Welcome to Friday fintech news with the latest new product launches, innovations and perspectives on the companies disrupting the global financial industry. The European Central Bank has plans to launch an instant payment settlement system for the EU in November 2018. Users of the Danish mobile payments app Dankort can now tap-and-go for small value payments and validate with Touch ID.

Swedish payments startup Klarna, which has handled 60 million payments and has 70,000 business customers, just received a full banking license. Worldpay is testing My Business Mobile which lets businesses download an app and accept face-to-face contactless card transactions on their smartphone without any hardware.

Swedish payments startup Klarna, which has handled 60 million payments and has 70,000 business customers, just received a full banking license. Worldpay is testing My Business Mobile which lets businesses download an app and accept face-to-face contactless card transactions on their smartphone without any hardware.

With a one percent cashback bonus and no annual fee, new credit card service Final hopes to change how people use credit cards by consolidating them on a single card payment platform. South Korea web host company Nayana has agreed to pay hackers a $1 million ransomware in bitcoin to unlock the company’s system.

Homegrown Indian startup Hike Messenger launched a new digital wallet called Hike Wallet – months ahead of competitor WhatsApp in India. Orchard Platform CEO Matt Burton says a lack of infrastructure and legacy systems is allowing Asian fintechs to “leapfrog” over US companies.

Homegrown Indian startup Hike Messenger launched a new digital wallet called Hike Wallet – months ahead of competitor WhatsApp in India. Orchard Platform CEO Matt Burton says a lack of infrastructure and legacy systems is allowing Asian fintechs to “leapfrog” over US companies.

In Brazil, Vindi and Smartbill merged to create one of the largest fintech payment systems with ambitious growth plans across Latin America. A result of a $3.6 billion merger between Misys and D-H, one week old Finastra is already signing partnerships. The International Monetary Fund (IMF) continues to explore the potential of cryptocurrencies and distributed ledger technology according to an internal research note.

ECB preps eurozone-wide instant payments service

The European Central Bank has outlined plans to build an instant payment settlement system that will let people and businesses send money anywhere in the euro area within seconds. Slated to go live in November 2018, the Target instant payment settlement (Tips) platform will offer real-time money transfer via banks around the clock, 365 days a year, in the 19 euro countries.

The European Central Bank has outlined plans to build an instant payment settlement system that will let people and businesses send money anywhere in the euro area within seconds. Slated to go live in November 2018, the Target instant payment settlement (Tips) platform will offer real-time money transfer via banks around the clock, 365 days a year, in the 19 euro countries.

Currently, it can take up to one business day for money transfers to make their way across the eurozone.

The ECB says it will work closely with banks on the service, which will be offered to them at the “low price” of 0.2 cents per payment for at least the first two years of operation. Via finextra.com

Danish m-payments scheme adds lock-screen payments and Touch ID

Users of the Dankort app and mobile wallets from more than 60 Danish banks can now tap-and-go for low value payments with their phones.

Users of the Dankort app and mobile wallets from more than 60 Danish banks can now tap-and-go for low value payments with their phones.

Nordic payment system provider Nets and bank association Bokis have updated the apps to add lock-screen payment functionality and biometric authentication. Similar to the contactless version of the national debit card scheme Dankort, low value payments under DKK 200 are completed without authentication. While the physical card requires a pin for contactless transactions overt that amount, iPhone users can now choose to validate payments with Touch ID instead.

Three weeks ago, Dansk Supermarked Group allowed a limited test group to trial the lock-screen Dankort mobile payment functionality in all Netto, Føtex, Bilka and Salling supermarkets. The functionality has now been extended to all users and makes performing mobile contactless payments for larger amounts even more convenient. Via finextra.com

Klarna gets a full banking license, gears up to go beyond financing payments

After Anders Holch Povlsen and his firm Brightfolk bought up a stake of at least $225 million in Klarna earlier this month, today the profitable Swedish payments startup, now valued at over $2.25 billion, is stepping up its game. Klarna has announced that it has picked up a full banking license from Finansinspektionen, the Swedish Financial Supervisory Authority.

After Anders Holch Povlsen and his firm Brightfolk bought up a stake of at least $225 million in Klarna earlier this month, today the profitable Swedish payments startup, now valued at over $2.25 billion, is stepping up its game. Klarna has announced that it has picked up a full banking license from Finansinspektionen, the Swedish Financial Supervisory Authority.

The license will give Klarna — which up to now has powered payments for 60 million customers and works with 70,000 merchants — the ability to turn on a range of new banking products and services for its customers across Europe. These could include issuing payment cards; and moving into products to become an all-in-one digital wallet.

Currently, Klarna’s business is focused on providing payments on e-commerce sites, and offering users different financing options to complete purchases on online stores, so it’s logical for it to consider ways of extending those one-off relationships. As part of the deal, we have confirmed that — as expected — Klarna is legally changing its name to Klarna Bank, although it will continue to operate in the market simply as “Klarna.” Via techcrunch.com

Worldpay pilots app-only mPOS for small retailers

Worldpay is conducting extended trials of a software-based mobile points of sale system which helps cash-only mobile and micro retailers to accept card and phone payments on their NFC devices. My Business Mobile enables businesses to download an app and accept face-to-face contactless card transactions on their smartphone without the need to plug in any additional hardware. The company believes the innovation gives it an advantage over long-established vendors like iZettle, SumUp and Square, which require the use of chip-and PIN reader peripherals.

Worldpay is conducting extended trials of a software-based mobile points of sale system which helps cash-only mobile and micro retailers to accept card and phone payments on their NFC devices. My Business Mobile enables businesses to download an app and accept face-to-face contactless card transactions on their smartphone without the need to plug in any additional hardware. The company believes the innovation gives it an advantage over long-established vendors like iZettle, SumUp and Square, which require the use of chip-and PIN reader peripherals.

The UK payments processor says the technology will be piloted among up to 50 micro-businesses in London in 2017, including coffee carts, barbers, festival vendors, pop-up shops and market traders. City-based coffee cart business Feijoa Tree Coffee is the first to use the app as part of a six month-long pilot which Worldpay will use to assess a possible larger scale roll-out at a later date and inform further development of the technology. Via finextra.com

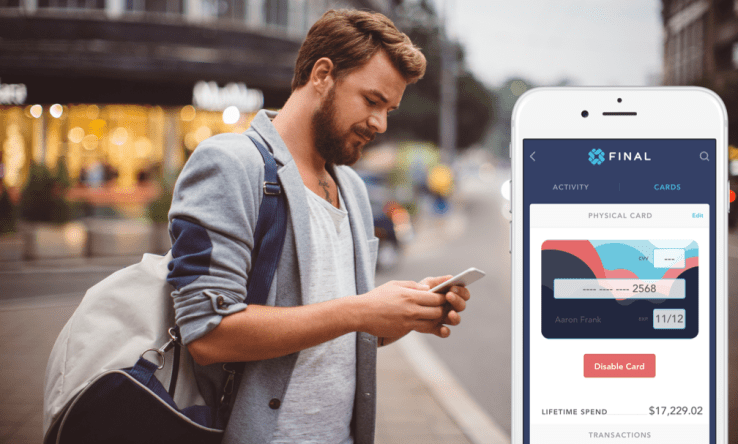

Final: One credit card account to rule them all

A startup called Final wants to change the way people use credit cards — or rather, the company wants to change the credit card industry to fit consumers’ lifestyles. With a 1 percent cash-back bonus and no annual fee, Final offers a competitive credit card product, but it really excels in the flexibility it provides in the way consumers can manage virtual cards across multiple vendors.

A startup called Final wants to change the way people use credit cards — or rather, the company wants to change the credit card industry to fit consumers’ lifestyles. With a 1 percent cash-back bonus and no annual fee, Final offers a competitive credit card product, but it really excels in the flexibility it provides in the way consumers can manage virtual cards across multiple vendors.

If you’re like most of the people who read this site, you probably have a Spotify account and a Netflix account, and maybe you subscribe to one or more online video services. You probably have a card on file at Amazon.com and shop a variety of different e-commerce sites. Who knows, maybe you pay monthly for some sort of subscription box that used to be all the rage a few years ago.

Increasingly more of your purchases are moving online, and you probably pay for all of those goods services with the same credit card. But what if I told you there was a way to have a different card number on file for each individual service? And what if I told you that each of those different card numbers would be aggregated into one single payment that you make monthly? Via techcrunch.com

South Korean firm’s ‘record’ ransom payment

South Korean web-hosting firm Nayana has agreed to pay a $1M ransom to unlock computers frozen by hackers. It is believed to be a record amount, although it is worth noting that many ransom payments are never made public.

South Korean web-hosting firm Nayana has agreed to pay a $1M ransom to unlock computers frozen by hackers. It is believed to be a record amount, although it is worth noting that many ransom payments are never made public.

Nayana’s chief executive revealed that the hackers initially asked for $4.4m, payable in bitcoin. Security experts warned that firms should not pay such ransoms or enter into negotiations with hackers.

Angela Sasse, director of the Institute in the Science of Cyber-Security, said that she was surprised both by the size of the ransom and that the firm went public about paying. Via bbc.com

Hike Messenger Beats WhatsApp to Launch Digital Wallet in India

Homegrown unicorn, Hike Messenger has launched a UPI-enabled digital wallet – Hike Wallet – months ahead of the proposed launch of digital wallet of rival WhatsApp in India.

Homegrown unicorn, Hike Messenger has launched a UPI-enabled digital wallet – Hike Wallet – months ahead of the proposed launch of digital wallet of rival WhatsApp in India.

The wallet services are available on the Hike 5.0 version introduced today. The latest version has a new design, a few new features like ‘Multiple likes,’ and new app themes for a personalised experience. The app also supports a ‘Magic Selfie’ option which edits pictures within the Hike App on the click of a button. The company has also introduced ‘text to stickers’ in four fonts that work with local languages.

YES BANK is the banking partner enabling the Tencent-backed company to launch UPI and the mobile wallet. With this update, users can make free bank-to-bank transactions via UPI. This functionality will even work for users that are not in the messenger app. Via inc42.com

Asian Fintech Scene ‘Leapfrogging’ Over US In Innovation

While fintech companies proliferate in the United States, driving the expansion of a well-established financial sector with flourishing credit card and personal banking industries, Orchard Platform CEO Matt Burton is turning an eye to the east.

While fintech companies proliferate in the United States, driving the expansion of a well-established financial sector with flourishing credit card and personal banking industries, Orchard Platform CEO Matt Burton is turning an eye to the east.

“In a lot of Asia, that doesn’t exist whatsoever,” Burton said at Benzinga’s 2017 Fintech Awards. “The population there are getting loans for the first time. There’s no credit bureaus there, so any data set that you’re able to acquire is completely proprietary.”

Lack of competition is proving helpful for the nascent fintech scene. “We’re just seeing, because they don’t have the legacy systems and mentality, they’re just leapfrogging us in terms of innovation,” Burton said. Via benzinga.com

Vindi and Smartbill Merge to Create Mega Fintech Provider in Brazil

Brazilian payment providers Vindi and Smartbill have announced that they are merging, confirming an earlier report about their integration to consolidate the market of payments focused on the service sector in Latin America.

Brazilian payment providers Vindi and Smartbill have announced that they are merging, confirming an earlier report about their integration to consolidate the market of payments focused on the service sector in Latin America.

The shareholders of both startups have approved the transaction and will continue to support the combined company, which is said to currently process more than $1 billion annually, and will now be an even bigger threat to local rivals.

Led by Rodrigo Dantas, Vindi is a Sao Paulo, Brazil-based provider of subscription/recurring billing and payment solutions. Smartbill is also based in the Brazilian capital and operates as a cloud-based subscription management system that allows companies of all sizes to join the subscription business model. The two companies said that combining their forces will allow to unlock growth potential and further extend the products and services they offer to their merchants. Via financemagnates.com

Finastra wastes no time to sign new Fintech partnerships

Finastra is barely a week old, yet the FinTech firm has already begun to shake hands and sign dots. A result of the much-feted mega-merger between Misys and D H worth $3.6 billion, it ranks third in the world for vendor size behind US giants FIS and Fiserv.

Finastra is barely a week old, yet the FinTech firm has already begun to shake hands and sign dots. A result of the much-feted mega-merger between Misys and D H worth $3.6 billion, it ranks third in the world for vendor size behind US giants FIS and Fiserv.

Finastra already boasts some impressive numbers – 10,000 employees, with 9,000 customers and 4,000 research and development staff.

It’s more than likely that the new name will be splashed across the internet via a waterfall of product announcements soon. Before those press releases have even been finalised, though, Finastra has signed some early bird deals. Via ibsintelligence.com

IMF Explores ICOs and Central Bank Coins in New Blockchain Note

The International Monetary Fund (IMF) is continuing to explore the potential of digital currencies and distributed ledger technology (DLT). In a staff discussion note released this week, entitled “Fintech and Financial Services: Initial Considerations”, the IMF places an emphasis on two impact areas: the use of the technology for cross-border payments and its potential to be leveraged as part of a central bank-backed digital currency.

The International Monetary Fund (IMF) is continuing to explore the potential of digital currencies and distributed ledger technology (DLT). In a staff discussion note released this week, entitled “Fintech and Financial Services: Initial Considerations”, the IMF places an emphasis on two impact areas: the use of the technology for cross-border payments and its potential to be leveraged as part of a central bank-backed digital currency.

In particular, the IMF hints at how blockchain-based ‘digital tokens’ are now being used to represent securities and ownership rights through so-called initial coin offerings (ICOs), though it stops short of any formal statements on the matter.

The IMF goes on to speculate that answers to these questions would likely vary by country and jurisdiction, but that the question of how such uses of the technology will be regulated is likely to be on the minds of policymakers in the years ahead. Via coindesk.com

LET’S CONNECT