By Jeff Domansky, Feb 1, 2021

Contactless payments are now approaching tsunami size. The latest Visa Back to Business Study shows just how far and fast adoption has occurred by merchants and consumers, even in the lagging US market.

The research covered business and consumers in Brazil, Canada, Germany, Hong Kong, Ireland, Russia, Singapore, UAE, and the US, and there’s no turning back even with a return to “normal” somewhere in the future.

Three insights stand out from Visa’s Nov 2020 survey:

- 82% of SMBs adopted new digital technologies as more than half of consumers used contactless payments whenever possible in the previous three months

- 39% of SMBs have started accepting new forms of digital payments (up from 20% in the original study in June)

- Only 16% of consumers said will return to their old payment methods, post-pandemic.

What are businesses doing with contactless?

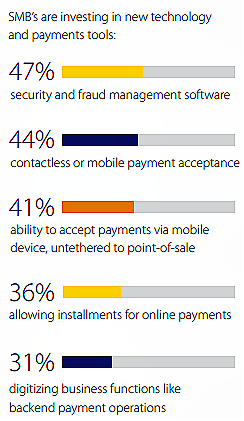

SMBs are assessing what other payment technologies are critical to meeting today’s consumer expectations, with results led by security and fraud management software (47%), contactless or mobile payment acceptance (44%), accepting payments via a mobile device (41%), installments or ‘buy now, pay later’ (36%) and digital backend payment operations (31%).

“With greater hindsight into 2020, we can clearly see that the digital payment experiences that excelled the most – contactless and e-commerce – were driven out of necessity and have become more habitual in people’s daily lives at a pace not often seen,” said Kevin Phalen, global head of business solutions, Visa.

“If 2020 was the year of contactless and eCommerce, results of this study tell us that 2021 will bring greater attention to security and fraud prevention, and trial of more emerging digital commerce tools that help businesses thrive,” Phalen added.

Globally, 82% of SMB owners have made updates to their operations to meet the increasing demand for digital payments, up from 67% in summer 2020.

The continued small and micro business shift to digital commerce will evolve in the New Year and increase focus on security and fraud prevention and more emerging payment tools such as ‘buy now, pay later’ (BNPL) mobile payment acceptance.

As we reported recently, BNPL saw dramatic growth in the past year, and mobile banking services, including mobile check deposits, grew quickly in popularity as well. Adoption of new technology happened in just 10 months where previously it may have taken 10 years.

What about consumers and contactless?

Contactless is here to stay as consumers seek safer, touchless payment experiences. It’s now a new year and an era of new habits.

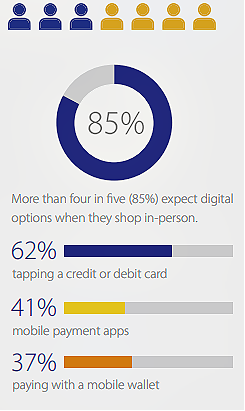

More than 85% expect digital options when they shop in person, including tapping a credit or business card (62%), mobile payment apps (41%), and mobile wallet payment (37%).

Among the shifts in consumer buying habits:

- Nearly half of consumers (47%) said they won’t shop at a store that doesn’t offer contactless payments

- 65% of consumers prefer to use contactless as much, or even more than they do now

- 74% of SMBs expect consumers to continue preferring contactless even AFTER a vaccine is available.

The global contactless payment market is projected to grow from US$ 1.05 trillion in 2019 to surpass $ 4.6 trillion by 2027, according to a new study by Precedence Research.

The contactless payments train is in the station, and consumers are already on board. More than ever, SMBs and retailers need to be equipped at the point-of-sale to offer contactless payments.

The Visa Back to Business Study was conducted by Wakefield Research between Nov 13-Nov 25, 2020, among 250 small business owners at companies with 100 employees or fewer in Brazil, Canada, Germany, Hong Kong, Ireland, Russia, Singapore, UAE, and the US. Consumers were surveyed by Wakefield Research between Nov13-25, 2020, among 1,000 adults in the US and 500 adults in Brazil, Canada, Germany, Hong Kong, Ireland, Russia, Singapore, and UAE.

For more detailed data, country comparisons, and SMB market information, you can view The Visa Back to Business Study 2021 Outlook here.

LET’S CONNECT