Remittances are a multi-billion-dollar industry and the latest Juniper Research offers valuable insight into the size of the market, the biggest sending and receiving countries, and what’s on the horizon for remittances in the future as a result of digitization.

In 2018, international remittances through formal channels totaled $682.6 billion, up from $613 billion, an 11% increase over 2017.

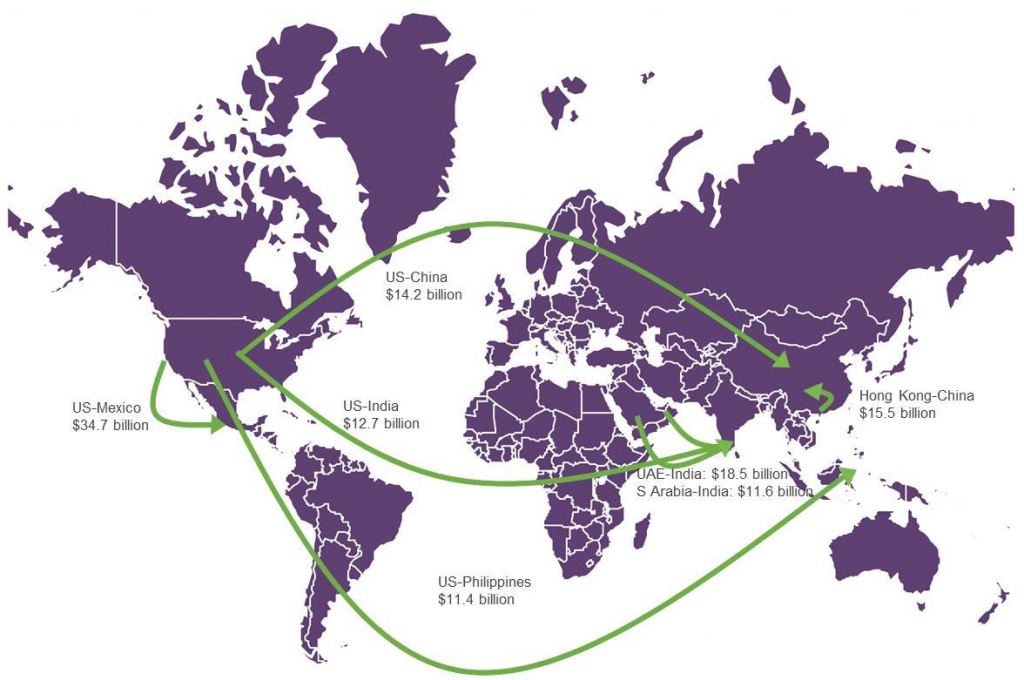

Top remittance corridors included:

- US-Mexico: $34.7 billion in 2018 ($30 billion in 2017)

- UAE-India: $18.5 billion in 2018 ($14B)

- US-China: $14.2 billion in 2018 ($16.1B)

- Hong Kong-China: $14.2 billion in 2018 ($15.5B)

- US-India: $12.7 billion in 2018 ($12B).

As the top destination for immigrants, the US accounted for $158.85 billion in remittances in 2018 (up from $148 billion in 2017), followed by Saudi Arabia ($42.9B), UAE ($42.12B), the UK ($31.43B), Germany ($27.7B), and Canada ($27.83) as the top six remittance-sending countries.

India continued to be the top remittance-receiving country, accounting for $78.61 billion in remittances, followed by China ($67.41B), Philippines ($35.56B), Mexico ($33.81B), and France ($27.01B).

Money transfer operators growing

Digital money transfer operators (MTOs) showed increased market share, revenue growth, geographic expansion, and new partnerships.

For example, Remitly partnered with Ria to add 73,000 new cash pickup locations to its network. While digital is growing, over half of remittances through Remitly were still picked up in cash at physical locations.

In May 2019, WorldRemit announced a partnership with MCB Bank in Pakistan, adding 1,400 cash pickup points. That same month, WorldRemit also partnered with Paga in Nigeria, adding access to 11 million potential customers.

TransferWise, reported revenues for the financial year ended March 2018 nearly doubled, reaching $117 million, up from $66 million in 2017. TransferWise also raised £65 million ($84 million) in debt financing in November 2018, with backing from JPMorgan and NatWest Bank and another $292 million through a share issue in May 2019.

Juniper Research estimates that TransferWise, Xoom, Remitly and WorldRemit, have a combined market share in terms of digital transactions processed that grew from 2.5% globally in 2015 to 8.5% in 2018 and it expects this to reach 11.4% in 2019.

Mobile transfers growing fast

Juniper Research reports the number of mobile money transfers through established MTOs grew from 11.4 million transfers in 2013 to more than 35.8 million mobile transfers in 2018.

Western Union, TransferWise and WorldRemit all have apps with over one million downloads on Google Play, a sign of certain mobile service growth in the future. Juniper Research expects the number of mobile subscribers sending international remittances will grow dramatically from 41.2 million in 2019 to 66 million in 2024.

Remittance fees continue to drop

According to the World Bank, the average cost of sending remittances reached 6.94% of transaction value in Q1 2019, down from 7.01% in Q4 2018. The global weighted average dropped to 5.2%, from 5.64% in Q4 2018 with the lowest average fee in the G8 in Russia at 1.9% in Q1 2019, compared to the highest in Japan, at 10.35% in the same period.

The decrease in fees is driven by two main factors: regulations and agreements by the G8, G20, and the UN to reduce fees for international money transfers and competition among digital MTOs.

Market forecast

Juniper Research predicts international digital money transfer transaction volume will nearly double, reaching 2 billion by 2024 from 1.1 billion in 2019.

Interestingly, it also projects that much of the growth will come from a reduction in “unofficial” remittances by family members.

Mobile transfers are expected to grow from 63% in 2019 to 68% by 2024 due to the superior mobile app-based experiences, growing interoperability of mobile money solutions, and highly competitive pricing from app-based disruptors.

You can read more about Juniper Research’s forecast for international remittances here.

Data courtesy Juniper Research

LET’S CONNECT