Despite the high profile of big digital security failures, consumers say they trust banks most with the security and convenience of their digital identity according to new research from Mitek.

Mitek found digital identity is becoming a key enabler for online banking and on-demand financial services. In fact, it’s almost hard to imagine life before the availability of online banking thanks to the expanding range of online financial services and mobile apps.

As we turn increasingly to online services, the consumer’s comfort with sharing their digital identity becomes a critical business success factor in financial services, e-commerce, retail, and every new business disruption in categories from insurance and investing to logistics and deliveries.

In banks we trust

Researchers surveyed more than 1000 US consumers and found some key insights into consumers and their digital identities:

their digital identity?

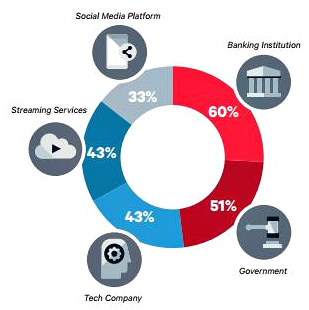

- Respondents were more comfortable sharing their digital identity information with banking institutions (60%) over any other groups, including government entities and tech companies

- 65% of consumers consider their banking transactional history (including bank accounts, credit cards, and financial transactions) to be part of their digital identity

- 86% currently use their digital identity for banking and 16% express interest in doing so in the future

- 78% of consumers are most concerned with theft and/or loss of money when using digital identity.

When it comes to who consumers trust most when sharing their digital identity, banks were the most trusted at 60%, followed by government (51%), tech companies (43%), streaming services (43%), and social media platforms (33%).

Most popular uses for digital identities

The use of our digital identities is becoming a bedrock of everyday life.

There were few surprises among the most common applications for digital identities including banking (86%), online shopping (76%), streaming services (72%), medical (60%), registration and voting (60%), and travel and hospitality (49%).

Biggest digital identity concerns

When it comes to the security of personally identifiable information (PII), consumers were most concerned about the protection of their social security numbers (88%), followed by their banking information (85%), date of birth (45%), phone number (45%), current or previous address (43%), name (40%), and email address (35%).

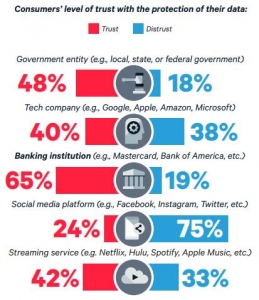

As mentioned earlier, 65% of consumers trusted banks the most with their personal identity information. The organizations they distrust the most was also revealing and included social media platforms (75%), tech companies (38%), streaming services (33%), banks (19%), and government entities (18%),

“While retailers, streaming services and other industries are making strides to integrate digital identities into their offerings, those markets don’t yet have the trust that banks do,” said Max Carnecchia, CEO of Mitek. “That means the banking industry will continue to spearhead the growth and innovation of digital identity services over the next few years as other industries look to catch up to their consumer usage rates.”

While there is a great deal of consumer trust in how organizations handle their personal digital identities, 78% of consumers listed theft or loss of money as their biggest concern and 60% believed their banking documents are safer than using digital IDs for banking. Surprisingly, 25% of consumers said they still prefer to verify their identity in person at a local branch.

Despite high-profile data breaches and hacking incidents, banks are leading in making consumers more comfortable with the security and convenience of their digital identities. There’s still much work to do for financial institutions and particularly other industries in educating and enhancing consumer trust in digital identities.

You can read more findings in the Mitek report Digital Identity 2020 – The Future of Banking here.

Data charts courtesy of Mitek

LET’S CONNECT