Recent research by payments provider PayActiv showed the growing impact of the pandemic on those essential workers still employed despite unemployment in the US reaching 14.7% in April.

The mid-March research showed serious concerns among employees surveyed as the pandemic began taking hold in the US:

- 82% of workers were more worried about financial issues than their health

- 67% of workers will seek payday lenders and access credit to meet their daily needs

- 60% of workers have no paid sick leave, employee insurance or coverage

- 58% of workers have seen their expenses increase during this time.

In recent months, Visa accelerated its Earned Wage Access (EWA) service in partnership with five key payment technology partners including DailyPay, FlexWage, Instant Financial, PayActiv, and ZayZoon, as well as merchants and payroll companies.

Between-payday funds are provided through Visa Direct, Visa’s real-time push payments platform. Workers simply download an app from their EWA provider to access and transfer earned wages to their bank account in real-time using Visa Direct.

Payments providers responded

In March, PayActiv announced it was waiving its fees for more than three million lower-income and hourly workers, many on the front lines in America’s hospital systems, senior living centers, recovery clinics, and other essential service providers during the COVID-19 pandemic. In addition, PayActiv said it was working closely with its 1,000+ employer partners to provide workers their earned wages and tips on-demand between paychecks during the coronavirus crisis.

“The American worker is already under a great deal of financial stress and this unprecedented crisis has exacerbated the existing critical situation for millions of families that need immediate relief to make ends meet,” said Safwan Shah, Co-Founder and CEO of PayActiv.

“The crisis calls for never-before-seen collective action by businesses and all Americans to help provide relief to the workers living paycheck-to-paycheck each month, whether that includes banks eliminating overdraft fees, utilities canceling late charges, landlords suspending evictions, or creditors temporarily halting interest charges,” Shah added.

In just months of working with PayActive to introduce EWA to its critical care workers, Nazareth Home saw real-time payments overtake ACH payments.

“Working at a senior living center, my patients are higher risk for being impacted by today’s crisis and are unable to see friends and family members who normally visit,” said Ayla Smith, a Certified Nursing Assistant at Nazareth Home who uses PayActiv. “Living paycheck-to-paycheck, it can be difficult for me to guarantee I can pay for things like gas and car insurance to get to work and see my clients every day. But with real-time access to my wages, I am able to ensure that I show up every day in this critical time.”

Serious pandemic impact on employees

By the end of April, Gallup estimated as many as 30% of Americans suffered disruptions to their jobs or finances as a result of COVID-19. Ten percent of Americans were temporarily laid off and 2% permanently lost their jobs as a result of the coronavirus crisis. Another 15% saw reductions in their hours and 26% said they had experienced a loss of income.

“We’re seeing a big uptick in demand for Earned Wage Access, especially among frontline workers. Visa Direct transactions for workers seeking on-demand pay have increased by 100% year-over-year across essential services, as more people need real-time access to their money,” said Cecilia Frew, SVP, Visa Direct,

Visa Direct and partners providing between-pay relief

The Visa Direct EWA program originally launched for different reasons, but it’s become a valuable way to help employees in critical healthcare and other essential services meet emergency expenses. By letting employers pay employees for wages and tips already earned in advance of an upcoming payday, it’s making a difference, particularly during the coronavirus pandemic.

In a March survey, 80% of ZayZoon’s customers said they were leveraging EWA funds for necessities like groceries and emergency expenses, and less than 3% said they were using early wage access for discretionary spending.

Visa Direct transactions for workers seeking earned wage access or on-demand pay across supermarkets, quick-service restaurants, healthcare, and hospitality industries, increased more than 100% year over year, and are in especially high demand during the COVID-19 crisis.

“Together, PayActiv and Visa are providing a lifeline for workers, especially those on the front lines of the COVID-19 crisis, while also providing employers with a powerful employee benefit to retain and motivate employees without impacting the company’s cash flow at this critical time,” said Shah.

EWA a recruiting and retention benefit?

For some employers and employees, EWA programs may be a recruitment incentive and a retention advantage both now and in the future.

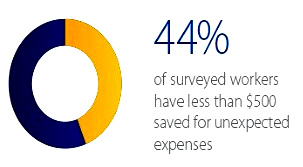

Visa research shows 44% of workers have less than $500 saved for unexpected expenses and 84% of workers were only looking to access less than $500 between paydays to buy essential items such as gas, groceries and to pay utility bills.

Research also found 89% of workers would be prepared to work longer for an employer who offered EWA and 79% also said they would be willing to switch to employers already offering EWA.

“Today’s hourly workforce wants and needs flexible tools to help them better manage their money and have more control over when they receive access to their funds. That’s why today Visa is working with fintech innovators to build solutions that give hourly workers faster access to the money they earn,” Frew said.

“We expect to continue to see high demand for EWA services over the coming weeks and months, as more companies and consumers realize the benefits of faster access to funds during these challenging times,” Frew added.

If we should see an unfortunate second wave of new coronavirus cases in the near future, earned wage access could become even more important to critical workers, essential service employees, employers, and the economy.

LET’S CONNECT