as things can and do go wrong.

Processing Fees

While this is not the focus of this article, readers may believe there’s a processing fee ‘race to the bottom’. If it were possible to capitalize on this, the merchant might be able to save 0.5% or more on their bottom line overnight.

Administration

Multiple-dashboards, incomplete logs, errant transactions, bulk settlement frustrations, batch processes, and audits are all profit-draining activities that add to the hidden cost of an online payment. This explains why many merchants forgo profit simply because they don’t want to disrupt administration activities and introduce change to management costs.

Merchants we deal with at Paydock often feel stuck and frustrated in this regard; however, there are simple tools available to optimize the administration process and reduce total time spent by as much as 60%. Talk about money going where it’s needed!

Along with this comes another hidden cost – employee satisfaction. By helping vital team members do their job effectively in a positive environment, turnover rates are reduced, and productivity increased.

Compliance

PCI DSS and other data privacy standards represent a material overhead and often lock merchants into inefficient, inferior, or more expensive solutions. Merchants can flatten their compliance burden to SAQ-A (PCI’s narrowest scope) and save up to hundreds of thousands per year by optimizing specific technologies to reduce scope and risk. Every merchant should seek to be PCI compliant – but how that compliance is achieved is a competitive differentiator.

Ensuring it’s done in a way that enables the merchant to have portability and interoperability as cornerstones of their enterprise payment stack are critical to overall profit maximization.

Opportunity Cost

Time or money spent on inefficient activities or neglecting customer-preferred solutions due to barriers to entry present substantial opportunity cost. Paydock recently had a customer who, after orienting their payments strategy to an orchestration-first methodology, rapidly included new payment methods (without any increase to administration effort) and realized a 40% uptake of this new method. This was after four years of non-utilization of this payment type. Like our customer before Paydock, many other merchants forgo the revenue that could be easily gained.

Conclusion

The hidden costs of digital payments are high and should not be underestimated. In this digital transaction environment, merchants must understand these payments’ actual costs and take advantage of all the tools available to maximize their bottom line. As my Mum says, “a penny saved is a penny earned.”

The good news is that many unexpected profit-draining aspects of digital payments can be easily addressed. Ensuring merchants take advantage of declining processing fees, reduce unnecessary tech investment, and flatten admin time through “off the shelf tools” will generate substantial profit and risk upside. These problems are not going away and will increase as payment fragmentation and commoditization grow. Taking a long-term view now will set many merchants up for long-term success in the digital payments market.

Rob Lincolne is the founder and CEO of Paydock, an innovative payment orchestration platform that enables digital merchants, B2B platforms, and not-for-profit organizations to increase revenue and efficiency while substantially reducing costs. Originally launched in Australia in 2017, the company is now headquartered in London, UK.

LET’S CONNECT