Dec 30, 2020

As 2020 fades into the rearview mirror, we’ve got a last look at a year notable for the stories of struggle, resilience, and survival in the payments world. It’s a credit to the industry that many grew their business and at the same time helped their small business clients survive through innovation, collaboration, and simple acts of kindness. Let’s take one last big news roundup look at a few highlights of the year past and a few glimpses of what’s ahead for payments in 2021.

Payment industry leader predictions for 2021

As the end of the year approaches, after a tumultuous, pandemic-fueled 10 months, publisher Doug Hall and managing editor Jeff Domansky reached out to payments industry leaders for their perspectives and predictions for the industry in 2021. These industry leaders have pivoted and innovated throughout the worst of the pandemic. They’ve supported their clients, helped their employees work remotely, and still managed to grow their businesses despite enormous challenges. Read more…

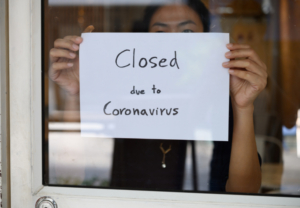

85% of US small businesses need support to survive next six months

As new COVID-19 deaths and hospitalizations threaten to overwhelm the US health system, 85% of US small businesses say they need government relief funds now to survive to June 2021. A poll of 5,000 small business owners conducted by Alignable between Dec 5-7, 2020, paints a devastating picture of potential small business failures without government support. Nearly half of respondents (48%) answered that it was “critical to business survival,” with another 37% noting that it was “significantly important” for their business survival. Read more…

Making waves: Charting a path for the future of payments – MasterCard

We’ve settled into working from home, pivoted to online events, and found new ways to stay connected to our partners and customers worldwide. In these turbulent times, we remain committed to enabling payment choice: whether a person or organization prefers to transact in-store or online, and from a bank account, using a card, or in cash — making payments safe, simple, smart, and accessible for everyone. If you haven’t already read our digital newspaper, The Different Times, click below for stories of hope, resilience, and innovation from across the Mastercard business and beyond. Read more…

3 payments trends to watch in 2021

As 2021 rapidly approaches, many of us are hoping for better days after the whirlwind year of 2020. While COVID-19 has certainly had an impact on every industry, certain trends that began in 2019 continued to develop in 2020, and some of them may even blossom fully in 2021. Watch out for cashless payments, fintech’s tackling the underbanked and the rise of blockchain in payments. Read more…

Mastercard SpendingPulse: US retail sales grew 3.0% this holiday season

According to Mastercard SpendingPulse, holiday retail sales excluding automotive and gasoline increased 3.0% this expanded holiday season (Oct 11 – Dec 24). Notably, online sales grew 49.0% compared to 2019, the preliminary insights show. Mastercard SpendingPulse measures overall retail spending trends across all payment types, including cash and check. Key findings underscore the shift to online spending, with e-commerce accounting for 19.7% of overall retail sales – up from approximately 13.4% in 2019. In addition, consumers continue to spend more time – and money – on their homes. Read more…

Amazon sellers have a merry Christmas but struggle with returns

There’s no arguing the fact that Amazon has been a lifeline for small businesses this year. During the extended holiday season, the eCommerce giant says its independent sellers saw their sales grow more than 50 percent over 2019. And while the eCommerce champion said it delivered more than 1.5 billion gifts, third-party sellers sold nearly one billion products this season. According to New York-based Rosenbaum Famularo, Amazon has a quick hook for sellers with minor infractions, such as not refunding customers fast enough. Read more…

The year shopping changed forever

When we look back at 2020 in the business world, we’ll remember it as the year online shopping stopped being the future of retail and catapulted firmly into the present. This was the year that local governments forced us to give up in-store shopping for weeks or months, and then when we had an opportunity to return when stores reopened, we mostly kept shopping online anyway. US e-commerce sales will have grown more than 30 percent in 2020, and there’s no going back. Read more…

CFOs navigate season of B2B payments change

With the pandemic forcing accounts payable (AP) and accounts receivable (AR) departments to hit the gas on their digitization roadmaps, finance leaders are grappling with an accelerated pace of change that can, at times, be overwhelming. But the challenge of igniting B2B payments innovation may not be as arduous as many chief financial officers (CFOs) and others believe, said Josh Cyphers, president of Nvoicepay. Read more…

China’s Central Bank tells Ant Group to concentrate on payments business

Financial regulators in China are moving to curb the influence of Jack Ma’s Ant Group by telling it to switch focus back to its mainstay payments business while fixing issues in personal lending, wealth management and more, The Wall Street Journal (WSJ) reports. The People’s Bank of China criticized Ant for how it treated competitors and consumers and seemingly disregarded regulations. Read more…

McKinsey & Company top 10 most popular 2020 surveys

As 2020 draws to a close, we’re revisiting our most popular articles of the year in a series that spans the best of McKinsey Quarterly, the McKinsey Global Institute, and more—we even feature an Editor’s Choice category. Today, we give you our best-read surveys, highlighting pressing issues for executives, including the economy, digital transformation, reskilling, and beyond. Read on for our full top ten. Read more…

What the subscription market’s 2020 surge tells us about retail’s 2021 remake

The holiday shopping season is in full swing — and it’s increasingly looking like “’tis the season for purchasing subscriptions.” Recurly CEO Dan Burkhart told Karen Webster in a recent discussion that consumers are asking themselves how to give gifts that will have lasting impacts on the intended recipients. That means it’s looking like a big year for all kinds of subscriptions, extending a trend that’s been building for the past several years. Read more…

Retail Therapy: Party City says ‘FU’ to 2020

As the year that was defined by disruption and uncertainty comes to a close, the retailer is gearing up for the celebration of a lifetime. It’s been another weird week in retail. Party City dropped products to help celebrate the end of 2020, Budweiser sought out the best dogs to model on its holiday cans, and Costco is selling a six-liter bottle of champagne — the only thing that will get us through the rest of this year. 2020 has worn out his welcome. Read more…

The running list of 2020 bankruptcies

This year started off with the parent of fine paper specialist Papyrus quietly going into liquidation before filing for bankruptcy, with home decor staple Pier 1 not far behind with its own, more uncertain, filing. Here is a closer look at the 29 major retail bankruptcies of 2020 so far, including Guitar Center, Furniture Factory Outlet, Stein Mart, Taylor Brands, Lord & Taylor, Brooks Brothers, GNC, Aldo, Neiman Marcus, JCPenney, J Crew, Pier 1, and many others. Read more…

More store closings in 2021? These are the most vulnerable major retailers of 2021 as pandemic continues

For retailers that survived the catastrophe that was 2020, there’s hope on the horizon in 2021. E-commerce sales growth has been enormous and is expected to continue. Moody’s projected growth of 14% to 15% for e-commerce sales in 2021, even as people are expected to return to stores as the pandemic ebbs. Here’s a list of major retailers for whom 2021 could be a make-or-break year based on USA TODAY research, public data, and analyst reports. Read more…

Publisher Doug Hall, Managing Editor Jeff Domansky, and the rest of the PaymentsNEXT team wish you all the best for a safe New Year’s celebration and a positive payments year ahead for 2021.

LET’S CONNECT