By Jeff Domansky

AR departments talk a lot about AR automation, integrated payments, efficiency, and saving money.

However, new research from Billtrust shows there may be a lot more talk than walk when it comes to modernization in today’s AR departments.

86% of AR leaders rated their departments as “very” or “somewhat” modernized. But only 25% of executives see their AR departments as strategic partners in the business, and only 18% see them as an innovative finance function.

That’s a huge gap between perception and reality.

Billtrust’s new white paper “The State of Accounts Receivable: The Journey to Modernize” points out the perception gaps at the same time as it highlights current AR trends, challenges, priorities, systems, tools, and modernization efforts.

The hard AR realities

Despite the growing availability of innovative AR and AP automation technology and tools, here are just a few of the realities surfaced in the report:

- more than 60% of AR decision-makers said they are mostly manual or a mix of manual and digital processes

- only 40% saw their current AR process as “not frustrating”

- over 40% of AR departments do not offer self-service capabilities

- over 50% do not have real-time integrations with their ERP systems, nor do they have automated integration with their customers’ accounts payable (AP) procure-to-pay platforms

- more than 60% do not have a majority of their payments or invoices as digital, with nearly 30% of payments still using cash and paper checks.

“Clearly, accounts receivable professionals’ perception of modern processes is not aligned with what is considered state-of-the-art,” said Steve Pinado, Billtrust President.

“The study does indicate a small percentage of strategic, innovative and highly modernized AR teams, and our hope is this research draws attention to what can be done to maximize efficiency and leverage the most advanced cash flow acceleration and integrated payments capabilities available,” Pinado added.

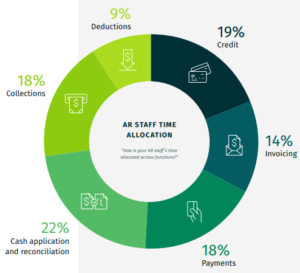

Where AR departments spend their time

Billtrust’s research shows where departments spend a lot of time on functions that can be very easily automated with significant savings in efficiency, human resources, and costs.

Nearly half of the organizations surveyed said they send an average of 10,000 to 25,000 invoices per month, with 30% sending less than that and 22% sending more. AR teams spend the most time on cash application and reconciliation, credit, collections, payments, and invoicing.

“Because benchmarking and self-assessment is so critical to organizational improvement, these findings are important for finance leaders in helping them evaluate their processes and make the connection between strong accounts receivable capabilities, productivity, and world-class customer experiences,” Pinado said.

AR pain points need action

The research shines a spotlight on some of the biggest pain points faced by AR departments. For example, more than half (51%) interact with between 11 and 20 client AP portals every month. Another 22% interact with 21 to 50 client AP portals monthly.

The report quotes a Corporate Credit Manager in the building supply and construction industry: “In many cases, you can’t email or mail an invoice. You have to go to a portal, find the PO#, and enter the relevant information. One of our larger customers recently began using one, and we are now inputting about 20 invoices per day.”

What a headache! And with the proliferation of new client AP portals, it’s likely to get worse before better integrations and solutions reduce the problem. But, on the other hand, it’s something the right AR/AP partner can easily automate, freeing staff to work on other higher-value processes.

At 27%, the lack of integration between AR department processes, internal tools, and external tools/dashboards was the biggest pain point. Following closely were headaches caused by too many AR tools (24%), insufficient customer self-service capability (23%), high credit card costs (22%), manual support for preferred customer billing and payment options (21%), inadequate reporting and insights (21%), poor UX for your team (20%), and efficient processes & workflows (20%).

We could go on. Sufficient to say, other AR system and tools pain points can be strategically eliminated with a welcome improvement in efficiency and lower operating costs. Not to mention higher employee productivity and job satisfaction.

Integration challenges

Integration challenges remain the biggest hurdles for many AR departments.

“The biggest pain point on integrations with AR tools is dealing with legacy technology, a proliferation of payment options, lack of consultants/internal knowledge and belief that what they have is “good enough.” Other challenges include unclear ROI, lack of budget, remote work and lack of executive support,” according to Billtrust.

Imagine if your AR department could eliminate just a few of these pain points?

AR/AP priorities and a path to close the perception-reality gap

AR departments told Billtrust they learned many lessons from the Covid 19 pandemic, including the need for remote work (51%), pressure to extend payment terms (42%), the risk of increased bad debt (41%), need to learn new tools and systems (40%), more use of digital invoices (37%), and a slowdown in cash flow (36%).

Clearly, AR managers need to move as many customers as possible to digital. “Processing checks is expensive and time-consuming. With hundreds of thousands of payments and lockbox fees of 14-15 cents per payment, it’s a considerable expense. When customers are paying digitally, expenses are reduced, and it removes a huge burden from our collections team,” a Worldwide Director of Credit and Treasury for a manufacturing company said.

When it comes to priorities in 2021, respondents said they ranked their top two priorities as people (58%), system/tools/software/technology (52%), data quality and insights (40%), ecosystems and integration (27%), and processes and workflows (23%).

“The technologies and technology initiatives they are most likely to investigate or trial in the next 12-36 months are campaigns to move customers to (accepting) electronic invoices and making electronic payments, credit (credit application and management), adding new forms of payment, real-time payments, integrations with AP portals, eCommerce (for invoices/payments), adding self-service payment portals, adding credit card payments, cash flow forecasting, and cash application,” the report noted.

Yes, it’s challenging times, but automation tools and technologies can help AR departments be higher value, strategic partners within their organizations and with their customers.

You can download a copy of Billtrust’s “The State of Accounts Receivable: The Journey to Modernize” white paper for more detailed analysis and insights here.

Recent PaymentsNEXT coverage of payments automation:

WEX adds new cross-border & payments automation partnerships

Beanworks acquisition highlights payments automation growth

Navigating payments automation, COVID impact, and finding success

LET’S CONNECT