By Jeff Domansky, March 4, 2021

When it comes to business loans, non-bank lenders have jumped out ahead of traditional banks as the fintech revolution disrupts the financial services industry.

Last month we analyzed PayPal’s outstanding 2020 financial results and its growth as the payments industry’s elephant in the room.

Writer Rex Pascual put together an interesting analysis of PayPal and other leading at TradingPlatforms.com on payment industry and non-bank lenders. The result is an eye-opener, and you’ll be surprised at the size of some of these non-traditional loan companies’ loans. Many are not household names when it comes to loans, and they’re not banks either.

Alternate Financing Leaps Ahead

The US Small Business Administration reports business owners borrow more than $600 billion every year. The problem is, traditional banks reject as many as 80% or more of the business loan applications they receive. It’s no wonder small and midsize businesses look to alternative lenders who often have less stringent qualification requirements.

Connie Evans, CEO of the Association for Enterprise Opportunity (AEO), said, “Banks decline almost 8,000 applications for small business loans every single workday in this country. We think that’s a real market failure,” she told Pymnts.com.

Reliant Funding showed only 12% of small businesses had loans with alternate lenders in 2017. That picture has changed dramatically.

Pascual’s analysis showed, “In the US, the market cap of four large fintech companies; Visa, Mastercard, PayPal, and Square combined for over 1 trillion dollars. This eclipsed the combined $880 billion market cap of the traditional “Big Six” banks in America; JPMorgan, Bank of America, Citigroup, Morgan Stanley, and Goldman Sachs.”

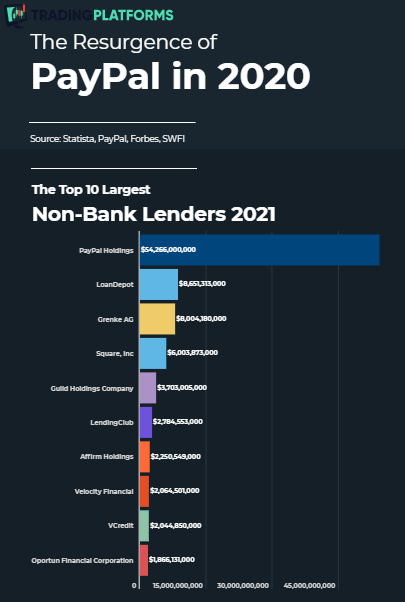

Paypal Dominates Non-traditional Loans

“With a market cap of $144.3 billion, PayPal is by far the largest non-bank lender with over $54 billion in total assets as of February 2021. PayPal’s total assets alone make up almost 60% of the top ten non-bank lenders’ total assets combined,” Pascual writes.

Other non-bank companies with a significant stake in the loan business include mortgage lender LoanDepot ($8.7 billion), Grenke AG ($8.0 billion), Square ($6.0 billion), mortgage lender Guild Holdings Company ($3.7 billion), LendingClub ($2.8 billion), new IPO favorite buy now pay later giant Affirm ($2.3 billion), Velocity Financial ($2.1 billion), China’s V Credit ($2.0 billion), and Opportun Financial Corp ($1.9 billion).

PayPal’s annual revenue in 2020 reached $21.45 million. It handled 15.4 billion transactions worth $936 billion and had more than 377 million registered accounts globally.

The impact of buy now pay later companies, new fintech payment operators, online lenders, non-bank loan competitors, and challenger banks is far-reaching.

You can see more of Pascual’s insight into PayPal and other non-bank lenders at TradingPlatforms.com.

Visuals courtesy of TradingPlatforms.com

LET’S CONNECT