In the run-up to the Super Bowl LIV, iovation released its 2020 iGaming Report, providing an analysis of more than 4 billion online gambling transactions from the past 15 years and screened for fraud by the company.

The biggest reported fraud for the third year in a row was “bonus abuse” which grew 72% in 2019 compared with 2018. Bonus abuse occurs when gamblers use several false accounts and many email addresses to multiply a single incentive bonus for new or existing customers into thousands of dollars in bonuses in order to gain more house money for gambling.

“Deposit bonuses can be a valuable tool for attracting and retaining players,” said Greg Pierson, TransUnion’s senior vice president of business planning and development. “Unfortunately, a few bad apples can abuse otherwise effective programs to the point of eliminating all their value.”

The four other largest fraud abuses included collusion, chip dumping, chargeback abuse, and credit card fraud using stolen credit cards and identities.

Self-exclusion grew 63%

iovation recorded more than 363,000 reports of gambler self-exclusion in 2019, an increase of 63% over 2018. Self-exclusion is legally required by gambling companies to help those with a gambling problem self-report and request they be excluded from gambling on a company site.

Self-exclusion is a challenging problem for operators because problem-gamblers often change their mind and then use family or other false identities to resume gambling. Fraudsters also open up new accounts with stolen credit cards, deposit funds, and then self-exclude before the chargeback is recorded against the merchant account.

“When looking at devices and accounts associated with self-exclusion reports in 2019, we saw eight times (three million) the number of devices and three times (1.2 million) the number of accounts in comparison to reports of self-exclusion. This paints a clear picture that those who self-exclude are not always walking away,” said Angie White, iovation product marketing manager. “Having multiple devices and accounts linked to self-exclusion reports could point to a self-excluded player trying to use another device to set up a new account or something more problematic like a fraud ring.”

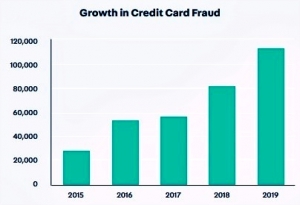

iGaming credit card fraud growing

Iovation’s iGaming customers reported a 37% growth in credit card fraud from 2018 to 2019. While operators try to stop credit card fraud, consumers expect fewer barriers, reduced transaction reviews, and fewer unnecessary steps in authentication with their credit card transactions.

Alternative payment methods such as e-wallets, bitcoin, and direct debits, as well as faster payments, are expected to add to the problem of account fraud by making real-time identity verification and risk management harder.

Fraud rings and money laundering challenges

In 2019, anti-money laundering (AML) fines jumped dramatically to reach $8.07 billion, an increase of 430%. One gambling operator in the UK alone was fined $7.2 million for AML violations

iGaming operators are left trying to balance risk management while trying to meet the Strong Customer Authentication (SCA) requirements under the second Payment Services Directive (PSD2) without adding too much friction to the player experience.

In response, gaming operators are likely to encourage the use of debit, e-wallet, and other alternate payments not subject to SCA requirements.

Super Bowl ticket fraud

In related research, fraud prevention company Forter looked at the problem of Super Bowl tickets scams.

“This year’s average Super Bowl ticket price is the highest ever at more than $8,000, making ticket scams even more attractive to opportunistic fraudsters. Statistical evidence shows that ticket sales spike up to 60% within three days of gameday, and that is when we can expect the most fraudulent activity (beginning Friday, January 31st) this year,” said Forter COO Colin Sims.

According to Ticket IQ, the average resale ticket is $8,264 for Super Bowl LIV this year.

“In years past, we noticed the majority of fraud coming from domestic crime rings who were purchasing legitimate tickets online to be counterfeited and re-sold and were altering IP addresses to fake their location, and frequently changing personal account details to avoid detection. We are seeing similar tactics this year, but the activity is largely international in nature,” Sims added.

Mobile is moving fast

iovation reports customers are moving quickly towards mobile for gaming and payments.

This requires a whole new focus by gaming companies on securing the mobile payments system as well as enhancing and streamlining the customer play experience on mobile.

The company says operators also need to put data identity at the heart of fraud detection and authentication management strategies. Device-based intelligence can help companies create a friction-right experience that ensures compliance without impacting the business negatively.

“Providing a secure and friction-right mobile experience to onboard new players has never been more important for competing effectively in the iGaming market with new countries and states seemingly legalizing online gambling every week,” added Pierson.

You can download a free copy of iovation’s 2020 iGaming Industry Report here.

LET’S CONNECT