by Jeff Domansky

According to TransUnion’s latest annual fraud survey, fraudsters are finding new ways to scam merchants and consumers, leading to a new growth industry. Overall fraud grew 9.4% globally from 2020 to 2021 and 52.2% from 2019 through 2021, according to the company’s review of billions of transactions on more than 40,000 websites and apps using its fraud prevention services.

Shipping fraud led the parade of fraud attempts with 780.5% growth in 2021 over the previous year. Shipping fraud was defined as sellers who received payment for goods or services but never shipped the product or provided services.

Fraud types shifted as consumer purchases changed during pandemic

With the ongoing impact of Covid-19, consumers continued to increase online purchases, with nearly half saying they did the majority of their transactions online. 42% of consumers said they were targeted by fraudsters.

“As consumers shifted from brick-and-mortar retailers to e-commerce platforms over the course of the pandemic, fraudsters gravitated toward where consumers were increasingly spending both time and money,” said Shai Cohen, senior vice president and global head of fraud solutions at TransUnion. “Online shopping has become the ‘new normal’ on a global scale, and as a result, the propensity for shipping fraud has also increased.”

Among the biggest eight fraud types were shipping fraud (+780.5%), business identity theft (+114%) identity mining/phishing (+105%), first party fraud (56%), scams or solicitations (+54%), true identity theft (+26%), application/first party fraud (+19%), and account takeover (+6%).

A TransUnion survey of 12,500 adults worldwide showed that 62% of consumers are concerned about identity theft.

Industries with biggest fraud problems globally and in the US

Globally, travel and leisure (+68.4%), financial services (+33.5%), and gaming (+32.6%) reported the largest growth in fraud attempts. The biggest fraud type in the financial services industry was true identity fraud.

In the US, the industries with the most substantial growth in fraud included gaming (+60.3%), travel and leisure (+58.4%), telecom (+29.5%), financial services (+27.2%), and insurance (+11.1%).

“Fraud continues to impact a variety of different business sectors, and fraudsters are always looking for the next opportunity. However, some industries continue to have a target on their backs – such as financial services or travel and leisure – that should preemptively employ fraud detection solutions and strategies to serve customers better and protect their bottom line,” said Sean Donnelly, senior vice president of global fraud solutions at TransUnion.

Fraudsters and bad actors are following the money and shifting their fraud focus rapidly as consumer payment preferences and purchasing journeys change quickly.

Encouraging signs despite some country, industry fraud growth

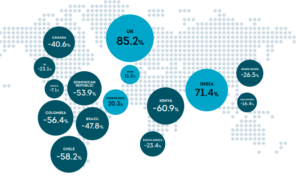

Overall, TransUnion reported fraud attempts decreased 22.6% in Q1 2022 compared with Q1 2021 across users of its fraud prevention platform. Several countries showed decreases in fraud attempts including Kenya (-60.9%), Chile (-58.2%), Colombia (-56.4%), Dominican Republic (-53.9%), Brazil (-47.8%), Canada (-40.6%), Hong Kong (-26.5%), South Africa (-23.4%), the US (-23.1%), Philippines (-16.4%), and Mexico (-7.1%).

Some countries resisted the fraud decrease trend in Q1 2022, with the UK showing an increase of +85.2%, followed by India (+71.4%), Puerto Rico (+20.3%), and Spain (+11.3%).

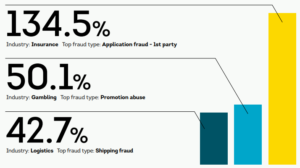

The three industries with the largest Q1 2022 increases in fraud attempts included insurance (+164.5%), where the top fraud type was application/first-party fraud. This was followed by gambling (+50.1%), with promotion abuse as the leading fraud type and the logistics industry (+42.7%) led by shipping fraud.

While fraud increases were widespread, several industries showed a decrease in Q1 2022 compared with Q1 2022, including financial services (-63.6%), telecom (-20.4%), and retail (-7.6%).

“To effectively mitigate digital fraud risks, businesses should ensure there are strong authentication processes in place as well as streamlined technology and multi-layered identity solutions. These solutions will help build trust with customers and thwart these fraud tactics,” added Cohen.

Specific country and regional data in the report include the US, Brazil, Canada, Chile, Colombia, the Dominican Republic, Hong Kong, India, Kenya, Mexico, the Philippines, Puerto Rico, South Africa, Spain and the UK. You can download a free copy of the 2022 TransUnion Global Digital Fraud Trends Report here.

Charts courtesy of TransUnion

LET’S CONNECT