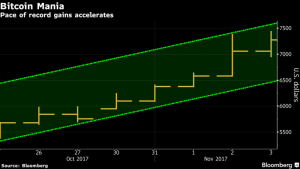

After crossing $7,400, bitcoin has retrenched somewhat although it is still in record-high territory in Monday trading. We’ve got a roundup of recent market news and comments by bitcoin bulls and bears to keep you up-to-date on the latest cryptocurrency developments.

At a recent New York conference, Wall Street Journal columnist Jason Zwieg cautioned investors to keep emotion out of bitcoin trading. Two firms specializing in exchange-traded funds (ETFs) – Reality Shares Advisors and Amplify Trust ETF – filed initial plans with the SEC to create blockchain investment products.

Standpoint Research’s Ronnie Moas revised his 2018 prediction for bitcoin from $7500 to a bullish $11,000. The Scaling Bitcoin conference highlighted varied opinions from developers and academics on the future of bitcoin and blockchain developments.

Standpoint Research’s Ronnie Moas revised his 2018 prediction for bitcoin from $7500 to a bullish $11,000. The Scaling Bitcoin conference highlighted varied opinions from developers and academics on the future of bitcoin and blockchain developments.

During Saudi Arabia’s recent crackdown on corruption, one of the people held is billionaire Prince Alwaleed bin Talal who had some recent negative things to say about bitcoin. What’s the difference between bitcoin price and bitcoin value? Cointelegraph featured an interesting op-ed that’s recommended reading.

Bloomberg reports Argentina’s Mercado de Termino de Rosario (called Rofex) will consider adding bitcoin futures trading by the end of the year. Following plans by CME Group’s an announcement it plans to add bitcoin futures trading, Coinbase exchange added more than 100,000 new accounts in just 24 hours.

Bloomberg reports Argentina’s Mercado de Termino de Rosario (called Rofex) will consider adding bitcoin futures trading by the end of the year. Following plans by CME Group’s an announcement it plans to add bitcoin futures trading, Coinbase exchange added more than 100,000 new accounts in just 24 hours.

These stories all add up to an interesting and ongoing conflict between bitcoin bulls and bears.

Investing Guru Warns Against Emotional Decisions While Trading Bitcoin

Jason Zweig, the author of the Wall Street Journal column ‘The Intelligent Investor’ gave his views on Bitcoin at the Evidence-Based Investing conference in New York. He asked investors to be clear upfront about how they would react to rapid price movements. Make sure you look first at an exit strategy before investing. Either it is going to be worth nothing or a lot of money. Via cointelegraph.com

Jason Zweig, the author of the Wall Street Journal column ‘The Intelligent Investor’ gave his views on Bitcoin at the Evidence-Based Investing conference in New York. He asked investors to be clear upfront about how they would react to rapid price movements. Make sure you look first at an exit strategy before investing. Either it is going to be worth nothing or a lot of money. Via cointelegraph.com

ETF Firms File to Create Blockchain Investment Products

Two firms specializing in exchange-traded funds (ETFs) filed with the U.S. Securities and Exchange Commission to create blockchain-related vehicles this past week. Reality Shares Advisors, a subsidiary of Reality Shares ETFs, plans to work with Nasdaq Inc. to offer securities for different blockchain companies. Similarly, Amplify Trust ETF also filed for permission to invest and trade in blockchain startups. Neither company completed their prospectus applications, but they both indicated they would exclusively invest in different blockchain companies. Via coindesk.com

Two firms specializing in exchange-traded funds (ETFs) filed with the U.S. Securities and Exchange Commission to create blockchain-related vehicles this past week. Reality Shares Advisors, a subsidiary of Reality Shares ETFs, plans to work with Nasdaq Inc. to offer securities for different blockchain companies. Similarly, Amplify Trust ETF also filed for permission to invest and trade in blockchain startups. Neither company completed their prospectus applications, but they both indicated they would exclusively invest in different blockchain companies. Via coindesk.com

Bitcoin’s Rally Makes Ultra Bullish Analyst Revise His Target Higher

Even the most bullish analysts can’t keep up with bitcoin’s rally. Standpoint Research’s Ronnie Moas, who says bitcoin’s market cap will one day catch up to gold at $8 trillion, is raising his 2018 price target for the digital currency to $11,000 from $7,500. “Every day more headlines are hitting the newswires on crypto,” Moas wrote in a note emailed to clients today. Moas predicts up to 5 percent of the global population will be invested in the asset in five to 10 years from less than 0.5 percent today, while circulation will be capped at 21 million coins because of how the computer code was built. “I have never seen a supply-demand imbalance like this in my life,” he says. Via bloomberg.com

Even the most bullish analysts can’t keep up with bitcoin’s rally. Standpoint Research’s Ronnie Moas, who says bitcoin’s market cap will one day catch up to gold at $8 trillion, is raising his 2018 price target for the digital currency to $11,000 from $7,500. “Every day more headlines are hitting the newswires on crypto,” Moas wrote in a note emailed to clients today. Moas predicts up to 5 percent of the global population will be invested in the asset in five to 10 years from less than 0.5 percent today, while circulation will be capped at 21 million coins because of how the computer code was built. “I have never seen a supply-demand imbalance like this in my life,” he says. Via bloomberg.com

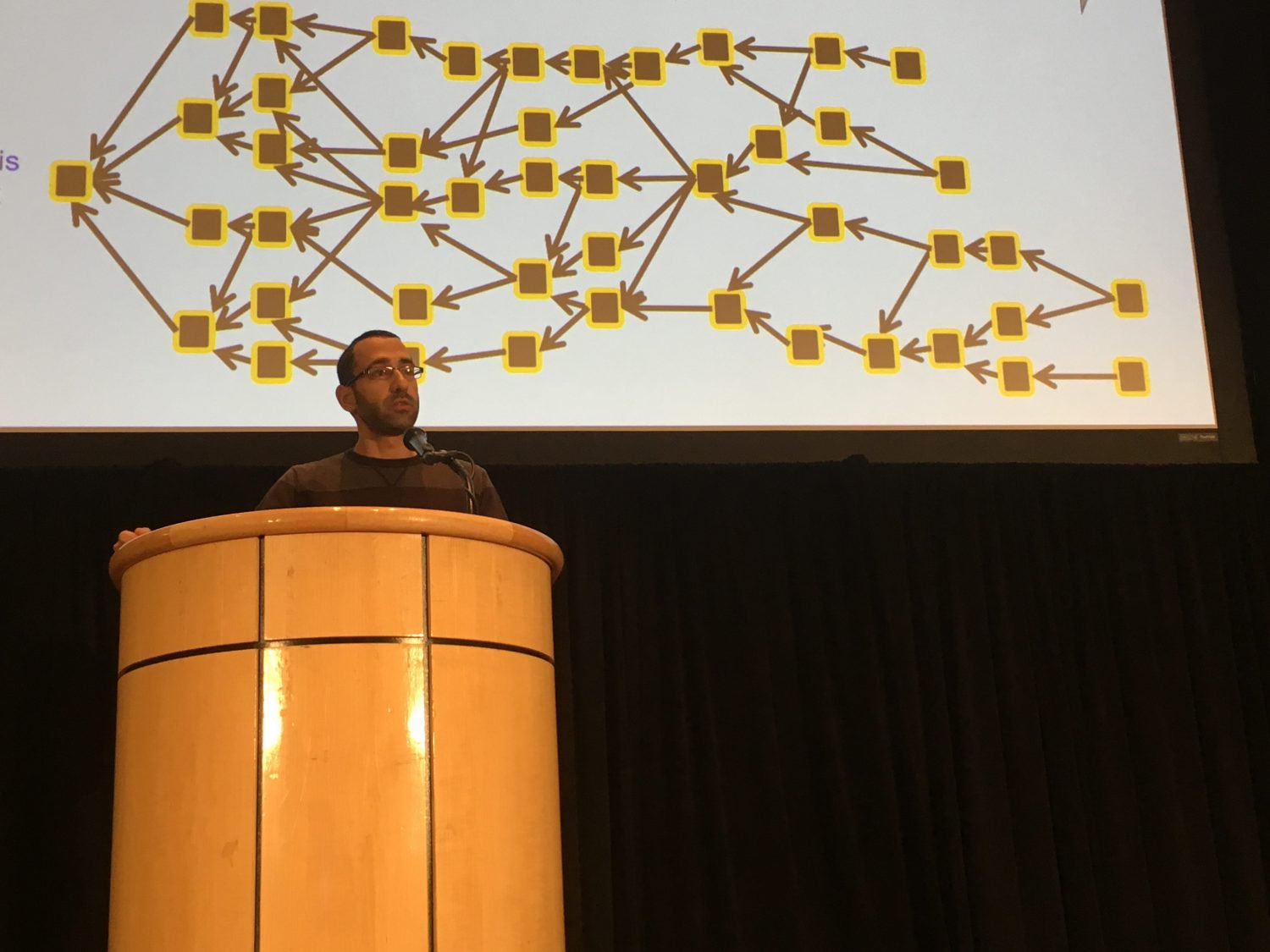

Price of Success? Bitcoin Faces New Pressure in a Multi-Coin World

If day one of Scaling Bitcoin showed how bitcoin’s technical and academic communities are moving swiftly to capitalize on the network’s newly updated code capabilities, day two offered a glimpse of a project emerging, hurdles overcome, into a world that appears more likely to play host to a diverse array of cryptocurrencies. In this way, the final day of this year’s conference showcased how, for the event, presenters and attendees, this transition is fraught with concern – as for all the talk of opportunities afforded by new crypto assets, the bitcoin community still largely traffics in reputation as its chief currency. Via coindesk.com

If day one of Scaling Bitcoin showed how bitcoin’s technical and academic communities are moving swiftly to capitalize on the network’s newly updated code capabilities, day two offered a glimpse of a project emerging, hurdles overcome, into a world that appears more likely to play host to a diverse array of cryptocurrencies. In this way, the final day of this year’s conference showcased how, for the event, presenters and attendees, this transition is fraught with concern – as for all the talk of opportunities afforded by new crypto assets, the bitcoin community still largely traffics in reputation as its chief currency. Via coindesk.com

Saudi Arabia Arrests Billionaire Prince – Could Uncertainty Boost Bitcoin?

Saudi Arabia has initiated a sweeping crackdown, ostensibly against corruption, today. King Salman has ordered the arrest of senior princes and ousted many senior officials from ministerial roles. The list of people arrested includes Prince Alwaleed bin Talal, the richest Arab in the world. Prince Alwaleed was in the news recently for his negative views on Bitcoin, saying that Bitcoin would face an Enron-like collapse. While the public reason given by King Salman for the arrests is his drive against corruption, many commentators believe that the King could be clearing the route for his son, Crown Prince Mohammed bin Salman, to take over as the King. Via cointelegraph.com

Saudi Arabia has initiated a sweeping crackdown, ostensibly against corruption, today. King Salman has ordered the arrest of senior princes and ousted many senior officials from ministerial roles. The list of people arrested includes Prince Alwaleed bin Talal, the richest Arab in the world. Prince Alwaleed was in the news recently for his negative views on Bitcoin, saying that Bitcoin would face an Enron-like collapse. While the public reason given by King Salman for the arrests is his drive against corruption, many commentators believe that the King could be clearing the route for his son, Crown Prince Mohammed bin Salman, to take over as the King. Via cointelegraph.com

Difference Between Price, Value: How to Assess an ICO

These are indeed heady days for investors in cryptocurrency, and with fortunes being made (and lost) rapidly, it’s easy to forget the difference between “price” and “value.” Many investors are focusing on the quick flip–they buy the “hottest” ICO and hope to immediately sell for huge profits once the crowdsale is over. However, it’s much easier and more certain to make profits by buying and holding, and in that case, investors need to clearly differentiate between a token’s price and its value. Many tokens and currencies represent great projects that have huge potential. Via cointelegraph.com

These are indeed heady days for investors in cryptocurrency, and with fortunes being made (and lost) rapidly, it’s easy to forget the difference between “price” and “value.” Many investors are focusing on the quick flip–they buy the “hottest” ICO and hope to immediately sell for huge profits once the crowdsale is over. However, it’s much easier and more certain to make profits by buying and holding, and in that case, investors need to clearly differentiate between a token’s price and its value. Many tokens and currencies represent great projects that have huge potential. Via cointelegraph.com

Lessons Learned From Speaking to Over 100 ICO Companies

Whether you are an investor, market participant, contributor, or in any other role that is expecting to benefit from new token creation, you should be extremely careful when it comes to putting your money or time into any of these ICOs. I usually like to compare the ICO era of 2017 to the bubble years of 1995–1999. In terms of the parallel mid-late 90’s timeline, we are currently in the early stages. Don’t get me wrong — there are some promising ones, but you need to know how to filter through them. Via blockchainatberkeley.blog

Whether you are an investor, market participant, contributor, or in any other role that is expecting to benefit from new token creation, you should be extremely careful when it comes to putting your money or time into any of these ICOs. I usually like to compare the ICO era of 2017 to the bubble years of 1995–1999. In terms of the parallel mid-late 90’s timeline, we are currently in the early stages. Don’t get me wrong — there are some promising ones, but you need to know how to filter through them. Via blockchainatberkeley.blog

Argentina’s Biggest Futures Market to Add Bitcoin

Bitcoin futures will come to Argentina soon, as the currency continues to go mainstream. The largest futures market in Argentina, the Mercado de Termino de Rosario (called Rofex) is considering offering Bitcoin futures to its clients, according to Bloomberg. The move comes as the country literally embraces the cryptocurrency in every sector due to the massive rise in inflation – termed bitcoinization. Via cointelegraph.com

Bitcoin futures will come to Argentina soon, as the currency continues to go mainstream. The largest futures market in Argentina, the Mercado de Termino de Rosario (called Rofex) is considering offering Bitcoin futures to its clients, according to Bloomberg. The move comes as the country literally embraces the cryptocurrency in every sector due to the massive rise in inflation – termed bitcoinization. Via cointelegraph.com

Bitcoin Exchange Coinbase adds 100,000 users in 24 hrs, Shows Surging Interest in Crypto

The announcement by CME that it plans to launch Bitcoin futures has resulted in a spike in interest across the world. Coinbase, the world’s largest Bitcoin exchange, added 100,000 new users in the 24 hours following the announcement. Why Coinbase matters? Coinbase is a popular exchange to buy Bitcoins with 11.9 million users supported across 32 countries. Via cointelegraph.com

The announcement by CME that it plans to launch Bitcoin futures has resulted in a spike in interest across the world. Coinbase, the world’s largest Bitcoin exchange, added 100,000 new users in the 24 hours following the announcement. Why Coinbase matters? Coinbase is a popular exchange to buy Bitcoins with 11.9 million users supported across 32 countries. Via cointelegraph.com

LET’S CONNECT