Our Friday payments and fintech news roundup includes items from Ant Financial, HelloPay, MasterCard, Apple, Google, ING and more. Ant Financial and HelloPay announced a merger to create a powerhouse Alipay payments platform across SE Asia as the Alibaba affiliate continues its global growth. Mizuho Financial Group, Mizuho Bank, Metaps and WiL will create a new digital wallet and payments platform called M Wallet Preparation Company Inc in Tokyo.

MasterCard will add MasterPass payments to the Facebook Messenger bots including FreshDirect, Subway, and The Cheesecake Factory. Google added PayPal to its Android Pay options in a move that should benefit both companies. Apple Pay added 20 more US banks and credit unions as well as four banks in China.

Six Dutch banks – ABN AMRO, ASN Bank, ING, Rabobank, Regiobank and SNS – will back ING’s multi-purpose mobile payments app Payconiq when it launches this summer. MasterCard will soon let you pay with a fingerprint when it adds biometrics to cards after successful tests in South Africa. Wells Fargo is now testing a Facebook Messenger banking bot.

People’s Bank of China reported 25.7 billion mobile payment transactions in 2016, valued at $24 trillion. The number of Apple Pay users tripled in 2016, the number of transactions rose 500% and it was accepted at 35% of retailers. Google Android Pay is accepted at 24%. New research by 3Cinteractive showed 62% of consumers visit stores more often and spend more due to loyalty programs.

Alibaba’s Ant Financial takes control of HelloPay to extend its reach in SE Asia

Another day, another deal to widen the reach of Ant Financial, the fintech-focused Alibaba affiliate.

Another day, another deal to widen the reach of Ant Financial, the fintech-focused Alibaba affiliate.

This week, Ant Financial announced that it is picking up HelloPay, the payments firm attached to Lazada, which Alibaba bought a major share in for $1 billion last year. HelloPay was founded in November 2014 by Lazada to develop payment services for its e-commerce business.

The deal is an entirely logical one, given the ownership chain, and it will see HelloPay become owned and operated by Ant Financial out of its Singapore office. Furthermore, HelloPay will be rebranded locally to Alipay Singapore, Alipay Malaysia, Alipay Indonesia and Alipay Philippines in its markets. Ant Financial is China’s largest mobile payment service with 450 million users, alongside digital banking and financial services. Via techcrunch.com

Mizuho, Metaps, WiL, Others to Launch Wallet Co

Mizuho Financial Group is teaming up with Mizuho Bank, Metaps and WiL to create a new service settlement using FinTech. According to a report, the four companies signed a memorandum of understanding in October where they agreed to create a new company that will be focused on providing a new digital wallet app and electronic payments by using big data.

Mizuho Financial Group is teaming up with Mizuho Bank, Metaps and WiL to create a new service settlement using FinTech. According to a report, the four companies signed a memorandum of understanding in October where they agreed to create a new company that will be focused on providing a new digital wallet app and electronic payments by using big data.

The jointly owned and established company will be able to access Mizuho’s customer base and tap its knowledge of the financial services industry to launch the company. Metaps brings data analytics and electronic payments know-how to the company, as well as smartphone app expertise. Meanwhile WiL, a venture capital firm, has extensive knowledge in cutting-edge service providers.

According to the companies, the new company will be called M Wallet Preparation Company Inc, will be located in Tokyo and will facilitate electronic payments via a digital wallet app, payment data-leveraged marketing, as well as engage in other related businesses. The company is slated to launch on May 1, 2017, with operations up and running by the summer. Via pymnts.com

MasterCard Brings MasterPass to Facebook Messenger Bots

It’s about to get a whole lot easier to check out from a Messenger chatbot. MasterCard is bringing MasterPass to bots.

It’s about to get a whole lot easier to check out from a Messenger chatbot. MasterCard is bringing MasterPass to bots.

MasterCard is getting more into the bot game. Or rather, it’s helping others make payments through bots easier. The company has announced that its MasterPass digital wallet system will now be compatible with a slew of Facebook Messenger bots, including bots from FreshDirect, Subway, and The Cheesecake Factory. What this means is that users will be able to use MasterPass to complete transactions through those apps, without having to enter critical credit card information directly into the chat windows.

MasterPass-enabled bots will work across a range of different services — including retail stores, restaurants, and more. The news isn’t all that surprising — MasterCard actually announced a MasterPass-enabled bot called Getir last month, and it’s likely we’ll see more bots with payment capabilities like this come in as time goes on. Via digitaltrends.com

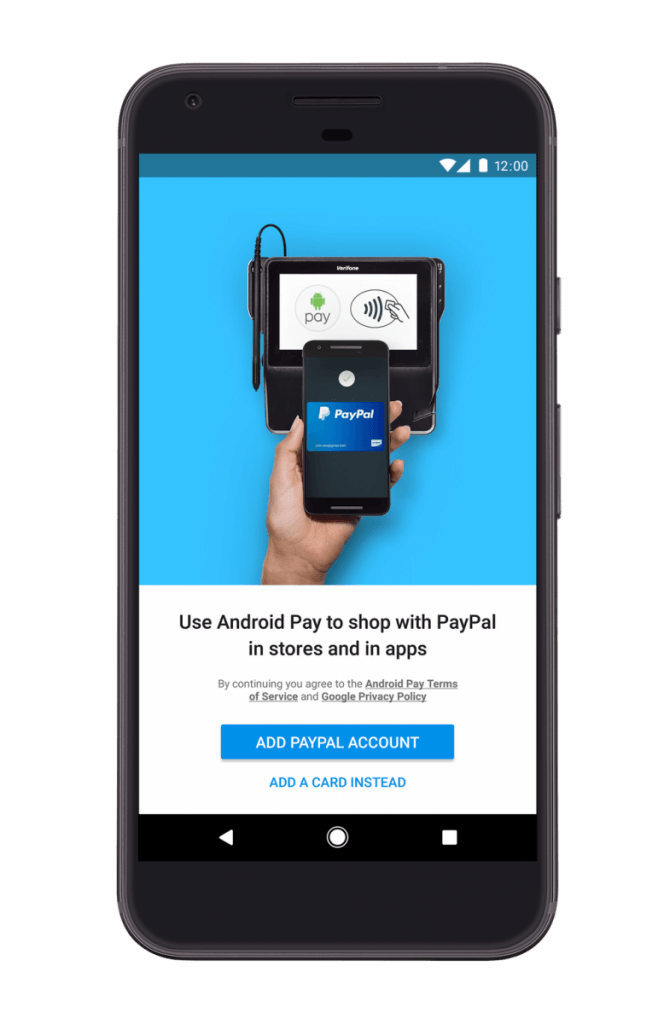

Google Announces Collaboration with PayPal for Android Pay Support

Android Pay as a means of quick, cardless, and cashless payment faces heavy competition from the likes of Apple Pay and Samsung Pay. So it comes as no surprise that all the competitors in the mobile payments space continue looking for more ways to one up their competitors.

Android Pay as a means of quick, cardless, and cashless payment faces heavy competition from the likes of Apple Pay and Samsung Pay. So it comes as no surprise that all the competitors in the mobile payments space continue looking for more ways to one up their competitors.

Google is doing just that with its latest strategic collaboration with PayPal, the popular online payments system. The partnership enables PayPal to be used as an option at checkout in Android Pay. Users can also utilize PayPal to checkout in Android apps that support Android Pay.

At launch, this feature will be available for users in the US, but Google is silent on when this functionality will roll out to other Android Pay-supported regions. Users in the U.S.A. can simply link their PayPal account to use with Android Pay once the feature starts going live. Via xda-developers.com

Apple Pay expands to over 20 more banks and credit unions across the US and China

Apple Pay is now available from over 20 more banks and credit unions around the United States and Mainland China as part of the latest expansion wave. Apple’s mobile payment service launched just over two years ago with hundreds of additional regional banks and credit unions added every few weeks.

Apple Pay is now available from over 20 more banks and credit unions around the United States and Mainland China as part of the latest expansion wave. Apple’s mobile payment service launched just over two years ago with hundreds of additional regional banks and credit unions added every few weeks.

Jennifer Bailey, the head of Apple Pay, shared late last year that Apple’s mobile payment service is coming to GAP stores this year and is currently accepted by 35% of US retailers. Apple Pay has expanded to Canada, France, Russia, Switzerland, the United Kingdom, Australia, Mainland China, Hong Kong, New Zealand, Singapore, Japan, Spain, Ireland, and Taiwan.

And Apple’s new MacBook Pro with Touch Bar is the first Mac to include Touch ID and support Apple Pay without a nearby Apple Watch. Apple Pay also recently became an option online for donations to several non-profit organizations. The Apple Store app for Apple Watch also supports Apple Pay for purchasing favorited items and Western Union has enabled cash transfers and bill payment through Apple Pay. Via 9to5mac.com

Dutch banks back all-in-one mobile payments tech from ING

Six Dutch banks are getting behind ING’s multi-purpose mobile payments app Payconiq for a Summer roll out in the Netherlands. The all-in-one app enables users to make direct payments online, in-store and peer-to-peer via a direct connection with the customer’s payment account at one of the participating banks.

Six Dutch banks are getting behind ING’s multi-purpose mobile payments app Payconiq for a Summer roll out in the Netherlands. The all-in-one app enables users to make direct payments online, in-store and peer-to-peer via a direct connection with the customer’s payment account at one of the participating banks.

The Dutch launch – backed by ABN AMRO, ASN Bank, ING, Rabobank, Regiobank and SNS – follows a successful pilot and introduction in Belgium, where the platform is supported by ING, KBC and Belfius. Via finextra.com

MasterCard Swaps PINs for Prints On High-Tech New Payment Card

Most of us are used to using a fingerprint for an assortment of verification processes, from unlocking our smartphones, to authenticating entry into buildings, or at passport control at the airport. Soon, you may also use your fingerprint to confirm purchases made in stores using a special MasterCard with a biometric reader built-in to it. MasterCard has revealed the first card to use the technology — something it has worked on for several years — which has undergone tests in South Africa.

Most of us are used to using a fingerprint for an assortment of verification processes, from unlocking our smartphones, to authenticating entry into buildings, or at passport control at the airport. Soon, you may also use your fingerprint to confirm purchases made in stores using a special MasterCard with a biometric reader built-in to it. MasterCard has revealed the first card to use the technology — something it has worked on for several years — which has undergone tests in South Africa.

The way it works is simple, and will be familiar to anyone that has used Apple Pay or another mobile payment system. Put the biometric card into the payment terminal as usual, and keep your finger on the card’s reader. Provided everything matches up, the payment will be approved. This means you no longer have to enter a PIN, and never have to hand the card over to a cashier. Of course, the biometric authentication aspect won’t work for online purchases, and it’s not compatible with contactless payments.

Also, you won’t need to worry about fingerprints being stored in a cloud-based server. Remember, the card doesn’t have a data connection, so it compares a captured digital image of the print taken when the card is inserted into the terminal, with an encrypted digital template stored on the card itself that’s set up when you first get it. Moreover, the transaction still has to be separately approved by the bank, even when the prints match. Think of it as a direct replacement for your PIN number, and because there’s no need for special equipment on the retailer’s part, the new cards are compatible with most existing chip-and-PIN readers. Via digitaltrends.com

Wells Fargo tests Facebook chatbot

Wells Fargo & Company is testing a “chatbot”, an automated program that can communicate with the bank’s customers on Facebook’s messaging platform to give them information on their accounts and help them reset their passwords.

The U.S. bank said on Tuesday that it is piloting the virtual assistant with several hundred employees, and plans to extend testing to a few thousand customers later this spring.

Wells Fargo’s chatbot will use artificial intelligence to respond to natural language messages from users, such as how much money they have in their accounts, and where the nearest bank ATM is. Via reuters.com

Mobile Payment Transactions Grew Dramatically in China

Digital payments in China are on a growth trajectory.

Digital payments in China are on a growth trajectory.

According to the People’s Bank of China (PBC), mobile transactions grew at about triple the rate of online transactions in 2016. But there were nearly twice as many online transactions, and the value of those transactions was dramatically higher than that of mobile.

There were 46.18 billion online transactions in 2016, the PBC data shows, with a value of RMB2 trillion ($290 billion). Total online payment transactions in China were almost double the 25.7 billion mobile transactions. But the mobile payment category is growing at a faster rate than online, albeit from a smaller base. PBC found that the value of mobile transactions was nearly RMB158 trillion ($24 trillion), and growth skyrocketed 85.8% over the previous year. Via emarketer.com

Why Apple is going to keep beating Google in mobile payments

During its most recent conference call, Apple revealed that the number of Apple Pay users had more than tripled over the last year and that transaction volume was up 500% year over year. The service has been rolled out in four new countries, for a total of 13. Apple admitted that while adoption has been slow, 4 million locations that cover about 35% of all retail stores in the U.S. now accept Apple Pay. Since Apple collects a piece of each transaction, this could eventually generate a significant ongoing revenue stream for the company.

During its most recent conference call, Apple revealed that the number of Apple Pay users had more than tripled over the last year and that transaction volume was up 500% year over year. The service has been rolled out in four new countries, for a total of 13. Apple admitted that while adoption has been slow, 4 million locations that cover about 35% of all retail stores in the U.S. now accept Apple Pay. Since Apple collects a piece of each transaction, this could eventually generate a significant ongoing revenue stream for the company.

A recent report by Statista revealed similar findings, with about 36% of U.S. retailers accepting Apple Pay. Google takes up the second spot with Android Pay, which is accepted at 24% of merchants, and Samsung offering Samsung Pay comes in third with 18%. Apple Pay’s acceptance at a significantly greater number of merchants appears to be paying off, and is likely the reason for Apple’s lead in the category.

Monthly Apple Pay transactions grew 50%

While one-off payments help growth, regular use will be a key driving factor. Consumer analytics firm TXN Solutions reviewed the transactions from over 3 million payments and reported that the number of monthly Apple Pay transactions grew by 50% between December 2015 and December 2016. Via businessinsider.com

Mobile Loyalty Programs Drive 62% of Customers to Increase Store Visits

In the what-a-difference-a-year-makes department, most (64%) brands reported an increase in loyalty program membership over the last year and most of those cited the addition of mobile components as the biggest contributor. The study comprised a survey of 125 consumers and 65 brand marketers in the US conducted by 3Cinteractive

In the what-a-difference-a-year-makes department, most (64%) brands reported an increase in loyalty program membership over the last year and most of those cited the addition of mobile components as the biggest contributor. The study comprised a survey of 125 consumers and 65 brand marketers in the US conducted by 3Cinteractive

Mobile-powered loyalty programs tend to influence customer purchase behavior. More than half (62%) of customers said they make more store visits and purchases because of mobile-enabled loyalty programs, based on the study. This is up from 59% last year.

Customers also seem to want loyalty offers coming in different ways. Last year, nearly half (48%) wanted offerings by text message. That dropped to 21% this year. Here are consumers’ preferences on how they want mobile communication:

21% — SMS

21% — Push notification

18% — Mobile wallet

18% — Mobile app

10% — Virtual assistants. Via mediapost.com

LET’S CONNECT