Happy New Year and welcome to the first global payments news roundup for 2019. We start with an in-depth World Payments 2018 Report from Capgemini and BNP Paribas, which should be essential reading for every payments professional. Wired magazine takes a look at the brighter future of retail after a successful 2018 in many segments.Juniper research forecasts $130 billion will be lost through card-not-present fraud by retailers globally in the next five years. There’s much more insight from industry experts with wide-ranging predictions for 2019.

World Payments Report 2018

In this 14th addition, the World Payments Report (WPR )provides insightful analysis of the development of new payments ecosystems,which are opening new horizons in payments and transaction banking. In-depth analysis of global non-cash transaction volumes is combined with an examination of the ever-changing regulatory landscape to track the evolution of payments ecosystems and payment service providers’ (PSPs’) ever-changing roles. Read more…

The surprisingly bright future of retail

Everybody, I’d like to announce that the retail apocalypse has been officially cancelled. It turns out, humans do occasionally like putting down their smartphones, leaving their sofas, and going to a real brick and mortar store to make a purchase. Six predictions for how we’ll shop in 2019, from embracing IRL stores to ditching Amazon. Read more…

Retailers to lose $130 billion globally in card-not-present fraud over the next 5 years

A new study from Juniper Research has found that retailers are set to lose some $130 billion in digital CNP (Card-not-Present) fraud between 2018 and 2023. It highlighted that increasingly complex approaches by fraudsters, alongside retailers’ inertia in adapting to new fraud prevention requirements, would be key factors behind the increases in fraud transaction value. Read more…

Four Payment Tech Predictions for 2019

Today’s ever-changing and competitive retail climate makes it essential for all IT security teams to be fully prepared for the future. As we edge closer to 2019, it is crucial for companies to provide a list of predictions for the year ahead. Here are some below predictions for the upcoming year. Read more…

Report: Amazon is planning a Whole Foods expansion to benefit Prime Now

Amazon is planning a Whole Foods expansion in the US,according to a report by The Wall Street Journal published this weekend. The goal is to put more customers within the range of Amazon’s two-hour Prime Now delivery service, including those in suburban areas outside cities, as well as those in regions where the grocer has yet to establish a presence. Read more…

Five Fintech Trends to Follow in 2019

The fintech progression in the latest years has marked a difference in the technology world. During the first years of the 21st century,we have witnessed growth in the financial sector in the form of financial literacy, new processes and automated services. But the financial revolution is far from coming to an end. Given the above, in this article, we have gathered some of the most relevant trends we are expecting to watch in 2019. Read more…

China’s Cashless Economy Set to Overtake USA by 2021

According to the World Payments Report 2018 produced by Capgemini and BNP Paribas, global non-cash transaction volumes grew at 10.1%in 2016 to hit 482.6 billion in value, with China contributing to 25.8% of that growth. When it comes to e-wallets specifically, China alone contributes to 16.3 billion transactions while the rest of the world accounts for remaining 25.5 billion transactions. China is predicted to help it overtake the USA in non-cash transaction volumes by 2021, in parts due to the American market’s slowness to adopt new payments technologies. Read more…

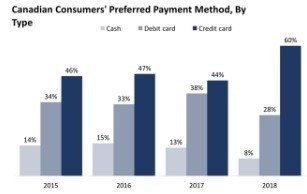

Canadian consumers love credit card rewards

Credit cards are the most preferred payment method in Canada, favored among all age groups, according to a TSYS study. Respondents of all ages and income levels indicated that they love paying with credit cards, and many consumers have multiple cards: 67% of respondents said they have two or more credit cards, up from 63% in 2017. Rewards have a sweeping impact on influencing consumer payment behavior across different payment methods. Read more…

LET’S CONNECT