By Jeff Domansky, Feb 18, 2021

When it comes to keeping up with payments industry trends, sometimes the pictures are worth more than 1000 words. Here are seven recent payments industry and e-commerce trend charts worth a second look at and to help you stay current.

Thanks to the pandemic, consumers have shifted their payment preferences, and contactless payments are rising fast.

Note the rise in payment options such as point-of-credit (48%), digital wallets (40%), QR codes (34%), contactless cards (37%), and card-on-file payments (28%).

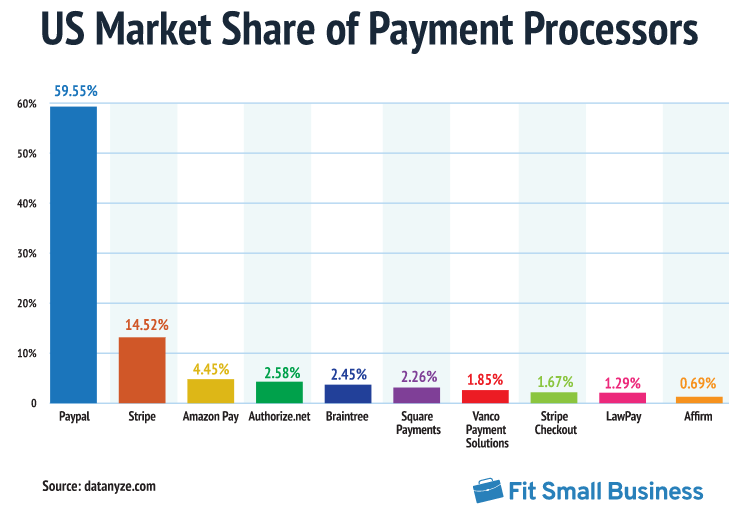

PayPal has the biggest share of the US payment processor market share at 59.6%, followed by Stripe (14.5%) and Amazon (4.5%).

Others jockeying for the smaller remaining market share include Authorize.net (2.6%), Braintree (2.5%), Square (2.3%), Vanco (1.9%), Stripe Checkout (1.7%), LawPay (1.3%), and Affirm ( 0.7%).

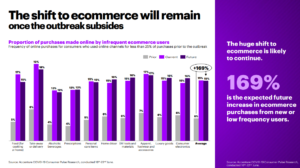

Accenture research shows the growing adoption of e-commerce and category spending by new e-commerce shoppers.

Future e-commerce spending intent will grow 169% on average and by category includes take away or delivery (18%), apparel & accessories (17%), home decor (16%), luxury goods (16%), consumer electronics (16%), personal-care items (15%), groceries (15%), prescriptions (13%), and alcohol (12%).

Ready-for-delivery services for groceries, meals, retail, and other categories are growing quickly due to the pandemic, according to Rakuten Ready research.

Click and collect volume dropped after the 2019 holiday season but immediately began to grow with the onset of COVID-19 and remained at high levels through the end of 2020. It’s now simply part of the new customer purchase journey.

Buy now, pay later is officially a “thing” and is growing across every product category due to the pandemic and work from home, among other influences.

While regulations are on the horizon in the EU, Australia, UK, and the US, consumers like the lower cost compared to credit card interest rates.

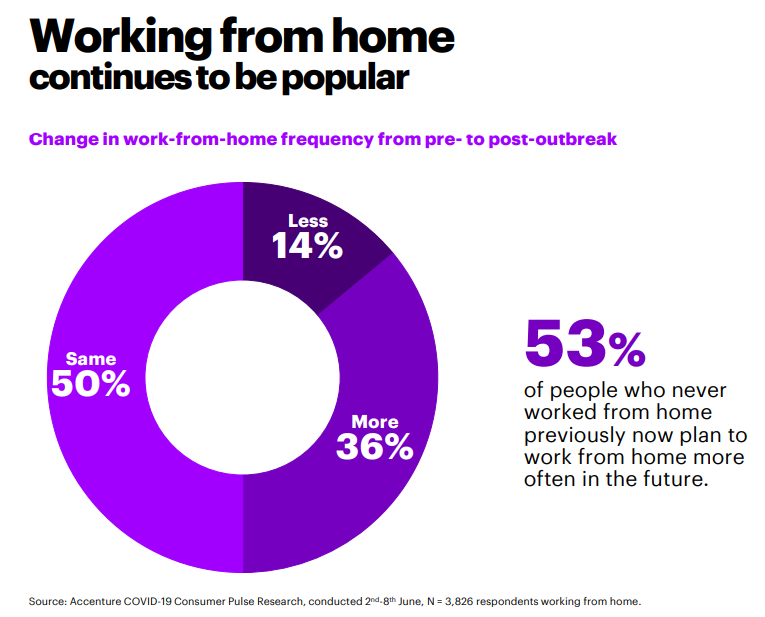

53% of people who never worked from home previously now plan to work more from home in the future, according to Accenture.

Half of those surveyed said they expect to continue working from home at the same level, while only 14% expect to work from home less after the pandemic ends.

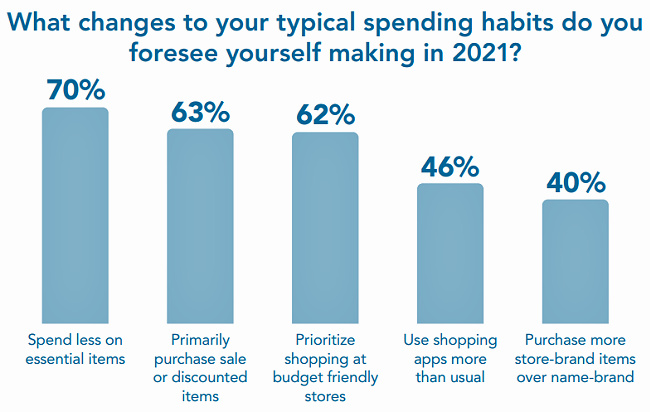

Through the final months of 2020, most consumers (52%) say they are proceeding with caution and keeping spending low. 19% say they have been hit hard and are significantly tightening their budgets.

46% say they will use shopping apps more than usual, and 40% expect to buy more store-brand items over name-brand products in 2021.

Charts provided by FitSmallBusiness, Accenture, Rakuten, and Shopkick

Recent PaymentsNEXT reports on payments trends include:

Super Bowl weekend, masks, and contactless payments

LET’S CONNECT