We’re looking at mobile payments news and trends from around the world, starting with China and how Chinese New Year celebrations are going digital in a big way. Experts predict more than 100 billion hongbao digital red gift envelopes will be exchanged this year. In India, PhonePe and other mobile payments developers see banks as barriers to the industry as well as failing to meet consumer needs.

We’re looking at mobile payments news and trends from around the world, starting with China and how Chinese New Year celebrations are going digital in a big way. Experts predict more than 100 billion hongbao digital red gift envelopes will be exchanged this year. In India, PhonePe and other mobile payments developers see banks as barriers to the industry as well as failing to meet consumer needs.

MoneyOnMobile is expanding into India’s B2B payments market, estimated by McKinsey to be worth $15 billion. Target plans to launch its own in-store payment app, joining Walmart and Kohl’s. While not an overwhelming success, ApplePay continues to make steady inroads into the payments market. Starbucks Rewards has 13 million active members, up 16% and mobile orders and payments were 7% of US sales. It’s popular app is frustrating some regular customers by long lineups.

MoneyOnMobile is expanding into India’s B2B payments market, estimated by McKinsey to be worth $15 billion. Target plans to launch its own in-store payment app, joining Walmart and Kohl’s. While not an overwhelming success, ApplePay continues to make steady inroads into the payments market. Starbucks Rewards has 13 million active members, up 16% and mobile orders and payments were 7% of US sales. It’s popular app is frustrating some regular customers by long lineups.

Jamaica is ready to start making government payments by mobile app. According to a Motley Fool report, MasterCard is competing well with its MasterPass service despite the competition. Tesco’s PayQwiq mobile app now covers all UK stores. PayPal reported mobile payment processing of $31 billion in Q4, up 53% and making up 31% of total payments.

Why this Chinese New Year will be a digital money fest

Over this weekend’s Chinese New Year celebrations, millions of people will give each other cash-filled red envelopes, called hongbao in Mandarin.

Over this weekend’s Chinese New Year celebrations, millions of people will give each other cash-filled red envelopes, called hongbao in Mandarin.

But this year, a record number of these red envelopes will be digital and sent online over social messaging services such as Tencent’s WeChat, usually via smartphone.

Over the six-day Chinese Spring Festival period last year, 516 million people sent and received 32 billion digital red envelopes – 10 times the number as over the same period in 2015. And this year forecasters are expecting up to 100 billion digital envelopes to be sent and received by Chinese well-wishers around the world. Via bbc.com

In the Dog-Eat-Dog World of Payments, It’s Techies Versus Banks

New payment firms like PhonePe are tying up with banks to facilitate UPI payments for their clients. In this process, the acquirer (PhonePe and its bank) gets the commission as well as the transaction data while the customer’s bank sits and does a simple double entry of debit and credit. Enter e-KYC and the payments bank. With high interest rates and tie-ups with existing banks, the likes of Bharti Airtel Ltd. and Paytm will not even need to go out to acquire customers. They can simply cannibalize banks’ existing customer base and shift transactions to their platforms.

New payment firms like PhonePe are tying up with banks to facilitate UPI payments for their clients. In this process, the acquirer (PhonePe and its bank) gets the commission as well as the transaction data while the customer’s bank sits and does a simple double entry of debit and credit. Enter e-KYC and the payments bank. With high interest rates and tie-ups with existing banks, the likes of Bharti Airtel Ltd. and Paytm will not even need to go out to acquire customers. They can simply cannibalize banks’ existing customer base and shift transactions to their platforms.

“Banks are the perfect keepers of the funds but they don’t necessarily need to be the gatekeeper of the funds,” said Rahul Chari, founder of PhonePe.

Anoop Shankar of Chillr also indicted banks fell behind while the world around them changed – he just used different words. “Net banking was one of the first serious use cases of internet in India but banking soon faced problems of scale. Other industries have leapt off banking by becoming better adopters of technology,” he said while nobody batted an eyelid. Via bloombergquint.com

MoneyOnMobile Enters India B2B Payments Space

India-based mobile payments company MoneyOnMobile is expanding into the B2B payments realm.

India-based mobile payments company MoneyOnMobile is expanding into the B2B payments realm.

The company revealed Thursday (Jan. 26) that it is expanding into this new segment of the market thanks to partnerships with institutions like the Reserve Bank of India, enabling MoneyOnMobile to support larger transaction sizes necessary for corporate payments.

The company also highlighted the size of the B2B payments market, citing McKinsey & Co. research that estimated the space to be worth about $15 billion. Via pymnts.com

You probably won’t be able to buy stuff at Target with Apple Pay anytime soon

Mobile payment is supposed to simplify the checkout process by eliminating the need to fumble around with cash or credit cards.

Mobile payment is supposed to simplify the checkout process by eliminating the need to fumble around with cash or credit cards.

But how much time does it actually save when every store runs on a separate app?

Target became the latest retail chain to announce plans for an in-app store payment option this week, following in the footsteps of big box rivals Walmart and Kohl’s. The service is expected to launch later this year, initially for holders of Target’s REDcard only, according to Recode, which broke the news on Tuesday. Via mashable.com

Mobile Pay Tracker: Apple Pay

Apple has surely managed to deliver a lot of hype with the launch of its mobile payments platform, but according to the numbers so far, it hasn’t really managed to deliver a hit.

Apple has surely managed to deliver a lot of hype with the launch of its mobile payments platform, but according to the numbers so far, it hasn’t really managed to deliver a hit.

Which isn’t to say it’s been a wholesale miss, which, in the world of mobile payments, is actually something of a success in and of itself — just ask the former teams from CurrentC or Softcard (we miss you Tappy, you were our favorite muppet). But it surely hasn’t set the world on fire to pay with a smartphone either, nor did it bring about the mass abandonment of plastic cards that its initial launch caused many to speculate was imminent.

Apple Pay continues to have its boosters, and Tim Cook remains unspeakably enthusiastic about its future. He recently told Asian journalists that consumers are ready to be done with cash, and Apple is ready to help them get there. “We don’t think the consumer particularly likes cash,” Cook noted. “We would like to be a catalyst for taking cash out of the system.” Via pymnts.com

Starbucks’ mobile orders are too popular for their own good

Convenient mobile orders are bringing endless lines of customers into Starbucks — and that’s a problem.

Convenient mobile orders are bringing endless lines of customers into Starbucks — and that’s a problem.

Lines at the coffee chain are out of control because of pile-ups of mobile orders that cause delays for IRL customers. Starbucks admitted the flaw in a conference call sharing its fourth quarter earnings on Thursday. The chain trimmed its revenue forecast for the year and announced a smaller-than-expected rise in quarterly sales, Reuters reported. Starbucks shares fell 3.8 percent in after-hours trading.

Starbucks is trying to solve the problem by adding baristas focused only on mobile orders and payment during peak hours, Reuters said. Even as Starbucks’ mobile popularity causes the chain problems, the mobile app is booming. Starbucks Rewards has 13 million active members, a 16 percent increase from last year, Forbes reported. Mobile order and payment makes up 7 percent of total Starbucks orders in the United States, double its percentage this time last year. Via mashable.com

Jamaica ready to go mobile with government payments

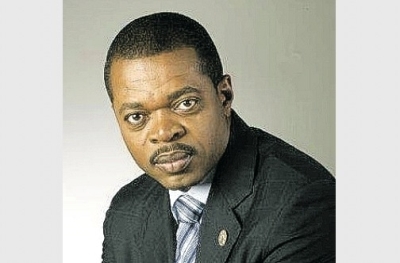

Payment systems expert, Bank of Jamaica (BOJ) Deputy Governor Livingstone Morrison, says that Jamaica — for which payment systems are much more advanced than some of its neighbours — is now ready to provide government payments on a mobile platform.

Payment systems expert, Bank of Jamaica (BOJ) Deputy Governor Livingstone Morrison, says that Jamaica — for which payment systems are much more advanced than some of its neighbours — is now ready to provide government payments on a mobile platform.

Jamaica, he told the Jamaica Observer, is now served by advanced payments and settlements system infrastructure which meets international standards of safety and security.

The system, he notes, features fast and reliable settlement of large value and time-critical payments. As such, the island is also now positioned to support the rapid deployment of mobile and other small-value payment options. Via jamaicaobserver.com

Are Mobile Payments Leaving MasterCard Behind?

The hot trend in the payments industry is mobile electronic payments — a way where customers can pay for things using their cellphone, rather than more traditional methods like credit cards, checks, or cash. Apple, Square, Paypal, and other companies are now offering mobile payment options to consumers and businesses in this increasingly crowded and competitive market.

The hot trend in the payments industry is mobile electronic payments — a way where customers can pay for things using their cellphone, rather than more traditional methods like credit cards, checks, or cash. Apple, Square, Paypal, and other companies are now offering mobile payment options to consumers and businesses in this increasingly crowded and competitive market.

MasterCard (NYSE:MA), whose business is processing electronic payments, isn’t just sitting back and letting this trend pass them by. The company’s MasterPass service is well-positioned to help it take advantage of changing consumer behavior. For MasterCard, unlike some of the other companies in this space, mobile and digital payments don’t represent a new business. MasterPass is nothing more than MasterCard using new technology to adapt its pre-existing business model to a changing market.

What is MasterPass?

Launched in early 2013, MasterPass is a digital payment service, an enhanced version of MasterCard’s original mobile payment offering introduced a year earlier. The platform has two main components — merchant checkout integration and partner wallet. The merchant checkout feature offers merchants and other service providers an easy, secure way to process digital payments on their website, app, or in a physical store using contactless payment. The partner wallet feature allows other companies to integrate MasterPass’ into their own apps and digital wallets to allow their users to make secure payments from their phone or other mobile device using that app. Via fool.com

Tesco expands PayQwiq mobile app to all UK stores

Tesco is expanding the availability of its PayQwiq mobile payments app to every Tesco store in the UK.

Tesco is expanding the availability of its PayQwiq mobile payments app to every Tesco store in the UK.

PayQwiq, available for both Android and iOS smartphones, enables customers to pay for purchases and collect Clubcard points. Users simply download the app and link a credit or debit card to pay for purchases at Tesco.

To ensure that customers can use PayQwiq to pay for their weekly shopping and more, the app allows individual single transactions of up to 250 pounds ($314.43). It also provides a record of the user’s transaction history and Clubcard points balance, according to the release. Via mobilepaymentstoday.com

PayPal processes $31B in mobile transactions in Q4 2016

PayPal processed a total of $31 billion in mobile payment volume in the fourth quarter of 2016, according to the company’s latest financial report.

PayPal processed a total of $31 billion in mobile payment volume in the fourth quarter of 2016, according to the company’s latest financial report.

This figure represents an increase of 53 percent over the same period in 2015. Mobile payments represented 31 percent of the company’s $99 billion in payment volume in Q4.

Venmo, the company’s social payments platform, processed $5.6 billion in total payment volume, up 126 percent from the same period in 2015. Via mobilepaymentstoday.com

That’s our mobile news update for this week. Watch for our payments disruption report on Wednesday.

LET’S CONNECT