By Jeff Domansky, Jan 25, 2021

With the new US administration in town, there’s a huge volume of payment news and new developments in the payments industry, and we’ve got highlights to keep you up to speed and in the know.

12 billion records stolen last year; cybersecurity spend will grow +10%

With new threats emerging and the number of attacks growing, global cybersecurity spending is expected to rise 10% in 2021, according to the latest global security forecast by Canalys. The research firm predicts $60.2 billion will be spent on security products and services this year. Canalys said more than 12 billion data records were compromised last year, and ransomware attacks jumped 60%. Read more…

Shocking cost of lost business from false customer declines

In analyzing more than 800 million unique users and $200 billion in e-commerce transactions in Forter’s Ninth Edition Fraud Attack Index, researchers found new online shoppers doubled in the first half of 2020 alone. The problem is new online shoppers are five to seven times more likely to be declined by merchants. What Forter calls the New User Missed Opportunity (NUMO) is billions in lost revenue for online merchants. Read more…

Digital wallet spend to exceed $10 trillion globally in 2025; driven by rising e-commerce & contactless spend.

A new study from Juniper Research found total spend via digital wallets will exceed $10 trillion in 2025, up from $5.5 trillion in 2020. The heightened adoption of digital payments will fuel the dramatic 83% growth in spending during the pandemic. The research forecasts in 2025, contactless and e-commerce payments will account for 50% of total wallet spend, from just under 36% in 2020, making these the high-priority areas where wallet providers need to maximize their merchant networks. Read more…

Venture Capital Funding Report Q4 2020

PwC and CB Insights’ Q4 2020 MoneyTree report highlights the latest trends in venture capital funding globally. 2020 investments hit a new annual record despite the pandemic. US-based, VC-backed companies raise nearly $130B in 2020, up 14% year-over-year (YoY) from 2019, despite the impacts of Covid-19 around the world. However, annual deal activity is down YoY, falling to 6,022 deals, a 9% decline from 6,599 in 2019. Read more…

Ten trends set to influence the payments industry

UK perspective: During times of economic stress, cash management and liquidity become ever more critical. That has led to the growing popularity of treasury management solutions that link money-in and money-out, providing a clear line of sight into your finances. We’ll likely see these solutions attract investment in 2021 as banks offer sophisticated, white-labeled cash management apps to their corporate customers. Read more…

Checkbook.io’s link to Plaid looks to bring verification to real-time payments

As the payments business moves toward faster settlement, verifying payor accounts becomes crucial. Yet, for non-card payments, “there’s a gap there,” notes Patricia Hewitt, principal at PG Research & Advisory Services LLC. San Mateo-based startup Checkbook.io said it is working with data-aggregator Plaid Inc to verify funding accounts for real-time transfers involving a form of digital checks. Read more…

TikTok owner ByteDance launches payments in China as it pushes into fintech and e-commerce

ByteDance has launched a new payment service within Douyin, the Chinese sister app of TikTok. Douyin users can choose Douyin eight Pay to make purchases within the short-video app. Douyin already offers payment options from Alibaba affiliate Ant Group’s Alipay and Tencent’s WeChat Pay, the two dominant mobile payment apps in China. Together, Alipay and WeChat Pay account for more than 90% of the mobile payments market in China, according to iResearch. Read more…

MoneyGram’s links to Visa Direct and Checkout.com hike the stakes in near real-time remittances

The remittance giants haven’t been shy over the last two years in adopting card-network technology and local payments services to close the last mile for fast transfers directly to users’ mobile devices. MoneyGram played its latest card in this market with an arrangement that enables transfers through Visa Direct and Checkout.com to debit cardholders throughout most of Europe. Checkout.com will allow senders to use the MoneyGram app or Web site to send funds directly to debit card accounts in 25 countries across Europe. Read more…

Scoop: Chime’s fee income

Chime, a fast-growing online bank most recently valued at $14.5 billion, derives about 21% of its revenue from fees its customers pay for using out-of-network ATMs, according to financial data obtained by Axios. Why it matters: Banking alternatives like Chime aggressively market themselves to consumers who have been burned too often by bank fees. Chime claims it has “no hidden bank fees,” while Varo advertises itself as “online banking with no fees.” Chime’s annual gross revenue per user was $208 as of June 2020. Read more…

Attention Walmart customers: Fintech on aisle five

Walmart announced plans for a new fintech startup that could soon offer its 265 million weekly customers a basket of fresh new financial products like those available from other successful fintech startups. Walmart’s strategic partner is San Francisco-based VC group Ribbit Capital, which has invested millions in several early-stage fintech disruptors, including Affirm, Checkout.com, Robinhood, and others. Read more…

Surge in pandemic spending drives shoppers to cut up credit cards

Millions of people discovered last year that while there weren’t many things to do during pandemic lockdowns, there were plenty of things to buy. American household spending rose for six consecutive months, even as personal income dropped, after a dip in March and April. But with people’s finances entering a shaky period this winter, some are going to great lengths to tighten their loose purse strings. A McKinsey report published in December found that 40% of Americans planned to limit their discretionary spending in the coming months. Read more…

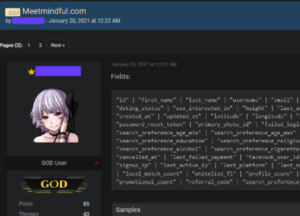

Hacker leaks data of 2.28 million dating site users

Data belongs to dating site MeetMindful and includes everything from real names to Facebook account tokens and from email addresses and geolocation information. A well-known hacker has leaked the details of more than 2.28 million users registered on MeetMindful.com, a dating website founded in 2014, ZDNet has learned this week from a security researcher. The dating site’s data has been shared as a free download on a publicly accessible hacking forum known for its trade in hacked databases. Read more…

PPRO raises $180 million for the next era of local payments infrastructure, is now valued at over $1 billion

PPRO, the global provider of local payments infrastructure, announced $180 million in new investment. Investors include Eurazeo Growth, Sprints Capital, and Wellington Management. PPRO’s valuation is now over $1 billion. The company doubled its year-on-year transaction volumes in the fourth quarter of 2020, expanded its global team by 60% in the last twelve months, and developed new strategic partnerships with local payment methods in high-growth markets like Indonesia and Singapore. Read more…

LET’S CONNECT