Corporate treasury departments are embracing social tokens, real-time payments, virtual cards and other digital innovations for their speed, security and convenience, according to new research from Citizens.

But, traditional payment modes – checks, Automated Clearing House (ACH) and physical credit cards still cling to life in some organizations.

“This is a time of disruption in the payments world,” said Matt Richardson, Executive Vice President and Head of Treasury Product Solutions, Citizens. “While we see many treasury departments taking advantage of new technologies, some have been slow to adapt.”

Preferred payment methods

Citizens surveyed 205 Treasurers at middle-market businesses ($50M to $1B annual revenue) in Feb and Mar 2023, focusing on company use of payment modes today and what treasurers think of their future payment options.

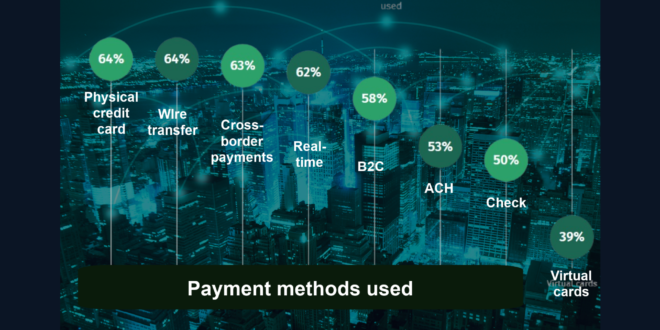

On average, companies were using five preferred payment methods, including physical credit cards (64%), wire transfers (64%), international/cross-border payments (63%), real-time payments (62%), B2C payment alternatives (58%), ACH (53%), checks (50%), and, moving up quickly, virtual cards (39%).

Interest in new payment methods

Attracted by faster payments, 60% of non-users of real-time payments said they were “very likely” to consider incorporating them into their payments strategy.

40% of non-users said they would consider virtual or digital credit cards or business-to-consumer (B2C) payment alternatives (platforms such as Zelle).

B2C payment tools potential

While 58% of businesses are using one form or another of B2C payment methods, strong resistance remains to the use of these solutions.

Only 40% of non-users said they would consider virtual or digital credit cards or B2C payment alternatives (platforms like Venmo, PayPal or Zelle).

Among companies who said they now use business-to-consumer payment options or are likely to soon, 80% say they’ll use these tools to pay vendors, followed by paying salaries (72%) and issuing refunds (49%). These high usage numbers suggest that non-users are missing out on a trend that peers embrace.

Buzz about social tokens

The simplicity of payment by social tokens such as mobile phone numbers or email instead of requiring bank account information has the interest of companies.

Most companies rate social tokens as both easy and secure, and they would use them for both bill pay (91%) and payment requests (89%). 90% feel the use of social tokens is more secure than using Visa or Mastercard Direct. In addition, there’s no need to retain bank account info on their servers, increasing security, according to 82% of respondents, and greatly reducing fraud or data loss potential.

Imagine the happy response by those receiving payments and not having to provide bank account, wire transfer or other bank information. Frictionless and fraud-resistant.

Virtual cards emerging

Virtual or digital cards instead of physical credit cards also earn more interest from middle-market companies. The highest virtual card adoption is in human capital management and business services, where a less-complex AP environment lends itself to accepting virtual card payments.

Consumer sector businesses have been the slowest to adopt virtual cards. As a result, companies not using virtual cards may be overlooking one of their benefits as a secure replacement for paper checks, the report notes.

“Adoption of virtual cards may be slower because companies may think of them as a payment to cover small ticket purchases, but we actually see many companies expanding the usage to cover a larger percentage of their budget given the working capital, security and financial benefits it offers both buyers and suppliers,” according to Rodrigo Sanchez, Head of Commercial Cards.

Digital or not?

The research pointed to the advantages and disadvantages of moving to a higher level of digital payments. Among the benefits are improved cash management efficiency, better cash flow forecasting, and enhanced financial control and visibility.

Disadvantages cited by respondents were security concerns, as well as challenges with systems integration and acquisition integrations.

“As companies transition to digital payments, they must maintain vigilance with fraud protection, detection and mitigation since fraudsters will always pursue new vulnerabilities. It’s important to note, however, that checks continue to be the payment method most impacted by fraud activity,” said Michael Cummins, Head of Treasury Solutions.

We won’t be burning the checkbooks or cutting the physical credit cards in half anytime soon, but the pace of progress is faster as we approach real-time, global payments capability.

You can read more details of Citizens’ Payment Trends Report 2023 here.

Recent PaymentsNEXT news:

Looking for use and insight into the buy now pay later industry? Check out BNPL Report for the latest installment loan news, technology, research, and company profiles.