A busy day and busy week ahead for global payments news in this roundup from PaymentsNEXT. US e-commerce jumped 14.2% in 2021, payments sector investment may get a reset, FYNCR introduced an all-in-one credit card bill payments mobile app, and the Tillful Card promises SMBs faster credit access.

In international payments news, Danish tap to pay Vibrant saw 1000% plus growth, Adyen launched new tech hubs in Chicago and Madrid, French BNPL Alma begged $130 million in new VC capital, and Italy’s Intesa will launch Isybank, a digital-only service. All that and some Valentine’s Day sales projections and insights just to sweeten your payments news.

US e-commerce growth 14.2% in 2021

Consumers spent $871.03 billion online with US merchants in 2021, up 14.2% year over year from $762.68 billion the prior year, according to early Digital Commerce 360 estimates. While that’s less than half of the record-breaking growth retailers experienced in a pandemic-fueled 2020, it’s noteworthy that the industry-maintained gains—and even grew—compared with the earlier giant surge in ecommerce. Amazon accounted for more than 40% of all digital revenue in the United States. Read more…

Payments confronts fundraising slowdown

The red-hot payments sector is mainly defying the chill affecting investments and valuations for other startups, but even in this dynamic fintech sphere investors may get choosier and initial public offerings may stall, said venture capitalists and analysts who track the industry. “There’s a reset going on,” said Parthenon Capital Partner Zach Sadek, referencing the public markets. Compared to six months ago, valuations and terms for payments startups are “not as frothy, not as aggressive, not as frenzied,” said Sadek. Read more…

Announcing FYNCR, the first all-in-one credit card bill payments mobile app

FYNCR announced the first mobile app that provides a one-stop solution for credit card bill payments, reward earning and the spending marketplace. Fyncr allows every credit card owner to securely store, view, and pay all their credit cards from any bank account and earn reward points called FYX to enjoy unbeatable deals, discounts, and freebies within the app from over 500 brands in the country. Read more…

Tillful teams with Highnote and Mastercard to help small businesses access and build business credit faster

Launching in early 2022, the Tillful Card aims to help new and emerging businesses as well as underrepresented owners of small businesses. This historically “credit invisible” segment of SMB borrowers tends to face more challenges to stay in business due to lack of credit history, which decreases their access to credit from lenders. Tillful gives Main Street SMBs access to a new kind of business credit score–using real time, alternative transaction data–along with previously unavailable credit-building tools and services. Read more…

Payment transactions exploded by over 1,000% in six months for Danish ‘tap-to-phone’ start-up Vibrant

Transaction values soared by over 700 per cent and number of users by more than 600 per cent for VISA-backed business The Danish fintech start-up Vibrant has seen an exponential increase in the use of its tap-to-phone payment solution. Between August 2021 and January 2022, it recorded 1,131% growth in the number of transactions made via its app. This has been matched by a 736% expansion in transaction values and a 606% boost in the number of merchants using Vibrant, which is backed by VISA. Read more…

Payment processing company Adyen launches tech hub in Chicago

In theory, credit and debit cards are simple technology. It’s a piece of plastic fitted with a chip and all you have to do is swipe it to make a payment. Behind the scenes, the tech used to read the card’s information, process the payment and transfer money is fairly complex, requiring code and often hardware. To help ease payment processing for businesses and online retailers, Adyen — a fintech company focused on payment solutions — will launch two new tech hubs in Chicago and Madrid. Read more…

BNPL payment startup Alma raises another $130 million round

French startup Alma is trying to build a new “buy now, pay later” giant in Europe. The company has closed a $130 million Series C round (€115 million). It has also raised $109 million (€95 million) in debt financing. The company has partnered with 6,000 merchants so that they offer more flexibility for expensive purchases. The main payment product is the option to pay in two, three or four installments. Alma processes more than €1 billion annually with its current run rate. Read more…

Banked announces $20 million Series A funding round led by Bank of America

Banked announced the completion of a $20 million Series A funding round. The investment was led by Bank of America and Edenred Capital Partners. Users do not need to create an account or pass any login information to Banked – they simply choose their existing bank at checkout and are securely connected to their mobile banking app to biometrically authenticate the purchase in less than 30 seconds. Read more…

Italy’s Intesa Sanpaolo teams up with Thought Machine in digital push

Italy’s biggest lender, is investing in British banking software maker Thought Machine after picking its application to run Intesa’s new digital bank, Intesa said on Monday. Under a four-year strategy, Intesa will launch Isybank, a digital-only service targeting 4 million customers under 40 who do not visit branches and allow it to close 1,050 branches in the next four years and save around €800 million ($905 million). Read more…

Americans to spend $23.9 billion on Valentine’s Day this year

Valentine’s Day spending is expected to reach $23.9 billion this year, up from $21.8 billion in 2021 and the second-highest year on record, according to the annual survey released today by the National Retail Federation and Prosper Insights & Analytics. According to the survey, shoppers expect to spend an average of $175.41 per person on Valentine’s Day gifts, up from $164.76 in 2021. The increase comes as many intend to spend more on significant others or spouses. Read more…

How Valentine’s Day impacts consumer behavior

Nearly 2 years after the start of the pandemic, with Valentine’s Day 2022 approaching, we wanted to dig into our data to learn more about how the pandemic might have impacted online demand for certain go-to gifts. Did fewer people going out result in more people shopping for online gifts? If so, which types got the biggest bump? And how are things looking as we head into 2022? It’s Teddy Bears that actually receive the biggest Valentine’s Day boost, with demand increasing by a whopping 151% during the week before the holiday. Lingerie and chocolate also got huge boosts. Read more…

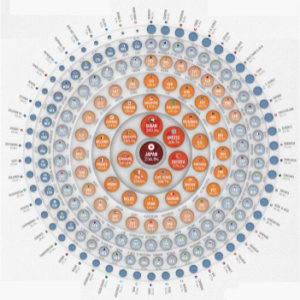

How much debt is too much? Government debt by country

The country same reasons you might find it already has a counter play cycle it all just OR anything that you so now I have nothing with the highest debt to GDP ratio is Japan. Japan has had huge levels of debt since the Japanese stock market and real estate bubble burst in the late 1980’s. They have had the most debt ever since their financial crisis over 30 years ago. Other countries with huge amounts of debt are also those that have had recent economic problems. Italy and Greece are well known for their recent debt crisis, with Greece having to completely rethink its economy. Read more…

LET’S CONNECT