Welcome to our Friday payments, fintech, and e-commerce news roundup with the business intelligence to keep you ahead of your competition. It was a busy week with much research on post-COVID-19 projections and possibilities and lots of new product announcements that caught our attention.

PayPal rolled out QR code payments as contactless options become more popular amid the pandemic

The company announced that it’s enabling QR code payments through its app in 28 markets, covering most major markets such as the UK and US, allowing merchants to conduct contactless transactions without purchasing additional hardware. Customers can make purchases with the feature by scanning a QR code that has been printed out or is presented on another screen. PayPal removed in-store payment capabilities from its app in 2018, but CEO Dan Schulman indicated in late 2019 that his company was set to build out its in-store capabilities. Read more…

Vendor payment habits shift in a pandemic-fueled cash flow squeeze

The pandemic continues to drive forward the conversation about B2B supplier payment habits, as some retailers vow to maintain timely payment terms to promote the cash flow of their vendor partners, while others choose to delay payment to preserve their own working capital needs. The latest data shows shifts on both sides, while Australian lawmakers have introduced legislation in an effort to support small suppliers’ need for timely payment. Read more…

US relaxes banks’ leverage rules to boost lending

US banking regulators have temporarily eased a key capital measure for large banks to allow them to grant more loans to distressed businesses and consumers. The Federal Deposit Insurance Corp. (FDIC) and the Office of the Comptroller of the Currency (OCC) have temporarily softened the supplementary leverage ratio rule to help banks do more lending during the pandemic. The supplemental leverage ratio, which was enacted as an extra safety measure during the 2007-2008 financial crisis, directs larger banks to hold more capital against their assets. The regulators said the change would allow banks to expand their balance sheets to continue lending to customers and businesses feeling the economic effects from the pandemic. Read more…

Amazon eyes JCPenney buy

Amazon could be in talks to acquire the bankrupt clothing retailer JCPenney, Fox Business reported Monday, citing Women’s Wear Daily (WWD). JCPenney officially filed for bankruptcy late on May 15, ending speculation as to the beleaguered former retail titan’s financial status. Now, Amazon could be moving in. One source, according to WWD, was “in Plano as we speak,” referring to the Texas city where JCPenney is headquartered. Read more…

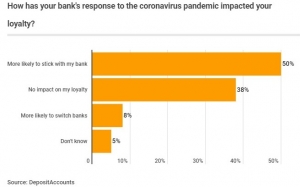

Americans trust their banks more than their government during pandemic

In our latest survey, DepositAccounts took a look into Americans’ loyalty to their bank and to the US government in the time of the coronavirus pandemic. We also investigated whether banks are reciprocating their consumers’ feelings through coronavirus relief assistance. Americans trust banks to do right by consumers during the coronavirus pandemic more than they trust the government to do the same. Of survey respondents, 40% said they trust their bank “a lot,” while just 27% expressed the same level of confidence in the government. Read more…

Alibaba reaches $1 trillion in sales with steady recovery since March

“Alibaba achieved the historic milestone of US$1 trillion in GMV across our digital economy this fiscal year,” said Daniel Zhang, Chairman and Chief Executive Officer of Alibaba Group. “Our overall business continued to experience strong growth, with a total annual active consumer base of 960 million globally, despite concluding the fiscal year with a quarter impacted by the economic effects of the COVID-19 pandemic.” Read more…

Remaking banking services after the pandemic

The fast-changing habits and needs of consumers, partly shaped by the coronavirus pandemic, will require banking and financial service leaders to adjust their services and their way of thinking if they want to build resilient organizations that thrive in the near future. In an intriguing new report – “Consumer Banking Remade by COVID 19: Scenarios for Resilient Leaders”, Deloitte explores how the pandemic could refocus and redirect consumer banking services in the next one to three years. Read more…

April US retail sales worst on record: What are consumers planning next?

US Department of Commerce statistics showed a worst-ever record 9% decrease in April 2020 US retail sales as COVID-19 stay-at-home orders hit the retail sector hard. One small bright spot was a 20.5% increase in non-store channels, primarily online sales, the second-largest ever recorded. Online grocery sales jumped 13% as consumers shifted their grocery shopping purchases online. Data from Nielsen and Rakuten Intelligence showed online sales for consumer packaged goods (CPG) rose 45% during April though that was down 5.9% from the shopping frenzy in March 2020 when consumers frantically stocked up on emergency products during the height of the pandemic. Read more…

Raisin launches deposit solutions for US banks and credit unions

Raisin, the Berlin-based savings marketplace, has launched a ‘savings-as-a-service’ software solution for US banks and credit unions looking for “cost-effective new deposits”. The Goldman Sachs and PayPal-backed backed fintech’s new software solution will allow US banks to offer customized time deposit products. These are interest-bearing bank accounts which have a pre-set date of maturity. Read more…

Streamlining remittance, empowering migrant workers & driving inclusion worldwide

Advances in fintech have changed the lives of people worldwide. In many ways fintech has simplified the way we handle money by allowing us to do things like transfer money between accounts, more easily pay a friend who picked up the check at dinner or pay bills from anywhere, at any time. But most importantly, fintech has transformed cross-border payments. Advances in fintech and innovation in cross-border payments have had a direct impact on 164 million migrant workers worldwide. Today, an estimated 800 million people worldwide are directly supported by remittances from loved ones abroad. Read more…

Major banks assess COVID-19 working from home policies

Large majorities of workers in the finance and financial services (70%) and legal (68%) industries have been doing their jobs remotely as a result of the coronavirus outbreak, according to the CNBC/SurveyMonkey data. Among these same workers, most report wanting to either work from home all the time even when it is safe to return to the office, or at least wanting to work from home more often than previously. FinTech Futures has compiled a list of how some major banks are responding to COVID-19 remote working policies. Read more…

Will India’s push for consumers to buy local have ripple effects on e-commerce?

The pandemic has spurred any number of efforts across various countries to restart economies as they emerge from lockdown. For India, in particular, the coronavirus has exposed some challenges for eCommerce giants such as Flipkart and Amazon – and now, there’s a new initiative to spur consumers to “buy local.” Soon after a nationwide lockdown became official in India, district- and state-level restrictions tied to curfews (which hindered staffers from going out and making deliveries) closed fulfillment centers. The end result was that the delivery of even essential items became logistically difficult for these major players. Read more…

BOLT ON Technology shifts into “second gear” with debut of text to pay and financing features

BOLT ON Technology, a leading supplier of technology solutions for the automotive aftermarket, launched SecondGear which adds BOLT ON’s popular Text To Pay functionality to the digital customer communication process for seamless payments in a manner with which ever-more drivers are comfortable – right from their cell phones. In conjunction with SecondGear’s debut, the company also announced BOLT ON Pay, an enhancement and rebranding of the company’s payment program. Read more…

Tech Alliance is helping rebuild the shattered economies by democratizing fintech during the pandemic

Corent Tech’s SurPaaS® Platform, together with Microsoft Azure Cloud are helping enable Mifos Initiative to offer affordable core financial services to the 2 billion unbanked and impoverished populations as a backbone of financial inclusion, access to credit and micro-financing. Corent recently collaborated with The Mifos Initiative to bring the Mifos X platform onto Microsoft Azure Cloud as an efficient self-service SaaS (Software as a Service) using Corent’s SurPaaS® SaaS-enablement platform, offering an easy pathway to an affordable Mifos X environment for any fintech solution provider for a modest monthly fee. Read more…

Ontario Systems accelerates consumer payment engagement strategy with SwervePay acquisition

Ontario Systems, a leading provider of enterprise software that automates complex workflows and accelerates revenue recovery for clients in the healthcare, government, and accounts receivable management (ARM) markets, announced the acquisition of SwervePay®, a payment facilitator in the ARM and healthcare industries. The acquisition of SwervePay offers Ontario Systems customers a simplified consumer payment engagement platform that helps drive revenue, reduce operational costs, and improve compliance. Read more…

8×8 selects GoCardless to manage recurring payments across its growing global business

GoCardless, the leading fintech for recurring payments announces that 8×8, a leading integrated cloud communications platform provider, is using GoCardless to provide direct debit as a payment method to its customers worldwide. The company joins a growing number of SaaS businesses choosing GoCardless to power their global payments. 8×8 was looking to transition its direct debit offering to an online solution that would manage payments across multiple bank debit schemes and countries, to increase their visibility within the business and minimize payment failure rates. Read more…

If you’re celebrating the US Memorial Day long weekend, enjoy safe social distancing with friends and family and stay healthy!

LET’S CONNECT