A busy week in payments news. ConnexPay with Payouts Network launched a unique push-to-card technology for real-time payments to debit or reloadable prepaid cards. Avalra teamed with eBay to offer a new simplified international shipping system. Six fintech companies joined Mastercard’s Start Path Digital Assets Program, designed to innovate e-commerce solutions. Paysend produced a poignant film examining the challenges of unbanked Latin Americans and solutions.

Citi’s Flex Pay installments are now available on Amazon Pay, thanks to a new partnership. CSI launched new IT Governance advisory services to enhance regulatory compliance. Quadient added its voice to AI-enabled financial services with faster invoice-to-cash processes. InComm opened a new Technology Development Hub in Brazil, creating 200 new tech jobs. Finally, The Healthcare Financial Management Association renewed the Peer Review status for Synchrony’s CareCredit.

ConnexPay partners with Payouts Network to launch Push-to-Card technology

ConnexPay and Payouts Network launched new functionality enabling payouts via Push-to-Card Payouts initiated by the payer, who “pushes” funds in real-time to a payee’s account through eligible Visa or Mastercard debit or reloadable prepaid cards. Unlike traditional bank-to-bank transfers, Push-to-Card Payouts are settled in real-time and need only the payee’s name and email to set up. The payee’s card information is then captured on the initial payment through a quick and easy white-labeled flow and stored for future payments with no need to collect banking information. ConnexPay

Avalara and eBay partner to solve cross-border compliance for global sellers

Avalara and eBay launched a program that takes the complexity out of selling products on eBay and shipping them internationally. eBay International Shipping leverages Avalara software natively to determine Harmonized System (HS) commodity classification codes, identify item-level trade restrictions, and generate landed cost pricing for more than 200 million items hosted on eBay and sold to more than 200 countries. Avalara

Embracing new ways to transact by unleashing the power of blockchain

Six fintech companies from across the globe are joining the Mastercard Start Path Digital Assets program to scale innovative solutions and build the future of commerce. The following startups are joining Start Path for opportunities to help them break into new markets and accelerate blockchain innovation: Axelar, Cheeze, Coala Pay, Quobay.io, RociFi, and Suberra. These six startups will join over 350 companies from 42 countries participating in Start Path. Mastercard

The virtual bank card boosting wellbeing

Paysend released a poignant short film produced by BBC StoryWorks to uncover the challenges surrounding financial inclusion in Latin America. With 70% of the Latin American population unbanked, millions rely on remittances from family members abroad for necessities like housing and food. To address this issue, Paysend introduced Paysend Libre in Nov 2022, allowing unbanked users in Guatemala and other countries in Latin America to receive remittances from the US instantly to a Paysend virtual Mastercard digital card. Paysend

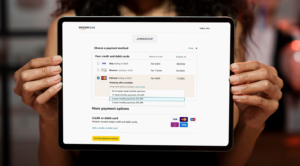

Citi Flex Pay and Amazon Pay launch BNPL

Citi Flex Pay and Amazon Pay have teamed up to empower eligible Citi cardholders with equal monthly payment options on eligible purchases of $50 or more. Eligible Citi credit card members can now pay over time with Citi Flex Pay when using Amazon Pay during checkout. This is the first time Citi credit card members can use Citi Flex Pay through a digital wallet. The digital wallet uses information stored in a customer’s Amazon wallet, so Citi credit card members can check out and pay over time in only a few steps using the Amazon Pay button. Citi-Amazon

CSI Adds IT Governance to advisory services offering as cybersecurity, regulatory landscapes grow in complexity

Coupled with CSI’s Compliance & Risk Management Services, IT Governance Services combines best-in-class domain expertise with leading compliance technology. The result is a holistic approach to managing critical IT and security issues, which helps minimize the risks of non-compliance penalties for financial institutions. A CSI report identified that respondents ranked employee turnover (34%) and regulatory change (27%) as the most significant issues bankers expect will affect the financial industry in 2023. CSI

Quadient announces AI-Based Cash Application Module to accelerate invoice-to-cash processes

The new Advanced Cash Application module eliminates manual tasks for financial teams, such as applying incoming payments to customers and invoices and re-keying payments received from the bank. Where a payment has been received but the customer has not been identified, the software’s machine learning engine automatically considers data—such as the type of payment, the amount and any remittance data—to provide a suggested customer. At that point, the AR team can review the transaction for easy, trustworthy cash matching and approve it, removing it from payment reminder workflows to avoid overcommunication and improve the customer relationship. Quadient

InComm Payments expands Brazil operations with new Technology Development Hub

InComm Payments Brazil Technology Ltda launched an information technology (IT) hub dedicated to developing payments solutions for industries including retail, financial services, mobile payments and more. Based in Fortaleza, the IT hub expands InComm Payments’ Brazil operations and creates approximately 200 jobs throughout the country for various financial technology development roles, supporting local and international projects under the leadership of the company’s US development teams. InComm

HFMA renews Peer Review designation for Synchrony

The Healthcare Financial Management Association (HFMA) today announced that, following rigorous review, Synchrony once again achieved the “Peer Reviewed by HFMA®” designation for its CareCredit credit card. Synchrony’s CareCredit is a health and wellness credit card that patients can use to pay for deductibles, treatments and procedures that are partially covered or not covered by insurance and other health and wellness services for individuals and their pets. It is accepted at more than 266,000 provider and retail locations nationwide. Synchrony

Recent PaymentsNEXT news:

Alternative payments are now a mainstream e-commerce preference

BNPL Report – News, insight and research for buy now pay later industry leaders

LET’S CONNECT