We’ve got a rapid-fire global payments news roundup from our long list of sources we follow. All the payments news you can use, including UK contactless card limit increases, ACI Worldwide’s latest Fraud Index, state of European checkouts in 2021, PayPal Latin America strategy, Veem, and Visa cross-border payment enhancement, EU checkout friction, future of Middle East payments, Mastercard-Pakistan govt partnership, and much more.

Contactless card limit increases to $124 in Britain

On Friday, the limit for contactless card payments rose by more than half, from 45 pounds ($62) to 100 pounds. It’s a milestone for a country whose banks got an early start with tap-to-pay technology and where 88% of debit and 81% of credit cards now have contactless features. There are now some 135 million contactless cards in circulation. Read more…

ACI E-commerce H1 2021 Fraud Index: Today’s Merchant Fraud Landscape: Key Lessons and Insights

An analysis of 100s of millions of transactions derived from ACI’s global customer network reveals 27% growth in eCommerce volume transactions in Q1 2021, with another 5% growth in Q2 2021. Mobile fraud increased by 1.22% in H1 2020 and 1.32 % in H1 2021; the buy online pick-up in-store (BOPIS) channel saw a 7% fraud attempt rate in H1 2020 (compared to 4.6% for other channels). Gaming and telco experience the highest fraud attempt rates in H1 2021, while fraud attempt rates in other sectors are declining. Read more…

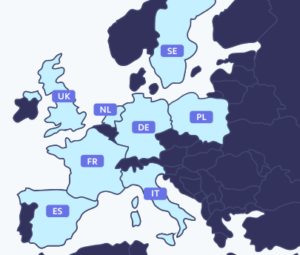

The state of European checkouts in 2021

Stripe analyzed the top 800 e-commerce businesses across France, Germany, Italy, the Netherlands, Poland, Spain, Sweden, and the UK and found 94% of checkouts had at least five basic errors. Most common issues include poor card information formatting and error handling, not offering popular payment methods, and not allowing customers to save their payment method for future use. When combined, they add up to a needlessly difficult checkout experience for customers and lost sales. Read more…

PayPal takes stake in LatAm SPAC

Digital payments giant PayPal has invested in a Miami-based special purpose acquisition company MELI Kaszek Pioneer, disclosing that it bought 2 million shares for a 6.73% stake. Bloomberg reported the SPAC is backed by Latin American e-commerce behemoth MercadoLibre and venture capital firm Kaszek, which raised $287 million in an offering for the SPAC. The new entity is targeting some 30 potential fintech or e-commerce acquisitions in Brazil, Mexico, Chile, and Argentina. Read more…

Veem partners with Visa to enhance domestic and cross border money movement

Veem clients will have the ability to immediately generate and issue virtual Visa payment cards for business payments to third parties like suppliers or general business expenses. The card program will provide reconciliation and financial benefits to Veem clients, helping to digitize and streamline their manual processes. Veem is also using Visa Direct to enable its US clients to send money directly to a bank account or eligible Visa card in over 160 currencies. Read more…

Cross-border shoppers face 11% more checkout friction than domestic peers

New data reveals global shoppers have come to expect equivalent personalized and streamlined features that make it easy to navigate websites and complete purchases when they’re browsing abroad. According to The Cross-Border Merchant Optimization Index, an examination of 137 eCommerce sites of retail merchants from six countries across six verticals found that cross-border eCommerce checkouts faced 11% more friction than domestic checkouts. Read more…

The future of payments in the Middle East

Despite the region’s digitally savvy population—with smartphone penetration reaching 80 to 90% in leading markets—the region has remained heavily dependent on cash. Only about a third of retail transactions are conducted electronically, thanks to factors such as underdeveloped digital-payments infrastructure and services, underbanked consumer and merchant segments, and a cultural bias toward cash. New government and regulatory initiatives, coupled with new local, regional, and global payment providers, are bringing rapid change. Read more…

Mastercard tapped by Pakistan government to create country’s first cashless zone

Mastercard has signed a strategic digital country partnership with the Special Technology Zones Authority (STZA) in Pakistan to expand the nation’s digital economy and advance Pakistan’s technology sector. In addition to enabling innovation and enterprise, the partnership will see the deployment of the latest digital payment solutions to ease cross-border payments, accelerate the flow of trade, and embed powerful new cyber security capabilities within digital infrastructures. Read more…

New fintech first to combine credit and international money transfers

Pomelo will offer a free, cashless product enabling users to extend their credit abroad while avoiding expensive remittance fees – an industry first. Eric Velasquez Frenkiel, Pomelo founder and CEO said, “The annual outflow of remittance from the US to countries like the Philippines and India is staggering, yet there remain few safe and cost-effective options to send funds to loved ones. Pomelo plans to change that.” Read more…

Synchrony moves into BNPL space with Fiserv Clover

Small businesses will now be able to access Synchrony products and services and accept private label credit card payments via the Clover point-of-sale and business management platform from Fiserv, accelerating growth for small businesses and offering more flexibility and choice in how consumers make purchases. Synchrony’s products via the Clover App Market will help Synchrony’s merchants attract more customers and drive more revenue through a broad suite of financing products. Read more…

LET’S CONNECT