Merchants, payment gateways, credit card issuers, and banks and have long battled the problem of orders falsely declined as part of fraud prevention programs often operated in isolation by partners in the payments system.

Experts estimate losses to merchants could be as high as 10% of revenue due to false declines.

Fraud prevention firm Forter today launched Forter Smart Routing, an automated payment routing solution to help merchants prevent the revenue loss driven by false payment declines by other partners who may not know or recognize the buyer during the payment process.

Because of COVID-19, the issue has grown bigger with changing customer purchasing habits, from in-store to online. This means as many as 30% of customers purchasing with a merchant may be new to them – twice the typical number – and these new customers are more likely to get falsely declined.

Solution could reduce merchant losses by 50%

Forter believes its new solution gives merchants more control by providing automated payment routing decisions to eliminate false declines and reduce lost revenue by 50%.

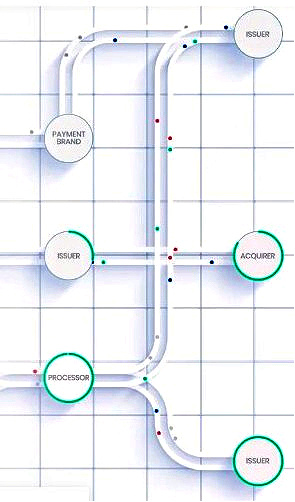

“By partnering with the world’s largest issuers and acquirers, Forter creates a unique, trusted network across each player in the payments ecosystem to improve their risk evaluations and authorization approvals at every level,” said Michael Reitblat, co-founder and CEO of Forter.

“This prevents legitimate transactions from being declined or lost at various points of the purchasing process, which hurts not only the merchant but their customers as well. Forter provides merchants with automated decisions throughout the entire payment flow and determines the best routing for a transaction to ultimately be approved,” Reitblat added.

Powered by advanced AI technology and a Global Network, Forter Smart Routing provides the following capabilities:

- Accurate pre-auth fraud detection: Improves business risk profile and increases authorization rates by blocking fraudulent transactions before bank authorization.

- Dynamic 3DS: Increases conversion while meeting all risk and compliance requirements by triggering 3DS authentication only when required.

- Smart routing: Determines the optimal processor for every transaction with advanced AI models to avoid authorization declines and minimize processing costs.

- Recovery of declines: Recovers legitimate transactions and revenue otherwise lost after false declines during the payment flow.

“Improving our approval rate is a major focus for us, especially because we have legitimate transactions that are potentially being declined during the payment flow. Improving our conversion and approval rates enables us to deliver a better customer experience, which drives repeat business,” said Nitish Pandit, Senior Director of Finance at Priceline. “With Forter, we have automated decisions that provide us with the best ways to process each transaction to boost approvals.”

Forter looks to have a potential game-changing solution to help merchants maximize purchases and lower costs by reducing or recovering troublesome false declines.

Headquartered in New York City, Forter processes more than $200 billion in online commerce transactions and protects over 750 million consumers globally from credit card fraud, account takeover, identity theft, and other security challenges. The company is backed by $100 million in capital from VCs including Sequoia, NEA, and Salesforce. You can find out more about Forter Smart Routing here.

Diagrams courtesy of Forter