Our global payments news roundup takes a look at highlights from CB Insights’ valuable Global Fintech Report for Q1 2017. The  report summarizes global fintech investment trends, top deals, active investors and corporate activity.

report summarizes global fintech investment trends, top deals, active investors and corporate activity.

In 226 deals in Q1 2017, venture capital-backed fintech raised more than $2.7 billion. The report said 22 global unicorns were valued at more than $77 billion reflecting strong growth and potential in the financial technology sector.

European VC investment up

While there were seven $50 million financings in 2017, this was down by 50% from 14 in Q1 2016. Atom and Funding Circle each raised more than $100 million in the biggest news of the quarter. Atom is a UK-based digital-only bank targeting millennials. Funding Circle is a UK online marketplace connecting businesses needing loans, with investors.

Top 10 deals in EU included: Raisin (Germany, $32 million), BitFury (Netherlands, $30 million), solarisBank (Germany, $28 million), CurrencyCloud (UK, $25 million), Monzo ($24.5 million), Cream Finance (Poland, $22.9 million), Simplesurance (Germany, $21.2 million) and VATBox (UK, $20 million)

Top 10 deals in EU included: Raisin (Germany, $32 million), BitFury (Netherlands, $30 million), solarisBank (Germany, $28 million), CurrencyCloud (UK, $25 million), Monzo ($24.5 million), Cream Finance (Poland, $22.9 million), Simplesurance (Germany, $21.2 million) and VATBox (UK, $20 million)

Raisin is an online marketplace for savings products. BitFury is a leading bitcoin blockchain security and infrastructure provider. solarisBank is a Berlin-based banking-as-a-platform solution that allows fintech startups to offer banking services to their customers. CurrencyCloud is a global payments platform.

Monzo provides mobile banking services, while Poland’s CreamFinance is a financial services provider. Simplesurance delivers traditional insurance services for digital business and VATBox enables automated VAT returns and governance.

![]() Ottonova is a German insurtech company based in Munich. Another German fintech, ShapeShift lets users trade any major blockchain asset with another and it raised $10.7 million in March. Advanon, based in Zürich, helps SMEs meet short-term financing needs by selling invoices to financial investors.

Ottonova is a German insurtech company based in Munich. Another German fintech, ShapeShift lets users trade any major blockchain asset with another and it raised $10.7 million in March. Advanon, based in Zürich, helps SMEs meet short-term financing needs by selling invoices to financial investors.

Most active VCs in EU fintech financing were: Index Ventures, SpeedInvest, Holtzbrinck Ventures, Global Founders Capital, Dieter von Holtzbrinck Ventures and SeedCamp.

North American deals down 12%

North America saw deals to VC-backed fintech startups drop 12% from 111 to 98 deals compared to Q4’16 and down 33% from the same quarter last year. $1.1 billion was raised by US fintech companies.

North America saw deals to VC-backed fintech startups drop 12% from 111 to 98 deals compared to Q4’16 and down 33% from the same quarter last year. $1.1 billion was raised by US fintech companies.

Largest US deals included San Francisco’s SoFi with ($500 million), Namely (New York, $50 million), Upstart (CA, $32.5 million), Tala (CA, $30 million), Trumid (New York, $27.6 million), Veem (CA, $24 million), PayFone (New York, $23.5 million), ActiveHours (CA, $22 million), PayNearMe (CA, $20.5 million) and Canopy (Utah, $20 million).

10 most active US VC investors were: New Enterprise Associates, Khosla Ventures, General Catalyst Partners, Bain Capital Ventures, Union Square Ventures, Nyca Capital, Andreessen Horowitz, GV, Founders Fund and Thrive Capital.

24% of US deals were backed by US corporate investment.

Most-active VC investors in global fintech

The most active VC investors in global fintech were: 500 Ventures, New Enterprise Associates, Index Ventures, Ribbit Capital, Union Square Ventures, Khosla Ventures, QED Capital, Bain Capital Ventures and General Catalyst.

Corporate venture capital was also active, participating in one-third of the deals in Q1 2017 compared to 22% in Q1 2016.

Largest fintech unicorns

The 22 VC-backed fintech unicorns with valuations above $2.0 billion include the following:

The 22 VC-backed fintech unicorns with valuations above $2.0 billion include the following:

- Lu.com (China) – $18.5 billion valuation

- Stripe (US) – $9.2B

- Zhang.an (China) – $8.0B

- One97 (S Korea) – $5.9B

- SoFi (US) – $4.5B

- Greensky (US) – $3.6B

- Credit Karma (US) – $3.5B

- Oscar Health (US) – $2.7B

- Mozido (US) – $2.4B

- Adyen (Netherlands) – $2.3B

- Klarna (Sweden) – $2.3B

- Zenefits (US) – $2.0B

Bitcoin and blockchain VC investments up

Investment to VC-backed bitcoin and blockchain startups rebounded in Q1’17 to $113M after dropping to $77M in Q4’16. The largest deals over the three-month period included BitFury’s $30M Series C and Veem’s $24M Series B.

VC-backed payments tech companies decreased

The total investment dollars to VC-backed payments tech companies (online and mobile payments, point of sales systems) fell 39% to $304 million in Q1 2017 from $495 million in Q4 2016, although the number of deals rose from 44 to 50 deals.

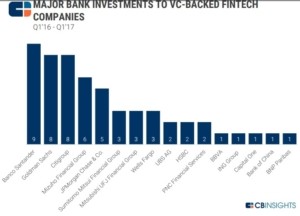

Major bank investments to fintech

Major banks continued their investment in fintech startups. Santander (9 deals), Goldman Sachs (8), and Citi (8) or their venture arms participated in the highest number of deals to venture-backed fintech companies over the last five quarters.

Major banks continued their investment in fintech startups. Santander (9 deals), Goldman Sachs (8), and Citi (8) or their venture arms participated in the highest number of deals to venture-backed fintech companies over the last five quarters.

Other banks included Mazuho Financial Group (6 deals), JP Morgan Chase (5), Sumitomo (3), Mitsubishi (3), Wells Fargo (3), UBS (2), HSBC (2), PNC Financial Services (2) and one each for BBVA, ING, Capital One, Bank of China and BNP Paribas.

Asian fintech VC investment trending lower

After a dip in Q4’16, Asia VC-backed fintech funding rose 89% in Q1’17. The 42 deals in Asia raised more than $826 million, up from $200 million in Q4 2016.

After a dip in Q4’16, Asia VC-backed fintech funding rose 89% in Q1’17. The 42 deals in Asia raised more than $826 million, up from $200 million in Q4 2016.

Top six Asian fintech financings included:

- DVCO.com – China, $72 million

- YongQianBao – China, $70 million

- Toss – South Korea, $48 million

- HuiFenQi – China, $33.4 million

- Amartha – Indonesia, $30 million

- Folio – Japan, $16 million.

50% of Asian Q1 2017 deals included corporate financing.

Leading VC investors included: 500 Startups, SBI Investment, East Ventures, Sequoia Capital, Matrix Partners China, Kaalari Capital, BEENEXT, IDG Capital and Source Code Capital.

Fintech deals in rest of world

Deals were also made outside of North America, EU and Asia. Of the 10 largest deals outside of Asia, Europe, and North America over the last five quarters, four took place in Australia and four in Brazil.

Deals were also made outside of North America, EU and Asia. Of the 10 largest deals outside of Asia, Europe, and North America over the last five quarters, four took place in Australia and four in Brazil.

In Brazil, NUBank received $132 million in new investment in the past 12 months. MoneyMe in Australia raised $30 million, Creditas (Brazil) got $19.4 million, Prospa in Australia received $19.3 million and SocietyOne got $19 million.

Want more global fintech intelligence?

If you’re finding this weekly mix of global payments, fintech, cryptocurrency and financial business intelligence useful, why not subscribe? Sign up at the top of the page and you’ll get these useful news briefs in your inbox every Mon-Wed-Fri morning.

LET’S CONNECT