By Jeff Domansky, Nov 17, 2020

In a new partnership with on-demand pay technology firm Even, PayPal will offer its US employees access to an early-pay service and other financial wellness tools designed to improve financial stability and enhance employee budgeting, savings, and other financial information.

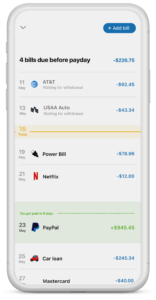

PayPal employees will have full visibility into their earnings, budgeting, savings, and other financial information through an easy-to-use mobile app provided by Oakland-headquartered fintech Even.

“Over the past year, we’ve made significant investments to strengthen the financial health of our workforce,” said Dan Schulman, president and CEO, PayPal. “We’ve made substantial progress to increase the net disposable income of all our employees, and our work with Even will help drive further improvements. Together, we’ll help employees safely navigate cash flow challenges, stay on budget, build financial resilience, and reach long-term savings goals.”

PayPal employee financial wellness strategy

PayPal launched its employee financial wellness initiative in 2018 after examining the financial wellness of its hourly and entry-level workers. The company found despite competitive market pay, many employees were still struggling to pay their bills every month. PayPal took action by increasing its hourly and entry-level employees’ net disposable income (NDI) to 20%. Net disposable income is the calculation of the financial amount left after paying taxes and basic living expenses.

Last year, PayPal rolled out a new comprehensive financial health program that lowered the cost of healthcare benefits, made every employee a stockholder, raised wages, and offered new financial learning and counseling programs. By the beginning of 2021, PayPal estimates the minimum NDI among hourly and entry-level workers will be approximately 16%, up from 4% in some locations.

Even adds on-demand pay and financial wellness tools

Fast forward to today’s announcement of PayPal’s selection of Even which adds the mobile app that allows users to get paid on demand, budget instantly, and save automatically.

“Dan Schulman and PayPal are ahead of the curve,” said Jon Schlossberg, CEO of Even. “Dan is showing the country – and other CEOs – that investing in the financial health and resilience of your people isn’t just the right thing to do. It’s the right thing to do for business.”

Company data shows Even’s approach works – 51% of Even members use the app every day, 72% use it weekly, and the average member saves $163 within their first three months of using the app, often saving for the first time.

Members have deposited more than $118 million in their Even savings accounts to date. More than 112,000 members are auto-saving, with 75% of employees who use Even say it’s positively impacted their financial well-being.

Even’s savings feature also helps the average user go from $0 to $160+ in savings in just three months, saving a total of more than $10 million since it was introduced in 2019.

Even now has more than 600,000 monthly active users, with more than 50% using the app every day. It is the most widely used opt-in benefit at Walmart, where Even is offered for free to more than 1.5 million associates.

Even launched in 2015, has raised more than $52 million, and is backed by PayPal Ventures, Valar Ventures, Founders Fund, Khosla Ventures, Allen & Company, Harrison Metal, SV Angel, Silicon Valley Bank, that’s all you and others. More information is available here.

Related PaymentsNEXT coverage:

Earned Wage Access companies tackle CA consumer regulation

Pandemic update: Visa Direct helps employees get emergency pay

LET’S CONNECT