Leading into the post-Thanksgiving weekend, we’re sharing a collection of global payments news that caught our eye this week, starting with a preliminary Black Friday sales report along with a few summaries of Thanksgiving Day shopping spending.

Early indicators reveal a strong Black Friday

Black Friday is on track to hit over $6.4 billion in online sales, with $643 million in online spend as of 10:00 AM him EST. Thanksgiving 2018 was the fastest growing retail day in online shopping history, with $3.7 billion in online sales, representing 28% growth from last year, according to the Adobe Analytics report. The holiday also marked $1 billion in mobile sales. Read more…

Black Friday is on track to hit over $6.4 billion in online sales, with $643 million in online spend as of 10:00 AM him EST. Thanksgiving 2018 was the fastest growing retail day in online shopping history, with $3.7 billion in online sales, representing 28% growth from last year, according to the Adobe Analytics report. The holiday also marked $1 billion in mobile sales. Read more…

Amazon reports ‘record levels’ of UK shopping as Black Friday takes off internationally

Inside an Amazon distribution center in Tilbury, to the east of London in the UK, shelves are stocked with everything from water filters to the newest Lego board game in preparation for a busy weekend of sales. As of mid-morning Friday, Amazon said it had seen customers in the U.K. shopping at “record levels” with 100,000 toys and 60,000 beauty items already being purchased since midnight. Read more…

Inside an Amazon distribution center in Tilbury, to the east of London in the UK, shelves are stocked with everything from water filters to the newest Lego board game in preparation for a busy weekend of sales. As of mid-morning Friday, Amazon said it had seen customers in the U.K. shopping at “record levels” with 100,000 toys and 60,000 beauty items already being purchased since midnight. Read more…

Thanksgiving online spend hits a record $3.7B, mobile accounted for one-third of sales

This year, US consumers spent a record $3.7 billion on Thanksgiving, according to analysts, with smartphones driving 54.4 percent of traffic to retail sites and 36.7 percent of all e-commerce sales. Thanksgiving also became the first day of the year to see $1 billion in sales completed on smartphones, Adobe said. It wasn’t the first time this has ever happened, but usually, it’s only on Cyber Monday that we’ve seen that shift take place. Read more…

This year, US consumers spent a record $3.7 billion on Thanksgiving, according to analysts, with smartphones driving 54.4 percent of traffic to retail sites and 36.7 percent of all e-commerce sales. Thanksgiving also became the first day of the year to see $1 billion in sales completed on smartphones, Adobe said. It wasn’t the first time this has ever happened, but usually, it’s only on Cyber Monday that we’ve seen that shift take place. Read more…

Consumers Spent $3.7 Billion on Thanksgiving

Consumers spent $3.7 billion on Thanksgiving, Adobe Analytics said, up 27.9 percent from last year. Tech, of course, topped the shopping lists. The top five products on Turkey Day were: Nintendo Switch, Beats, Hot Wheels, Red Dead Redemption 2, and Hatchibabies. Retail sales for November currently tally $38 billion, according to Adobe, which polls 80 of the top 100 US retailers. Read more…

Consumers spent $3.7 billion on Thanksgiving, Adobe Analytics said, up 27.9 percent from last year. Tech, of course, topped the shopping lists. The top five products on Turkey Day were: Nintendo Switch, Beats, Hot Wheels, Red Dead Redemption 2, and Hatchibabies. Retail sales for November currently tally $38 billion, according to Adobe, which polls 80 of the top 100 US retailers. Read more…

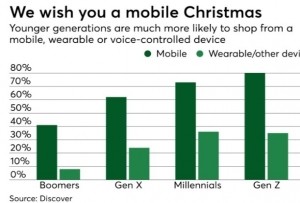

PwC: Mobile Payments a Big Part of the 2018 Shopping Season

We’ve already heard more than a little about mobile payments and the 2018 Christmas shopping season, and from the looks of things, it could be a banner year for shopping mobile-style. A new report sent our way from PwC, meanwhile, reveals the potential color of that banner, and what it could mean for mobile payments going forward. Read more…

Mobile’s loose grip on holiday spending

Retail is more digital than ever, but that doesn’t mean that smartphones and wearable devices have taken over holiday shopping. Across all age groups, many consumers still prefer shopping in stores for various reasons. But even when going into a brick-and-mortar store, these consumers don’t leave their digital habits behind; many still prefer to pay by mobile or wearable when the option presents itself. Read more…

Retail is more digital than ever, but that doesn’t mean that smartphones and wearable devices have taken over holiday shopping. Across all age groups, many consumers still prefer shopping in stores for various reasons. But even when going into a brick-and-mortar store, these consumers don’t leave their digital habits behind; many still prefer to pay by mobile or wearable when the option presents itself. Read more…

NRF/Forrester research shows retail payments changes coming

New research from the National Retail Federation (NRF) and Forrester show retailers, e-commerce sellers and payments industry leaders expect many changes in retail payments in the near future. 44% of retailers no longer require signatures for debit card transactions, 13% will eliminate them by the end of 2019 and another 9% by the end of 2020. For some reason, 36% still have no plans to eliminate signatures. Old habits die hard, but consumers may force retailers to adopt change faster. Read more…

New research from the National Retail Federation (NRF) and Forrester show retailers, e-commerce sellers and payments industry leaders expect many changes in retail payments in the near future. 44% of retailers no longer require signatures for debit card transactions, 13% will eliminate them by the end of 2019 and another 9% by the end of 2020. For some reason, 36% still have no plans to eliminate signatures. Old habits die hard, but consumers may force retailers to adopt change faster. Read more…

75.6% abandon purchases in their online shopping cart

SurePayroll estimates US e-commerce platforms lose roughly $18 billion in potential revenue each year to abandoned carts. According to SalesCycle, 75.6% of consumers abandoned purchases in their online shopping carts in the first quarter of 2018. The cart abandonment bad news ranged from fashion (69.1%) and retail (75.6%) to nonprofit (75.6%), finance (80.4%), and travel (81.1%). Read more…

SurePayroll estimates US e-commerce platforms lose roughly $18 billion in potential revenue each year to abandoned carts. According to SalesCycle, 75.6% of consumers abandoned purchases in their online shopping carts in the first quarter of 2018. The cart abandonment bad news ranged from fashion (69.1%) and retail (75.6%) to nonprofit (75.6%), finance (80.4%), and travel (81.1%). Read more…

Amazon pay accepted here? Web giant aims to put its digital wallet system in physical stores

Amazon is preparing to roll out their new digital wallet to compete with Apple Pay in the mobile payments race. The tech giant is persuading merchants to accept its Amazon Pay digital wallet, according to a source familiar with the company’s plans. The source said the firm is quietly looking for petrol stations, restaurants and shopping outlets that don’t directly compete with Amazon. Read more…

Amazon is preparing to roll out their new digital wallet to compete with Apple Pay in the mobile payments race. The tech giant is persuading merchants to accept its Amazon Pay digital wallet, according to a source familiar with the company’s plans. The source said the firm is quietly looking for petrol stations, restaurants and shopping outlets that don’t directly compete with Amazon. Read more…

Biometrics-secured voice banking with Amazon Alexa now available from two Canadian credit unions

Innovation Credit Union and Conexus Credit Union partnered with Central 1, which provides services to credit unions, to develop the technology, which leverages Amazon’s voice biometrics and the OAuth open standard for token-based authentication. Customers can make bill and vendor payments, transfer money, and check account information through the voice channel, making financial interactions easier for many customers, including those with visual or mobility impairments. Read more…

Innovation Credit Union and Conexus Credit Union partnered with Central 1, which provides services to credit unions, to develop the technology, which leverages Amazon’s voice biometrics and the OAuth open standard for token-based authentication. Customers can make bill and vendor payments, transfer money, and check account information through the voice channel, making financial interactions easier for many customers, including those with visual or mobility impairments. Read more…

Amazon exposed customer names and emails in a ‘technical error’

Amazon exposed some customers’ names and emails due to a “technical error,” according to emails the company sent to affected customers. Several people shared screenshots of the emails online Wednesday morning. BetaNews first reported the incident. Amazon did not answer questions about how many customers were affected by the error nor about how long information was exposed. Amazon’s website and systems were not breached, an Amazon spokesperson told CNBC. Read more…

Amazon exposed some customers’ names and emails due to a “technical error,” according to emails the company sent to affected customers. Several people shared screenshots of the emails online Wednesday morning. BetaNews first reported the incident. Amazon did not answer questions about how many customers were affected by the error nor about how long information was exposed. Amazon’s website and systems were not breached, an Amazon spokesperson told CNBC. Read more…

LET’S CONNECT