Today we’re looking at SE Asia fintech news, new markets and which companies are accelerating in these high-growth economies. With more than $2 billion invested in fintech in India in 2015, CB Insights profiles the 72 fintech leaders across banking, payments and insurance. Fintechs in SE Asia raised $158 million in 2016 according to CB Insights, down just slightly from $177 billion in 2015.

Forrester reports that e-commerce in India will reach $64 billion by 2021. In the Asia-Pacific region, 78.1% of online sales will be done on mobile by 2021, reaching more than $1.1 trillion. In India, Amazon received approval for its Prepaid Payment Instrument (PPI) licence, allowing it to introduce mobile wallet payments in the future. Global Times reports increased collaboration between Indian and Chinese e-commerce companies including Tencent and Alibaba.

Forrester reports that e-commerce in India will reach $64 billion by 2021. In the Asia-Pacific region, 78.1% of online sales will be done on mobile by 2021, reaching more than $1.1 trillion. In India, Amazon received approval for its Prepaid Payment Instrument (PPI) licence, allowing it to introduce mobile wallet payments in the future. Global Times reports increased collaboration between Indian and Chinese e-commerce companies including Tencent and Alibaba.

Ant Financial and Indonesia’s Emtek Group will partner on a mobile payments and financial services joint venture in Indonesia. With 30,000 merchants already, India’s payment gateway Razorpay aims to double its B2B business in Indonesia, Sri Lanka and the Middle East. Japan’s CyberAgent Ventures estimates $2.6 billion has been invested in SE Asia tech startups and there are opportunities for more Japanese investment.

Credit card payments in Japan totaled more than $494 billion in 2016, up 8.2% and powered mainly by e-commerce. Singapore fintech startups got more than $605 million invested in 2015, while Japan received only $142 million. This prompted the Science & Technology Office in Tokyo to call for more Japanese VC investment.

Credit card payments in Japan totaled more than $494 billion in 2016, up 8.2% and powered mainly by e-commerce. Singapore fintech startups got more than $605 million invested in 2015, while Japan received only $142 million. This prompted the Science & Technology Office in Tokyo to call for more Japanese VC investment.

K-Bank – South Korea’s first digital-only bank – launched April 3rd and within three days had more than 100,000 new clients. Malaysia’s Islamic Financial Services Board says the country was the world’s largest issuer of sukuk or Islamic corporate bonds, totaling $5.98 billion. While Taiwan is taking a slow and steady approach to fintech, Carl Wegner, director of Greater China business development for tech investment group R3, forecasts opportunities ahead in the $25 billion global fintech industry.

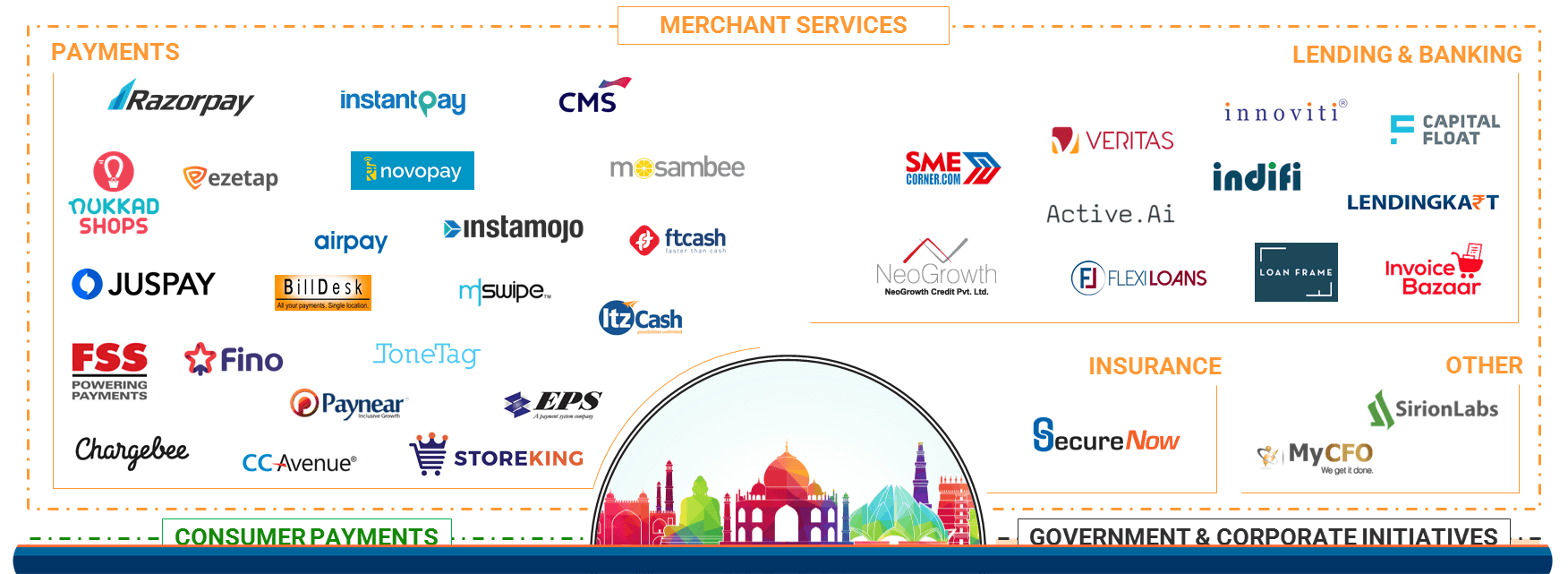

India Fintech Market Map: 72 Startups Working Across Lending, Payments, Insurance & Banking

Aggressive recent government initiatives in India, including bringing more people into a formal ID system (Aadhaar) and increased funding and tax relief for startups, have made starting a business in India much more attractive. Foreign investors have rushed to capitalize as the country’s GDP continues to grow at a steady clip.

Aggressive recent government initiatives in India, including bringing more people into a formal ID system (Aadhaar) and increased funding and tax relief for startups, have made starting a business in India much more attractive. Foreign investors have rushed to capitalize as the country’s GDP continues to grow at a steady clip.

Looking at Indian fintech specifically, funding to private companies in the sector boomed from about $175M in 2014 to a high of $2B in 2015 (buoyed by mega-rounds to Paytm) and then slid to $530M in 2016. Still, 2016′s total funding was more than 200% higher than total funding in 2014. A host of global corporations and their venture arms have entered the fray, eager to reach India’s mostly unbanked population and profit from the country’s tech-friendly regulatory environment. Via cbinsights.com

Fintech in Southeast Asia: Deals up in 2016, but dollars down

Southeast Asia recorded the largest number of fintech deals backed by venture capital (VC) firms last year, since 2012, but deal value during the 12-months ended December 2016, were lower when compared to the corresponding period the previous year.

Southeast Asia recorded the largest number of fintech deals backed by venture capital (VC) firms last year, since 2012, but deal value during the 12-months ended December 2016, were lower when compared to the corresponding period the previous year.

In 2016, about 71 fintech firms raised funding from VCs, amounting to $158 million, when compared to 55 deals in 2015 which were valued at $177 million, according to data complied by CB Insights.

Overall deal value was down in 2016 as several of the transactions were driven by seed and angel stage investments in the region. The numbers present a clearer picture – early stage funding as a percentage of the total number of deals increased to 62% in 2016, as against 55% for the 12-months ended December 2015. Via dealstreetasia.com

India’s e-commerce battle is not Indian anymore

India is the fastest growing e-commerce market in the world, according to a report published by Forrester. The same report claims the online retail market in India is poised to reach $64 billion by 2021, with a 31.2 percent compound annual growth rate over five years. In the Asia-Pacific region, mobile commerce is expected to account for 78.1 percent of online sales in 2021, amounting to $1.1 trillion.

India is the fastest growing e-commerce market in the world, according to a report published by Forrester. The same report claims the online retail market in India is poised to reach $64 billion by 2021, with a 31.2 percent compound annual growth rate over five years. In the Asia-Pacific region, mobile commerce is expected to account for 78.1 percent of online sales in 2021, amounting to $1.1 trillion.

Considering that mobile will be the predominant driver for online commerce, the future looks promising for the Indian market, where the number of mobile Internet users is expected to reach 650 million by 2020 and high-speed Internet users will be around 550 million (more than 2x growth from 2016). So it’s a no-brainer that the global giants are vying for a sizable share of the e-commerce market in India.

Back in 2004, eBay entered the Indian market by acquiring Bazee for $54 million but missed the opportunity to take the early-mover’s advantage. Home-grown Flipkart was launched in 2007, followed by New Delhi-based Snapdeal in 2010, and Amazon entered quite late in 2013. But Amazon India was able to capitalize on the market created by the home-grown players and has received a huge amount of capital from its global arm ($5 billion to date). Via venturebeat.com

Amazon receive E-Wallet licence – Indian E-commerce War heats up

Now Amazon has joined the biggies to gain a slice of India’s fast-growing digital payments business.

Now Amazon has joined the biggies to gain a slice of India’s fast-growing digital payments business.

As per reported by Mint, Amazon India, which had applied for a Prepaid Payment Instrument (PPI) licence nearly a year ago, will now look to take on established rivals such as Paytm and Freecharge as it prepares to launch a prepaid wallet service that will be broader in scope than its Pay Balance service and will not be restricted to Amazon-based transactions.

After demonetization, digital wallet companies saw a sharp rise in wallet adoption & companies like Paytm had seen a massive increase in user base. Via bizztor.com

China-India: China-India e-commerce collaborations show potential, says Chinese daily

Internet-related cooperation between China and India could eventually lead to market integration between them, says a Chinese state-run daily, days after Flipkart, India’s largest e-tailer, said it had received a $1.4 billion capital infusion from various companies including Chinese internet giant Tencent Holdings.

Internet-related cooperation between China and India could eventually lead to market integration between them, says a Chinese state-run daily, days after Flipkart, India’s largest e-tailer, said it had received a $1.4 billion capital infusion from various companies including Chinese internet giant Tencent Holdings.

In an article, titled ‘China-India e-commerce collaborations show promising potential for cooperation’, the Global Times said: “In terms of India’s external trade, it is possible that Internet-related cooperation between China and India will eventually lead to market integration as online platforms give vendors a direct access between the two countries.

“When it comes to market integration, one plus one will be greater than two if companies from both sides can take advantage of their economic complementarity to stimulate greater domestic demand.”

It said around a third of the world’s population live in China and India, two of the world’s major emerging economies that are seeing a fast-expanding middle class. “Economic integration is likely to create immeasurable market potential and thus push both economies into a new stage.” Via indiatimes.com

Ant Financial brings mobile payments to Indonesia

In its latest foray outside of China, Ant Financial has teamed up with Indonesia’s Emtek Group on a mobile payments and financial services joint venture. Alibaba’s Ant has made a rash of deals over recent months, spending some of the $4.5 billion it raised in a funding round a year ago to become a globe-straddling payments behemoth.

In its latest foray outside of China, Ant Financial has teamed up with Indonesia’s Emtek Group on a mobile payments and financial services joint venture. Alibaba’s Ant has made a rash of deals over recent months, spending some of the $4.5 billion it raised in a funding round a year ago to become a globe-straddling payments behemoth.

The latest deal will see it bring its payments expertise to a platform offered on BBM, which is operated by an Emtek subsidiary in Indonesia and is the country’s most-installed and most commonly used messenger app, with 63 million monthly active users. Via finextra.com

Razorpay plans overseas foray

Razorpay, a payment gateway solution provider focused on online merchants, plans to go international. It is looking to enter South East Asia and West Asia markets in 2018-19, Harshil Mathur, co-founder, has said.

Razorpay, a payment gateway solution provider focused on online merchants, plans to go international. It is looking to enter South East Asia and West Asia markets in 2018-19, Harshil Mathur, co-founder, has said.

“South East Asia and West Asia will be our next markets because the technology is scalable. Indonesia will be the first market we will look at. Sri Lanka and Middle East will be next,” Mathur told BusinessLine here.

The fintech startup, which started its journey in mid-2014, is in talks with local and global (banking) players in these markets, Mathur said. Via thehindubusinessline.com

ASEAN and Japan aim to foster startups in SE Asia

TOKYO – Venture capital investment is booming in Southeast Asia, boding well for the region’s startups. And there is greater scope for collaboration between businesses in the region and in Japan to make innovation happen.

TOKYO – Venture capital investment is booming in Southeast Asia, boding well for the region’s startups. And there is greater scope for collaboration between businesses in the region and in Japan to make innovation happen.

That was the message at the ASEAN-Japan Open Innovation Forum in Tokyo on April 7, as speakers ranging from startup founders to a venture capitalist to media experts discussed the latest developments in a market that is just picking up steam.

“Risk money is steadily gathering in Southeast Asia,” said Takahiro Suzuki, the Jakarta head of Japan’s CyberAgent Ventures, which is an investor in Indonesia’s Tokopedia, an online marketplace. According to data cited by Suzuki, total venture capital investment in Southeast Asia reached $2.6 billion in 2016, about 60% more than the previous year. Via asia.nikkei.com

Credit card payments top 50 trillion yen in Japan

Credit card use in Japan is on the rise thanks to the growing popularity of internet retailers and a widening range of establishments that accept that payment option.

Credit card use in Japan is on the rise thanks to the growing popularity of internet retailers and a widening range of establishments that accept that payment option.

Payments made with credit cards rose 8.2% in 2016 from the previous year to 53.9 trillion yen ($494 billion), exceeding 50 trillion yen for the first time, according to the Japan Consumer Credit Association.

The largest factor behind the rise is the growing e-commerce market. Internet retailers like Amazon and Rakuten allow a variety of payment methods such as cash-on-delivery or payments at convenience stores, but a growing number of people are using credit cards for instant settlements. “We are seeing a nearly 20% year-on-year jump every month in use for e-commerce,” said an official at Sumitomo Mitsui Card. Via asia.nikkei.com

Tokyo and Seoul should take a leaf from the Singapore fintech playbook

With news last month that Japan’s banks are being forced to embrace fintech, and PayPal is throwing its weight behind a South Korean fintech pioneer in a US$48 million deal, it’s clear there’s a growing need for further deregulation and government support of the financial technology (fintech) space.

With news last month that Japan’s banks are being forced to embrace fintech, and PayPal is throwing its weight behind a South Korean fintech pioneer in a US$48 million deal, it’s clear there’s a growing need for further deregulation and government support of the financial technology (fintech) space.

But business and financial leaders in Tokyo and Seoul would do well to take a leaf out of Singapore’s fintech playbook, where the government is relaxing regulations and aggressively supporting innovation at the grassroots.

The results to date have been dramatic: US$605 million invested into Singapore’s fintech startups in 2015 alone, according to KPMG. In the same year, Japan received only US$142 million, according to data cited by Science & Technology Office Tokyo. Numbers for South Korea are harder to come by. Via e27.co

Launch of So Korea’s first online-only bank, K-Bank

A bank that’s open around the clock… The age of online-only banks has begun in Korea with the country’s first digital-only banking venture, K-Bank, launched on April 3rd and the second online-only bank, Kakao Bank, also gaining regulatory approval. With the launch, many changes are anticipated for the nation’s banking industry. We’ll take a closer look at what online-only banks are and what kind of changes they will bring about with LG Economic Institute’s Kim Gun-woo.

A bank that’s open around the clock… The age of online-only banks has begun in Korea with the country’s first digital-only banking venture, K-Bank, launched on April 3rd and the second online-only bank, Kakao Bank, also gaining regulatory approval. With the launch, many changes are anticipated for the nation’s banking industry. We’ll take a closer look at what online-only banks are and what kind of changes they will bring about with LG Economic Institute’s Kim Gun-woo.

Online-only banks can be simply thought of as the internet banking system that we currently use. For an ordinary consumer, the services provided by an online-only bank are exactly the same as those of internet banking. However, while internet banking is an extra service provided by an offline commercial bank, online-only banks will solely provide their services online. Therefore, they do not have to invest in office space and associated staff, and can pass on these savings to their customers in the form of higher savings rates or lower loan rates.

Online-only banks manage all of their services, such as opening accounts, wire transfers, and loan applications, online through the internet or on mobile platforms. They can provide their services 24 hours a day, 7 days a week without restrictions on place or time. As online-only banks can cut costs on office space and personnel, consumers can take advantage of favorable savings and loan interest rates. With these advantages, Korea’s first online-only bank, K-Bank, racked up more than 100,000 customers in the three days since its launch. Via world.kbs.co.kr

Growing demand for fintech in Islamic finance

“There are tremendous opportunities for fintech within Islamic finance.

“In the aftermath of the global financial crisis, there has been a loss of confidence, so people are looking for alternatives,” he told reporters on the sidelines of IFSB’s Annual Meetings and Side Events 2017 yesterday.

According to the IFSB’s Islamic Financial Services Industry Stability Report 2016, Malaysia was the largest corporate sukuk issuer in the world in 2015, accounting for nearly 33.7% or US$5.98bil (RM26.5bil) that year. Via thestar.com.my

The Need for Speed: Taiwan Taking the Slow Road on Fintech

Financial industry observers see big potential for Taiwan in the nascent fintech sector, citing the ways in which emerging technologies could help the banking and insurance components of the nation’s financial conglomerates share information safely and efficiently.

Financial industry observers see big potential for Taiwan in the nascent fintech sector, citing the ways in which emerging technologies could help the banking and insurance components of the nation’s financial conglomerates share information safely and efficiently.

A special characteristic of the Taiwan market is that many of its largest banks, insurance companies, and securities firms operate under the umbrella of a financial holding company, observes Carl Wegner, director of Greater China business development for R3, a New York-based financial technology consortium created by more than 70 leading global financial-services companies. For Taiwan’s financial institutions, he says, new distributed ledger technologies such as blockchain “represent an outstanding opportunity for cost savings” in that they allow the sharing of client information while still maintaining the security controls needed to comply with data privacy laws.

Acknowledging the disruptive nature of some of the new financial technology, Wegner urges regulators to “actively learn” about fintech, a fast-growing industry that saw almost US$25 billion in global investment last year (including US$7.1 billion in Asia), according to a February report by KPMG. “To make judicious decisions, you need to first understand how this technology works, how it’s going to change the playing field, and why it can be good for both businesses and consumers,” he says. Via international.thenewslens.com

LET’S CONNECT