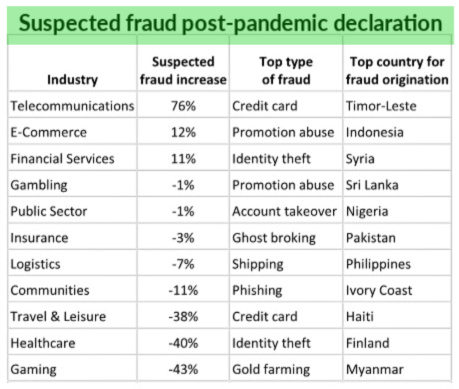

A new quarterly analysis of global online fraud trends found the telecommunications, e-commerce, and financial services industries were increasingly impacted along with Millennials among the victims most targeted by fraudsters using COVID-19 scams.

Global fraud and identity solutions company Trans Union used the March 11, 2020 announcement of the global pandemic by the World Health Organization (WHO) as a base date for its analysis.

TransUnion found suspected fraudulent digital transactions were 5% higher when comparing the periods Jan 1 to March 10 with March 11 to April 28 timeframes. Researchers identified more than 100 million suspected fraudulent transactions from March 11 to April 28.

“Given the billions of people globally that have been forced to stay at home, industries have been disrupted in a way not seen on this massive of a scale for generations,” said Shai Cohen, senior vice president of Global Fraud & Identity Solutions at TransUnion.

“Now that many transactions have shifted online, fraudsters have tried to take advantage, and companies must adapt. Businesses that come out on top will be those leveraging fraud prevention tools that provide great detection rates and friction-right experiences for consumers.”

Key industries most impacted

TransUnion researchers found that fraudsters followed consumers who moved many of their purchases online as a result of the pandemic, focusing their attacks on e-commerce and companies transacting their business online.

“Our data shows that as social distancing changes shopping patterns, fraudsters have taken notice and targeted the more digital forward industries while following the money,” said Melissa Gaddis, senior director of customer success, Global Fraud & Identity Solutions at TransUnion.

That means while sales online grew, so did the incidence of fraud in the telecom, e-commerce, and financial services industries.

“For instance, although we found online gaming increased 64% as people stay home, it isn’t immediately lucrative to target those companies since financial information isn’t generally shared there. However, telecommunications, e-commerce, and financial services all have large digital adoption, financial information, and payments at the center of their online experience and fared relatively well compared to other industries during the pandemic.”

Globally across industries, TransUnion found the countries with the highest percent of risky transactions were Yemen, Syria and Kazakhstan. In the US, TransUnion found the cities with the highest percent of risky transactions were Springfield, MA, Akron, OH, and Louisville, KY.

Younger consumers a favorite target of scams

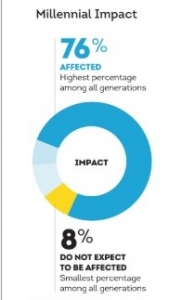

To understand the impacts of COVID-19 on consumers, TransUnion surveyed 9,215 adults in the US, Canada, Colombia, Hong Kong, India, South Africa, and the UK during the week of April 13. Nearly three out of 10 respondents (29%) said they had been targeted by digital fraud related to COVID-19, with Millennials (ages 26-40) the most targeted at 34%.

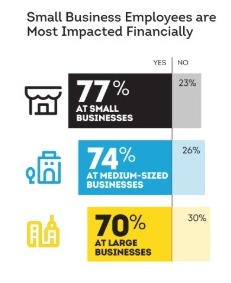

TransUnion found that consumers who said their household income is being negatively impacted by the COVID-19 pandemic are more likely to experience digital fraud with 32% reporting being targeted by online COVID-19 scams compared to 22% of people not financially impacted.

Researchers also found young people were a surprisingly large target of fraud and were among those highest impacted financially by the coronavirus pandemic.

“A common assumption is that fraudsters target older generations who are perceived to be less digitally capable,” said Gaddis. “Our data showed the opposite with younger generations, Millennials and Gen Z (those born in or after 1995), were the most targeted. Adding insult to injury, our survey found Millennials are being financially challenged the most during the pandemic.”

Of the estimated 32% of consumers worldwide who said they were not directly impacted financially by the pandemic, 43% were Boomers, 47% more likely to work for large companies, and were most likely to work in healthcare, government, and educational services.

TransUnion has an extensive set of global Consumer Financial Hardship reports helping businesses understand how consumers are being impacted financially by the COVID-19 health crisis. The reports included breakouts by country including the US, Canada, UK, Hong Kong, South Africa, and Colombia and they can be viewed here.

LET’S CONNECT