Alibaba’s global payments group Ant Financial Services Group took a big step in advancing its global growth strategy by acquiring US-based MoneyGram. The $880 million merger will bring Ant Financial more than 350,000 MoneyGram outlets in 200 countries and give it a foothold into the “underbanked” consumers market estimated at 7% in the US.

Alibaba’s global payments group Ant Financial Services Group took a big step in advancing its global growth strategy by acquiring US-based MoneyGram. The $880 million merger will bring Ant Financial more than 350,000 MoneyGram outlets in 200 countries and give it a foothold into the “underbanked” consumers market estimated at 7% in the US.

We’re taking a look at recent news reports to put this acquisition in context and forecast what’s ahead for Ant Financial which operates Alipay, Ant Fortune, Zhima Credit, MYbank and Ant Financial Cloud.

Ant Financial most recently acquired EyeVerify for a reported $100 million. The US biometrics ID company verifies payments app users by mobile phone eye scans or “selfies.” This is a savvy investment when you consider the possibility of India eliminating debit and credit cards and ATMs in favor of biometrics ID by 2020 according to some sources.

Ant Financial most recently acquired EyeVerify for a reported $100 million. The US biometrics ID company verifies payments app users by mobile phone eye scans or “selfies.” This is a savvy investment when you consider the possibility of India eliminating debit and credit cards and ATMs in favor of biometrics ID by 2020 according to some sources.

In December 2016, Ant Financial announced its first investment in Thailand-based fintech company Ascend Money which provides digital and off-line payments services to Thai consumers. Ascend Group operates in six SE Asia countries with its TrueMoney payments and Ascend Nano lending services. Most notably, Ant CEO Eric Jing said the company “aims to provide services to over two billion users in ten years.”

In 2015, Ant Financial invested in India’s payments powerhouse Paytm, the world’s fourth-largest digital wallet app. Paytm has grown even more quickly since the November demonetization of India’s currency.

In 2015, Ant Financial invested in India’s payments powerhouse Paytm, the world’s fourth-largest digital wallet app. Paytm has grown even more quickly since the November demonetization of India’s currency.

Ant Financial’s global payment partners include Concardis, Ingenico, Wirecard and Zapper in Europe; First Data and Verifone in North America; Paysbuy and Counter Services in SE Asia; Recruit in Japan; and KICC and ICB in Korea.

Alipay’s in-store and other offline payments and lifestyle services have more than 450 million users and is accepted by more than two million Chinese retailers. More than 80,000 other merchants in more than 70 countries including Harrods and Selfridges in London also accept Alipay. US partner First Data has six million global business locations and Verifone more than 29 million payment terminals worldwide.

At the October 2016 Las Vegas Money 2020 show, Douglas Feagin, Senior Vice President of Ant Financial and Head of Alipay International said, “We aim to have at least one million merchants outside the Chinese Mainland to accept Alipay worldwide in three years.”

At the October 2016 Las Vegas Money 2020 show, Douglas Feagin, Senior Vice President of Ant Financial and Head of Alipay International said, “We aim to have at least one million merchants outside the Chinese Mainland to accept Alipay worldwide in three years.”

At the World Economic Forum in Davos, Ant Financial CEO Eric Jing said Alipay is exploring the use of blockchain technology to increase security as well as artificial intelligence.

It’s useful to look at the genesis of Ant Financial from its roots in China. A new EY/DBS Bank report says China has moved beyond the inflection point of fintech. More than 40% of Chinese consumers are using new payment technologies compared to just 4% in Singapore. 35% of Chinese consumers also use fintech for insurance products compared to 1-2% in other SE Asia countries.

It’s useful to look at the genesis of Ant Financial from its roots in China. A new EY/DBS Bank report says China has moved beyond the inflection point of fintech. More than 40% of Chinese consumers are using new payment technologies compared to just 4% in Singapore. 35% of Chinese consumers also use fintech for insurance products compared to 1-2% in other SE Asia countries.

The report identifies key reasons for the rapid, widespread adoption of fintech in China and provides the US, UK, EU and other developed markets with some valuable insight:

- unmet financial needs (traditional banks with poor service, poor technology, slow to market with new services)

- ubiquitous connectivity (656 million or 92.5% of users were going online via connected devices)

- e-commerce with Chinese characteristics (digital sales of $899 billion in 2016, 47% of global e-commerce sales)

- internet giants driving innovation (Alipay, WeChat, WeBank, MyBank)

- fintech-ready generation (45% of consumers are Gen-Y and millennials; 54% bank by mobile)

- tech talent.

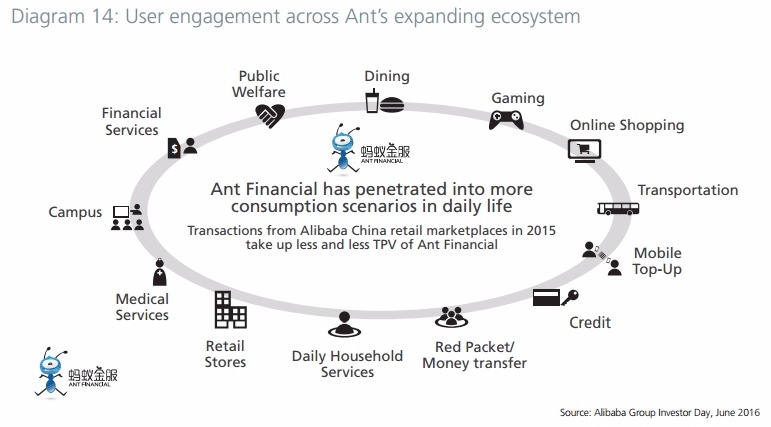

The report also highlights user engagement across Ant Financial’s growing ecosystem as an example of why it is so successful and poised to grow globally.

Chinese tourists spend an estimated $200 billion overseas annually and Alipay hopes to service this market in addition to expats and underbanked consumers.

While many Chinese businesses have been challenged to grow successfully outside of their unique home market, Alibaba Group, Ant Financial Services Group and its payments services subsidiary Alipay seem ready to make the leap to significant global players. Baidu and Tencent, large competitors in China, could also decide to look abroad for growth.

While many Chinese businesses have been challenged to grow successfully outside of their unique home market, Alibaba Group, Ant Financial Services Group and its payments services subsidiary Alipay seem ready to make the leap to significant global players. Baidu and Tencent, large competitors in China, could also decide to look abroad for growth.

In the meantime, this report will serve as a canary in the coal mine alert for banking and financial services in the US, UK, EU and other established markets.

Ant Financial news highlights

Alibaba’s Ant Financial buys MoneyGram for $880m

MoneyGram has about 350,000 outlets in nearly 200 countries. Ant Financial has more than 630 million users.

MoneyGram has about 350,000 outlets in nearly 200 countries. Ant Financial has more than 630 million users.

The takeover by the Chinese group will need regulatory approval from the US Committee on Foreign Investment. The inter-agency committee reviews foreign acquisitions of domestic American assets on grounds of national security.

Eric Jing, chief executive at Ant Financial, said in a statement that the marriage of the two companies will “provide greater access, security and simplicity for people around the world to remit funds, especially in major economies such as the United States, China, India, Mexico and the Philippines”. Via bbc.com

Alibaba Buys Eye-Scan Firm EyeVerify Used by Banks

Alibaba’s payments arm, Ant Financial, has acquired EyeVerify, a maker of optical recognition technology used by Wells Fargo along with dozens of regional banks and credit unions across the country.

Alibaba’s payments arm, Ant Financial, has acquired EyeVerify, a maker of optical recognition technology used by Wells Fargo along with dozens of regional banks and credit unions across the country.

Bloomberg reported the purchase price as around $70 million, but a person close to EyeVerify says this is incorrect and that the actual amount was $100 million, and that it was an all-cash transaction.

The deal is significant partly because biometric tools such as eye-recognition software, which lets customers log into accounts with their eyes, are becoming mainstream as banks look for new ways to fight fraud. Via fortune.com

Alibaba affiliate Ant Financial says blockchain coming to Alipay

Alibaba’s payment affiliate Ant Financial is aiming to have 2 billion customers in 10 years, the chief executive of the $60 billion firm told CNBC, adding that the Chinese giant is exploring further uses of blockchain technology.

Alibaba’s payment affiliate Ant Financial is aiming to have 2 billion customers in 10 years, the chief executive of the $60 billion firm told CNBC, adding that the Chinese giant is exploring further uses of blockchain technology.

Ant Financial runs the Alipay mobile wallet in China which has over 450 million users. But Eric Jing, the CEO of Ant Financial, said the aim is to more than quadruple that over the next decade. “We have an ambition to be a global company,” Jing told CNBC at the World Economic Forum in Davos.

“So my vision (is) that we want to serve 2 billion people in the next 10 years by using technology, by working together with partners … to serve those underserved.” Via cnbc.com

The Rise of FinTech in China

China’s FinTech revolution is a consequence of multiple factors – not least the scale of unmet needs being addressed by dominant technology leaders, combined with regulatory facilitation and easy access to capital. Underserved by China’s incumbent banking system, consumers and small-to-medium-sized enterprises (SMEs) are increasingly turning to alternative providers for access to payments, credit, investments, insurance, and even other non-financial service offerings.

China’s FinTech revolution is a consequence of multiple factors – not least the scale of unmet needs being addressed by dominant technology leaders, combined with regulatory facilitation and easy access to capital. Underserved by China’s incumbent banking system, consumers and small-to-medium-sized enterprises (SMEs) are increasingly turning to alternative providers for access to payments, credit, investments, insurance, and even other non-financial service offerings.

The willingness of Chinese consumers to adopt FinTech services is just as striking. Forty percent of consumers in China are using new payment methods compared to 4% in Singapore. Thirty-five percent are using FinTech to access insurance products compared to 1-2% in many Southeast Asian markets. There are also significantly higher rates of FinTech participation in wealth management and lending.

Underpinning China’s FinTech dominance are leading domestic technology companies setting out to own entire customer journeys and consumption ecosystems across both financial and non-financial activities. ‘Platform effects’ enable them to capture data and use it to offer ever more services with significantly better and more comprehensive customer experiences than traditional financial services players. The relationship with Chinese corporates and start-ups is also often very collaborative, helping to fuel the rapid innovation and expansion. If FinTech in the West has reached the tipping point of inflection, China has moved beyond the point of disruption. Via EY & DBS Bank

Alipay Helps U.S. Retailers Bridge Chinese Tourist Cultural Gap

As China celebrates the “Year of the Rooster” through Feb. 15, tourists from the country continue to travel abroad — spending heavily on accessories, apparel and luxury goods. Economists estimate Chinese tourist-related spending to be around $200 billion globally.

As China celebrates the “Year of the Rooster” through Feb. 15, tourists from the country continue to travel abroad — spending heavily on accessories, apparel and luxury goods. Economists estimate Chinese tourist-related spending to be around $200 billion globally.

But there are challenges to selling this market. Souheil Badran, the president of Alipay North America, said ongoing barriers include language and cultural differences, which can sour the shopping experience and impact sales.

Here, Badran discusses the importance of the Chinese tourist, opportunities in the market and how his company is positioning Alipay as a tool for retailers and brands to better serve this segment. Via wwd.com

Finnair to trial China’s Alipay for in-flight shopping

Finnair will become the first airline to allow travelers to pay for in-flight shopping and services with Chinese online payment app Alipay, the company said on Wednesday.

The airline, which uses its Helsinki hub to bring Asian travelers to European destinations, said it will trial Alipay on its flights between Shanghai and Helsinki.

“As the number of travelers grows between Asia and Northern Europe, the need for a familiar and convenient payment platform has never been greater,” Finnair Chief Digital Officer Katri Harra-Salonen said in a statement. Via reuters.com

China’s Alipay to be accepted at all of Lawson’s Japan stores

Major Japanese convenience store operator Lawson Inc. said Monday that it will accept payments via the Alipay electronic payment platform, which is popular in China, at all its outlets in Japan.

Major Japanese convenience store operator Lawson Inc. said Monday that it will accept payments via the Alipay electronic payment platform, which is popular in China, at all its outlets in Japan.

From Tuesday, the Alipay payment service will be available at some 13,000 stores, the biggest number among Japanese retailers that accept Alipay.

Lawson will make its chain more convenient to visitors from China to boost sales further, officials said. Via japantimes.co.jp

Payments disruption ahead

If you enjoyed this in-depth profile of Ant Financial and Alipay, get more news reports and analysis every Monday-Wednesday-Friday morning in your inbox for free by subscribing to PaymentsNEXT at the top of the page.

Want to stay ahead of disruptions in the payments industry? Check out the latest fintech and other payments innovations impacting the industry in our Payments Disrupted archive.

LET’S CONNECT