Kount just released its 2017 Mobile Payments & Fraud Report and it’s essential reading for retail, e-commerce and the payments industry. We’ve got highlights of the report, key findings and analysis to provide background and context for your mobile fraud prevention strategies.

Kount just released its 2017 Mobile Payments & Fraud Report and it’s essential reading for retail, e-commerce and the payments industry. We’ve got highlights of the report, key findings and analysis to provide background and context for your mobile fraud prevention strategies.

Mobile Impact

Need proof that mobile matters to retail and e-commerce? In five years of publishing this report, the uptake in mobile payments is dramatic:

- only 20% of merchants earned less than 5% of revenue from mobile sales compared to 50% five years ago

- only 7% of merchants said mobile was not important to their revenue compared to 20% five years ago

- merchants actively supporting mobile grew from 54% to nearly 80%.

Mobile Fraud Growing

More than 40% of merchants said mobile fraud is growing compared with 23% a year ago. Only 8% claimed mobile fraud decreased as a percentage of total volume in the past year, a big concern for the future. 60% of merchants said mobile payments are the greatest risk of mobile fraud.

More than 40% of merchants said mobile fraud is growing compared with 23% a year ago. Only 8% claimed mobile fraud decreased as a percentage of total volume in the past year, a big concern for the future. 60% of merchants said mobile payments are the greatest risk of mobile fraud.

Kount found that only 25% of those surveyed felt mobile fraud was higher risk than e-commerce compared to 44% two years ago. Five years ago, over 55% of merchants said they were unable to detect whether a payment was coming from a mobile device, while fewer than 15% believe that now.

The report noted several mobile payment trends:

- 44% now support mobile shopping apps compared to 21% five years ago

- nearly 30% now accept mobile point-of-sale payments, twice that of five years ago.

Mobile and Revenue Growth

At least 50% of merchants in every product/service category claimed mobile revenue was “very important.” In 15 categories, at least two-thirds of merchants said mobile revenue is important. in six segments, more than 75% said mobile revenue is very important including: alcohol/tobacco (88.9%), telecom (84.6%), flowers/gifts (84.2%), travel services (80%), jewelry (75%) and dating/social (75%).

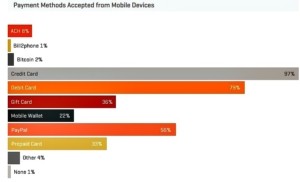

Mobile Payment Types

Apple iOS and Google Android mobile payments systems were supported by 70% of merchants compared to 56% just two years ago. The number of merchants supporting mobile-optimized checkouts grew from 30% to 40% in just one year.

97% of merchants accepted credit cards via mobile devices and PayPal was accepted by 56% of merchants, the third most common platform after debit cards (79%). Gift cards were supported by 36% and mobile wallets by 22%. Interestingly, 2% of merchants now accept bitcoin.

On average, merchants supported 3.4 types of mobile payments; 70% supported at least three mobile payment types and 20% accepted more than five mobile payment types.

Nearly 90% of merchants said mobile transactions had grown over the previous year and 48% said mobile transactions had grown more than 11% in the past year.

Mobile Revenue Growth

Mobile revenue has grown strongly each year for the past five years of Kount surveys. five years ago, 78% of merchants earned less than 10% of revenue via mobile. This year, 48% said they earned more than 20% of revenue via mobile sales channels and 32% claimed they earned more than 40% of revenue via mobile.

25% of merchants believe they will earn more than 50% of their revenue via mobile channels in two years or less. 56% believe they will earn more than 30% of revenue via mobile within two years.

The biggest products/services categories that earned more than 50% of revenue via mobile in the past year included: flowers/gifts (36.8%), gaming (33.3%), books/music/video (25.8%), home improvement/hardware (25%), food/drug (25%) and ticketing (25%).

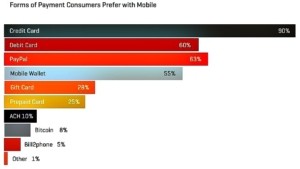

Consumer Payment Preferences

So how do consumers prefer to pay? According to Kount, Credit cards (90%), PayPal (63%), debit cards (60%), and mobile wallets (55%) were the most popular followed by gift cards (28%), prepaid cards (25%) and bitcoin (8%).

So how do consumers prefer to pay? According to Kount, Credit cards (90%), PayPal (63%), debit cards (60%), and mobile wallets (55%) were the most popular followed by gift cards (28%), prepaid cards (25%) and bitcoin (8%).

The research also showed that merchants believed that consumers were more concerned about ease of payment (70%) than security (30%). More than 40% of merchants said they have shopping cart abandonment rates over 50% – an incredible loss of business and revenue.

Mobile Fraud Challenges

Merchants were asked the five biggest challenges in implementinge their mobile fraud strategies: choosing the right solution partner, the costs and complexity of implementing a new solution, gathering IT resources, finding fraud prevention solutions that were adequate for the mobile channel, and the number of tools need to manage fraud risk in the mobile channel.

Merchants were asked the five biggest challenges in implementinge their mobile fraud strategies: choosing the right solution partner, the costs and complexity of implementing a new solution, gathering IT resources, finding fraud prevention solutions that were adequate for the mobile channel, and the number of tools need to manage fraud risk in the mobile channel.

52% of merchants said cost and complexity of fraud solutions were the biggest barriers while 47% said finding IT resources was their biggest challenge.

Mobile Fraud Risk

Kount research finds merchants are becoming more complacent about mobile fraud risk where only 25% believe mobile fraud is riskier than e-commerce compared to 41% several years ago. The number of merchants who said mobile is less risky than e-commerce jumped from 5% to 15%.

Ironically, 40% of merchants said that mobile fraud has increased in the past year. As a percentage of transactions, 21% said mobile fraud increased in the past year; 29% said mobile fraud grew proportionately; only 7.7% said it decreased and an astounding 42.1% said they didn’t know.

Merchants thought 38% of mobile fraud came from domestic orders while 18% thought were was international and 17% thought it came equally from each. A large number – 28% – could not tell.

Greatest Risk of Fraud

When it comes to payment systems, the research showed some interesting opinions on platform risks. 61% associated Apple with “safety” followed by “nobody” (30%), Android and Blackberry (3.7% each) and Windows (1.4%).

When it comes to payment systems, the research showed some interesting opinions on platform risks. 61% associated Apple with “safety” followed by “nobody” (30%), Android and Blackberry (3.7% each) and Windows (1.4%).

44% of merchants said following a data breach, their biggest worry was consumers perceiving they were risky. 36% were concerned with the loss of personal and financial data. Ironically, only 31.8% of merchants made changes to their fraud program following a data breach.

46.3% of merchants said they had seen an increase in card-not-present fraud compared with two years ago and the implementation of EMV, while 28% had seen fraud decrease in the same timeframe.

The ability to detect the use of mobile payment systems is a critical part of fraud prevention. This year, 86% of merchants could detect the use of a mobile system compared to 71% a year earlier.

Regarding fraud prevention tools, the report found:

This year, the fraud prevention tools, techniques and services used most by merchants to prevent fraud in the mobile channel were card security codes or checking the CVV (58%), AVS (46%), Fraud Scoring (48%), Device ID (38%), Velocity Checks

(35%) and a Complete Fraud Platform (47%). Whereas ID Authentication was the most

used tool for mobile channel fraud prevention in each of the first three years of the Mobile Payments and Fraud Survey, it has declined from being used by 32% of merchants in 2015 to just 15% of merchants today. While 25% of merchants used Fraud Scoring and 20 percent had Complete Fraud Platforms for managing risk in the mobile channel in 2015, this year these have each increased to being used by nearly half of merchants.

40% have no plans to add new or additional mobile fraud prevention tools in 2017. The most likely tools to be added included: “About 17 merchants said they plan to add secure mobile payment methods in 2017, while 3D secure (13%), AI/Machine Learning (13%) and Device ID (11%) were the tools or services the most merchants planned on adding this year.”

The report added: “This year, the tools or services most likely to be considered one of the three best were a Complete Fraud Platform (52%), Device ID (27%) and Secure Mobile Payment Methods (24%).”

Evolution of Mobile Fraud Prevention

Kount’s report shows just how far mobile fraud prevention has come in five years:

- 86% of merchants can now identify transactions from a mobile device compared with 33% five years ago

- 78% now support mobile channels compared to 54% and only 7% consider mobile channels not important compared to 20% five years ago

- The number of merchants earning more than 50% of revenue from mobile has grown from 2% to 24% in five years; another 26% expect mobile to make up more than half of their revenues in two years.

A ll in all, it’s a compelling look at mobile fraud, its growth, tools used to prevent it and the somewhat unusual note that merchants are becoming more complacent about mobile risk.

ll in all, it’s a compelling look at mobile fraud, its growth, tools used to prevent it and the somewhat unusual note that merchants are becoming more complacent about mobile risk.

Copies of the Kount 2017 Mobile Payments & Fraud Report are available for download at no charge here.

LET’S CONNECT