We’re starting this week with a big global payments news roundup since there’s so much going on in the payments, fintech, and e-commerce industry around the world. We hope you find the business intelligence valuable and that you’re staying safe and healthy during these trying times.

The payments world is seeing incredible stress, demand, adjustment, and innovations, particularly in response to the coronavirus pandemic. The following news stories reflect the latest developments.

COVID-19 crisis highlights need for real-time and new digital payments services around the world

More than half a trillion real-time payment transactions will be processed over the next five years, according to a new global report from ACI Worldwide and Global Data. This research analyzes global real-time, account-to-account payment volumes and forecasts across 30 global markets, a Compound Annual Growth Rate (CAGR) of 23.4% from 2019 to 2024. The report outlines the five strongest indicators of a market’s real-time payment success. Read more…

MasterCard enables higher contactless payments across Canada

Mastercard today announced it is enabling the increase of contactless payment limits to $250 across Canada, as people look for safer ways to pay in the wake of the COVID-19 (coronavirus) pandemic. The move follows similar announcements made by Mastercard recently to champion contactless limit raises around the world, as health officials recommend social distancing and a growing number of merchants encourage consumers to pay with contactless to minimize interaction. Read more…

IRS issues warning about Coronavirus-related scams; watch out for schemes tied to economic impact payments

The Internal Revenue Service today urged taxpayers to be on the lookout for a surge of calls and email phishing attempts about the Coronavirus, or COVID-19. These contacts can lead to tax-related fraud and identity theft. “We urge people to take extra care during this period. The IRS isn’t going to call you asking to verify or provide your financial information so you can get an economic impact payment or your refund faster,” said IRS Commissioner Chuck Rettig. “That also applies to surprise emails that appear to be coming from the IRS. Remember, don’t open them or click on attachments or links. Go to IRS.gov for the most up-to-date information.” Read more…

Coronavirus is eliminating chokepoints in supplier payments

The coronavirus pandemic is likely to force a great leap forward in the fight to crush paper checks, which still account for about half of B2B payments, by moving more invoice payments online. Certain organizations also are voluntarily abandoning contractual payment terms and using electronic channels to pay bills immediately so businesses deprived of cash from the crisis may get paid faster. Read more…

Coronavirus adds to uncertainty of payments in emerging markets

Amid the worldwide coronavirus crisis, making cross-border payments to emerging markets has been akin to putting together a jigsaw puzzle without many of its pieces. With that type of stress on a local banking system and financial market, some countries have closed markets, the stock exchange, and even the payments systems… “Some of our clients are corporate people making payments to other corporations, such as a company from Honduras selling coffee to Starbucks can’t be paid anymore,” said Carsten Hils, global head of INTL FCStone’s Global Payments Division. Read more…

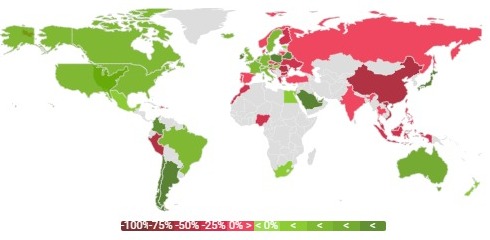

COVID-19 E-commerce Insight website

A new project, called COVID-19 Commerce Insight, shows the impact coronavirus is having on e-commerce in Europe and around the world. Updated daily, the tool shows new data at global and regional levels in key business sectors. Emarsys created a platform to help a business by drawing from online engagement data from more than 1 billion consumers worldwide interacting with more than 2500 brands to provide an up-to-date view and trends of the economic impact of the Cove and-19 pandemic on online retailers. Read more…

Amazon to take $100 million hit as it’s forced to delay Prime Day indefinitely

Amazon is set to take a $100 million hit in lost revenues as it is forced to delay Prime Day amid the global pandemic. Prime Day, the online retailer’s key annual summer shopping festival, will now be pushed back until at least August, according to documents seen by Reuters. Delaying Prime Day would lead to around 5 million tech devices usually heavily promoted during the event, such as Amazon’s Echo smart speakers, to go unsold. Read more…

Contactless payments are paving the way for future blockchain growth

During the stay-at-home lockdown (which President Trump extended to April 30), the amount of digital payments is skyrocketing from online grocery and pharmacy shoppers. For example, e-commerce transactions in Italy have soared 81% since the end of February, according to estimates by McKinsey… The key factor of blockchain security is its decentralization. There is no central location for cyber thieves to search for your personal data. Cybersecurity expert Cybersecurity Ventures forecast that total global spending on cybersecurity will exceed $1 trillion by 2021. Read more…

Seamless banking, seamless payments: Making every business a fintech business

Research by Modularbank shows the critical importance of technology in banking services. UK banking consumers prize a strong technology offering above all else – it is cited by consumers more than any other factor, including interest rates, as being important when choosing where to bank. Over 90% of UK consumers cite effective technology as being important in deciding where to bank, versus 88% who cite interest rates. Both far exceed brand of bank which 68% of consumers cite as being important. Read more…

Self-driving vehicles delivering COVID-19 medical supplies

Self-driving vehicles may not be ready for consumers for a number of reasons, but new uses are being found for them because of COVID-19. At the Mayo Clinic in Florida, fully autonomous vehicles are being used to transport medical supplies. The Jacksonville Transportation Department (JTA), Beep and driverless vehicle company Navya are using self-driving vehicles to transport COVID-19 tests collected at drive-through testing locations at Mayo Clinic. Read more…

How can stores get social distancing right?

Walmart, Target, Home Depot and Lowe’s this past weekend joined many other retailers in limiting the number of customers allowed in stores at one time to help stop the spread of the coronavirus. The retailers are taking some extra measures as well. At Menards, the Midwest home improvement chain, children under the age of 16 are banned. In the UK, Sainsbury’s isn’t letting couples shop together. At Costco, only two family members are now being allowed to enter their stores per membership card. Hy-Vee is encouraging customers to follow a “one person per cart” guideline. Schnucks and H-E-B are suggesting one shopper per household when possible. Read more…

LET’S CONNECT