By Jeff Domansky, March 9, 2021

Consumers quickly embraced e-commerce and online payments last year while fraudsters high-fived with record purchase scams, impersonation, money mule schemes, and account takeover scams.

A new report from risk management platform Feedzai surveyed 2020 fraud results and painted a disheartening picture of fraud scams skyrocketing during the past 12 months of the global pandemic. The report also highlighted key fraud impact differences between Asia, the EU, and North America.

“2020 was a year of rapid growth in financial crime. Fraudsters tried to take advantage of the convergence between a fast-paced digital environment and a new wave of inexperienced consumers to perpetrate a multitude of attacks that created a significant uptick in fraud,” said Jaime Ferreira, Senior Director of Global Data Science at Feedzai.

Biggest fraud concerns

Feedzai researchers compared data in Q1 2020 with Q4 2020 and identified five of the biggest fraud concerns and the scale of their impact on merchants and consumers. Researchers also noted an increase in stolen credentials for sale on the dark web.

- Account Takeover (ATO) scams jumped 650% – Consumers embraced the growth of real-time payments and online banking services, and fraudsters took advantage, stealing credentials, account information, and passwords of legitimate users. Impersonation scams jumped 600%, and purchase scams grew 300%.

- Online banking fraud grew 250% – With a 200% increase in mobile banking during 2020, cybercriminals ramped up their attempts at online banking fraud and mobile banking incidents as well.

- Digital media fraud up 178% – During lockdowns, consumers turned to books and streaming services, and digital fraud grew 178% as a result.

- Card-not-present (CNP) fraud drove 70% of attacks – Fraudsters love CNP transactions. Without essential security measures such as machine learning, behavioral analytics, biometrics, and two-factor authentication, it remains a serious headache for sellers.

- Card-present fraud dropped 48% – Not surprisingly, fraudsters were social distancing like most of us as card-present fraud dropped 48%, although volume was only down 20%.

Top five transfer fraud scams

The Fraud Report found the most popular fraudster scams involved impersonation scams (23%), purchases (22%), account takeovers (22%), investment scams (6%), and romance scams (3%).

Impersonation scams involved email, phone, or text contact with consumers pretending to represent government agencies or financial institutions. Purchase scams usually took advantage of high-demand healthcare or other popular products during the pandemic. Often, phony e-commerce sites took payments for products never delivered.

Cybercriminals stole consumer identity info, bank account information, and passwords and then transferred money or purchased goods with these stolen credentials using ATO attacks. Investment scams remained popular, often involving employment, affinity fraud, pyramid, and Ponzi schemes. Romance schemes also took advantage of people hungry for human contact during the pandemic isolation or work from home.

Top targets for debit & credit card fraud included ATMs, grocery stores, money services, computers and software, and specialty retail stores.

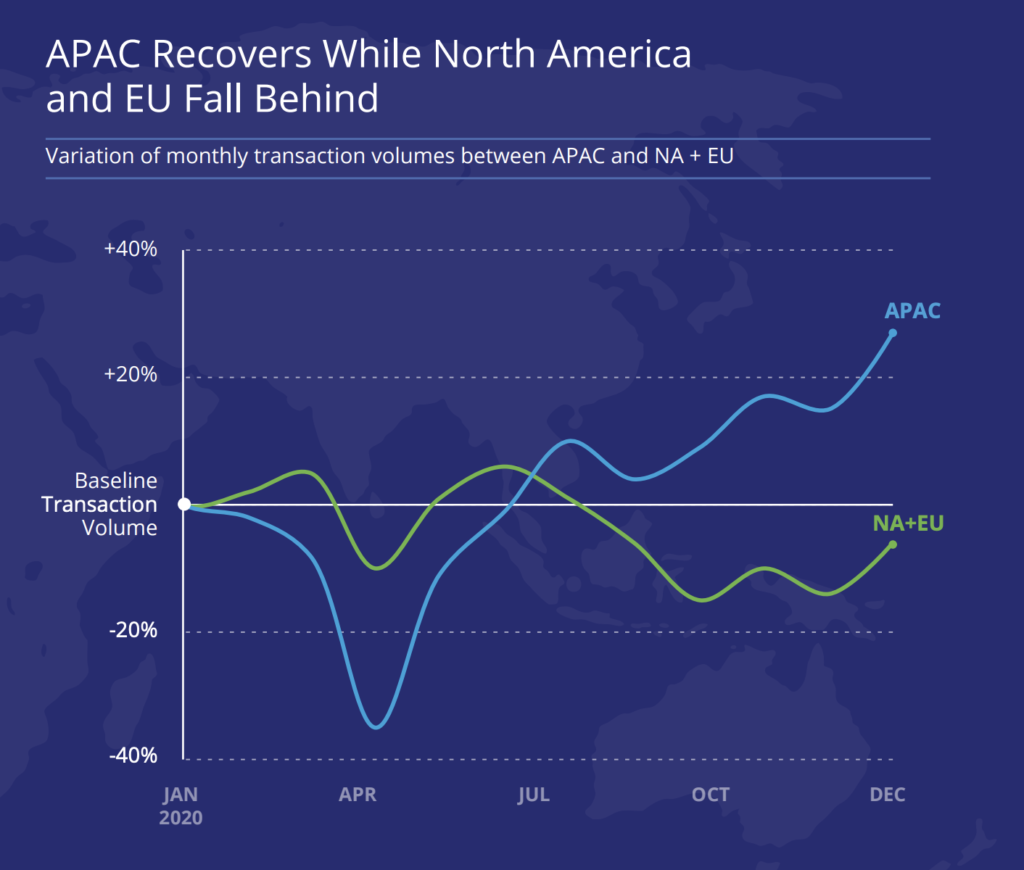

Asia versus North America/EU fraud

The Feedzai fraud report highlighted interesting differences between industry transactions in Asia and those in North America (NA) and Europe (EU). They included:

- 41% drop in restaurant transactions in NA/EU in Q2 2020 recovering to -20% in Q4; restaurants recovered to +33% in Asia by Q4; fraud volume dropped 75.4% in NA/EU and 82.3% in Asia

- fast food transactions recovered to +15% by Q4 in NA/EU and +33% in Asia; fraud decreased 48.3% in NA/EU and -12.0% in Asia

- grocery transactions were down -20% in NA/EU with fraud down 53.2%; Asian grocery transactions were +9% by Q4, and fraud jumped 243.7% as Asian consumers began shopping online for groceries

- beauty/Barbara transactions in NA/EU declined -34% from Q1-Q4; Asian transactions were +29%; fraud decreased -27.2% in NA/EU and increased +14.4% in Asia

- electronics and software purchases grew 16% in NA/EU while fraud was -36.5%; sales grew 72% in Asia, but fraud grew 56.0%

- the transportation industry crashed -56% by Q4 in NA/EU was fraud -86.5%; in Asia, transaction recovered to Q1 levels, and fraud dropped -54%.

With high unemployment, criminals took advantage and recruited money “mules,” resulting in a 383% increase in FBI actions against 2300 individuals. The report noted UN estimates of money laundering between $800 billion and $2 trillion globally.

Fighting financial fraud

Feedzai concluded with a warning to banks. “Financial institutions need to further invest in technologies to protect their customers while developing educational approaches. Robust technology and informed consumers are a powerful combination when fighting financial crime,” Ferreira said.

The most effective fraud prevention steps include creating detailed customer profiles, educating customers on best digital practices, and implementing security measures such as 2FA.

Ferreira also suggested tighter monitoring of inbound and outbound payments, collaborating with cybersecurity experts, leveraging machine learning, AI, and data analytics to prevent fraud and financial crime.

Feedzai’s risk management platform now protects companies with more than 800 million customers worldwide. Read more Feedzai Financial Crime Report highlights here or download a free copy of the full report.

Other PaymentsNEXT stories on fraud include:

Research: Fraud transparency is key to earning US consumer trust

New fraud prevention tool will reduce merchant false order declines