By Jeff Domansky, Dec 12, 2020

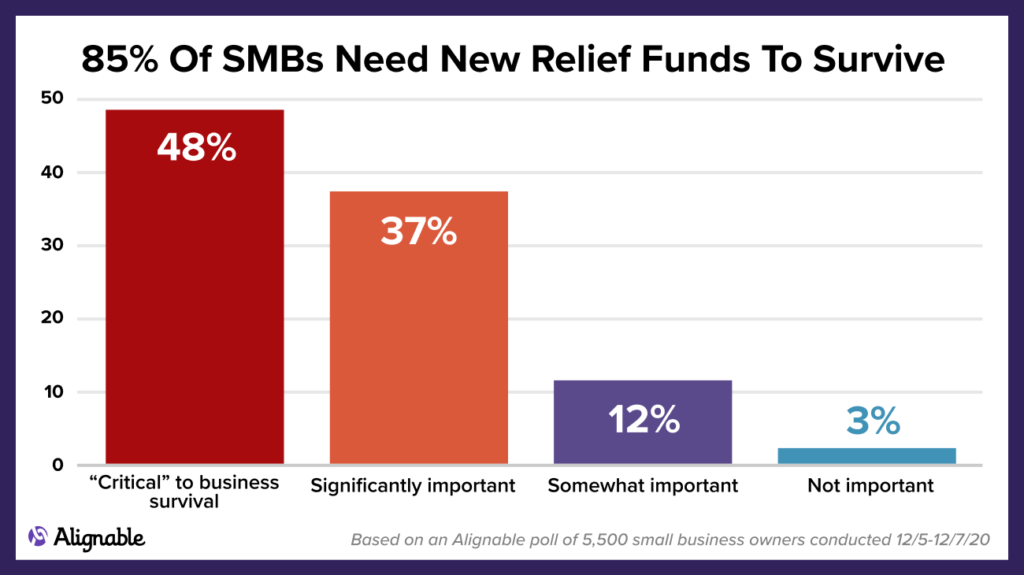

As new COVID-19 deaths and hospitalizations threaten to overwhelm the US health system, 85% of US small businesses say they need government relief funds now to survive to June 2021.

A poll of 5,000 small business owners conducted by Alignable between Dec 5-7, 2020, paints a devastating picture of potential small business failures without government support.

Nearly half of the respondents (48%) answered that it was “critical to business survival,” with another 37% noting that it was “significantly important” for their business survival. On average, respondents said they required around $110,000 in funding to stay on their feet now and for the first six months of 2021.

Of the biggest concern is an additional late-November poll where 48% of more than 9,000 small businesses surveyed said they could fail before the end of December, which is fast approaching.

Congress must act now to save small businesses

Small businesses in every sector have been very resourceful in their efforts to survive during the pandemic. They contribute up to 50% of US GDP and account for 65% of the new jobs created. If more small businesses fail during the age of COVID, the fragile economic recovery delay is sure to be extended.

“Dueling members of Congress need to compromise and jump over political hurdles to ensure that more small businesses weather the rest of this catastrophic COVID storm,” said Alignable’s Co-founder and CEO Eric Groves. “Our latest poll clearly demonstrates that more aid is desperately needed to keep hard-working small business leaders afloat – and to continue fueling the recovery.”

The survey noted that only 3% said additional relief funding was “not important” for their business. In comparison, the remaining 12% said it was “somewhat important,” leaving no doubt about the outcome without a new financial relief package.

Minority and women-owned businesses in bigger jeopardy

Overall, Alignable found only 43% of the entire small businesses polled were highly or somewhat confident their businesses would make it through the COVID era. It will surprise no one that minority and women-owned businesses are in even bigger jeopardy.

Of minority-owned businesses, 87% report needing new funds to survive through mid-2021, including 56% who report a critical need, 31% say it’s significantly important, and 10% say it’s somewhat important. Only 3% say it’s not important to remaining in business.

For women-owned businesses, 88% report needing new funds to survive through June 2021, including 52% who say it is critical, 36% say it’s significantly important), 10% say it’s somewhat important. Just 2% say it’s not important to their business survival.

Where businesses would spend relief funds

Alignable also asked small businesses where any potential federal funds received would be spent.

For 20% of the small business owners, the top priority would be paying their rent and employee salaries. Based on other Alignable polls, one-third (32%-34%) of all small businesses since May have not had the money to cover their full rent on time.

Other spending priorities include paying additional business expenses (16%), “paying myself” (13%), paying off other loans (12%), investing in expansion plans (8%), and participating in online education to add more virtual business capacity (6%).

Government action needed to support small business now

As we reported several days ago, more than 110,000 US restaurants (17% of all) have already closed in 2020, and 58% of chain and independent full-service operators and 40% of limited-service restaurants expect to reduce staff levels and continue layoffs for at least the next three months.

This week, new US jobless claims totaled 853,000 versus the Dow Jones estimate of 730,000 and a sharp increase from 716,000 last week. The US Labor Department said more than 19 million Americans were collecting benefits under various relief programs. Still, many expire at the end of this month without a new relief program on the books.

“This recent surge suggests that claims are not just stagnating, they’re actively worsening,” Daniel Zhao, senior economist at job placement site Glassdoor, told CNBC. “The surge in initial claims is especially concerning when claims are still above levels near the peak of the Great Recession.”

It’s devastatingly clear that while Congress fidgets and place political games, small businesses are failing. They’re the lifeblood of jobs and services in many communities and a foundation for the entire US economy.

You can read more detailed insight from Alignable’s Dec 5-7, 2020 poll of 5,500 US small business owners here.