Another week, another great global payments news roundup for you. Best Buy just threw down the free next-day holiday delivery gauntlet for its competitors. Kount and BlueSnap have partnered to enable and encourage international e-commerce for US companies. Look, up in the sky, it’s Wing drones delivering packages to home for FedEx and Walgreens in Christiansburg, VA. Mastercard launched Payment on Delivery for B2B transactions.

In the news roundup, Deloitte takes a look at the barriers and progress of open banking in the US. Walmart and Target take two different approaches to using robots in store. Meanwhile, a US federal court ruling against the OCC makes it harder for fintechs to get a nationwide banking license. Digital bank Chime severs its third outage in three months leaving customers hanging. Brex is partnering with MasterCard to extend corporate credit card services into the US. Finally, Bank of America relaunches its nearly redesigned mobile banking app. That’s all we know and now you do too.

Best Buy takes on holiday competitors with free next-day delivery

Best Buy announced it will offer free next-day delivery on online purchases over $35 through Christmas Day for the first time. The home electronics retailer will also offer the option of free standard shipping with no minimum purchase price which proved popular during the 2018 holiday season. Read more…

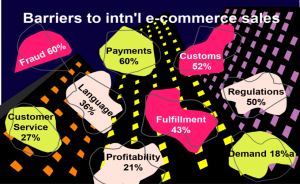

Partnership attacks two biggest barriers to US international e-commerce sales

With global e-commerce likely to reach a record of nearly $3.5 trillion in 2019, why are more US businesses not making bigger headway in growing their international e-commerce sales? New research from fraud prevention consultants Kount and payments processor BlueSnap suggests fraud concerns and payment processing challenges are the two biggest barriers facing US companies wanting to grow their international online sales. Read more…

Home delivery by drone on a Wing and a prayer

Residents of Christiansburg, Virginia will be looking to the sky a lot more in the near future, and it won’t be with a prayer. Rather, they’ll be buzzing about Walgreens, FedEx and Sugar Magnolia package deliveries by Alphabet subsidiary Wing Aviation’s fleet of drones. Wing began air drone delivery trials in the Virginia town last Friday after receiving Federal Aviation Authority (FAA) approval allowing the first full commercial air delivery service by drone directly to homes in the US. Read more…

Mastercard launches B2B payment on delivery

Mastercard launched Payment on Delivery, a new solution that lets businesses pay a supplier in real-time when receiving goods or services. The company is piloting the program with PNC Bank, which uses the RTP® network from The Clearing House for real-time payments clearing and settlement capabilities. MasterCard is targeting industries with complex distribution networks and supply chains and hopes to solve several pain points for B2B Read more…

Executing the open banking strategy in the US

In the US, open banking is expected to evolve as an industry-driven initiative, unlike other countries, where regulatory mandates are forcing many banks to adopt open banking. However, US banks can benefit from lessons learned in these regions, such as how to establish technical and customer experience standards for data-sharing/APIs. If done well, open banking can help US banks achieve key strategic goals. Open banking can amplify and accelerate banks’ digital transformation efforts and the emergence of new business models. Read more…

Walmart wants robots in stores. Target doesn’t

Walmart and Target are taking different approaches to adding robots in stores, a split that will have an impact on the companies’ massive workforces and shape the future of automation in retail. Both of these legacy brick-and-mortar companies are testing robots in their warehouses. Walmart (WMT), the country’s largest retailer and private employer, expects to add self-driving robots that scrub floors to 1,860 of its more-than 4,700 US stores by February. Read more…

Federal judge rules against OCC in fintech regulatory lawsuit by NYS

A US District Court judge ruled that the Office of the Comptroller of the Currency lacks the authority to grant nationwide bank charters to fintechs, striking a major blow against the efforts to create a uniform regulatory framework to challenger banks here. Regulators in New York, considered the nation’s leading state regulator of the banking industry, filed suit in 2018 to block the effort by the OCC to provide a regulatory framework that would allow fintechs to compete with banks on a nationwide basis. Read more…

Chime outages illustrate complexities of digital banking

Chime Bank, one of the nation’s largest neobanks, is recovering from an outage that left millions of customers temporarily unable to buy groceries, access cash from ATM machines and get their balances. The outage, which stemmed from a disruption at a third-party processor, and also impacted rival fintech Varo Money, highlights the vulnerabilities facing digital banking customers that rely on mobile apps to conduct banking and have no walk-in branches to get answers to when a crisis hits. For Chime, which has 5 million customers, the outage represents the third such incident in three months. Read more…

Brex and Mastercard partner on US expansion

Mastercard today announced that Brex, the financial technology company that helps ambitious companies scale, has partnered with Mastercard as its preferred network to bring cutting-edge technology and top-tier benefits to its corporate card portfolio in the United States. San Francisco-based Brex provides startup founders, e-commerce, and life science companies corporate credit cards that require no personal guarantees, deposits or credit scores. Read more…

Bank of America unveils redesigned mobile banking app

Bank of America relaunched its newly designed mobile banking app. The new app is meant that will provide a more seamless and streamlined experience for its approximately 29 million mobile clients. The latest version of the app also includes enhancements to Erica, the bank’s AI-driven virtual financial assistant, designed to help clients better manage their finances. Read more…

LET’S CONNECT