It’s time for our regular Friday fintech news feature with all the global fintech news you can use. Vantiv and Worldpay finally concluded their $10 billion merger and the combined company will process an estimated $1.5 trillion in payments annually. PayPal strikes a deal to acquire small business loans specialist Swift Capital. Lending Club bounced back with its second-best quarter earnings ever and $139 million in revenue, up 35% over previous year.

It’s time for our regular Friday fintech news feature with all the global fintech news you can use. Vantiv and Worldpay finally concluded their $10 billion merger and the combined company will process an estimated $1.5 trillion in payments annually. PayPal strikes a deal to acquire small business loans specialist Swift Capital. Lending Club bounced back with its second-best quarter earnings ever and $139 million in revenue, up 35% over previous year.

![]() Fellow Finance launched a new business invoice financing service this week. Fintech startup RailsBank raised new financing of $1.2 million to expand access to banking services with what it claims is five simple lines of code. Sberbank invested $500 million for a 50% stake in Russian e-commerce company Yandex.Market which offers 20,000 merchants and more than 150 million products to its 20 million users.

Fellow Finance launched a new business invoice financing service this week. Fintech startup RailsBank raised new financing of $1.2 million to expand access to banking services with what it claims is five simple lines of code. Sberbank invested $500 million for a 50% stake in Russian e-commerce company Yandex.Market which offers 20,000 merchants and more than 150 million products to its 20 million users.

![]() Irish B2B payments company TransferMate received US regulatory approval. Chinese consumers spent more than $5.5 trillion on mobile transactions, 50 times more than their US counterparts. Tencent customers did more than 600 million mobile transactions in 2016. The latest PYMNTS/InfoScout Mobile Payments Adoption and Usage study shows US consumers are still slow to adopt mobile payments.

Irish B2B payments company TransferMate received US regulatory approval. Chinese consumers spent more than $5.5 trillion on mobile transactions, 50 times more than their US counterparts. Tencent customers did more than 600 million mobile transactions in 2016. The latest PYMNTS/InfoScout Mobile Payments Adoption and Usage study shows US consumers are still slow to adopt mobile payments.

Vantiv To Take Worldpay’s Name In a Merger That Will Create a Global Acquiring Powerhouse

After two delays, processor Vantiv Inc. and London-based merchant acquirer Worldpay Group plc finally announced a formal deal Wednesday that has Vantiv acquiring Worldpay in a deal that creates a global processing powerhouse.

After two delays, processor Vantiv Inc. and London-based merchant acquirer Worldpay Group plc finally announced a formal deal Wednesday that has Vantiv acquiring Worldpay in a deal that creates a global processing powerhouse.

The cash and stock deal values Worldpay at $12 billion, a 34% premium to Worldpay’s six-month volume-weighted average share price and $2.1 billion more than Vantiv’s original bid announced in early July. Worldpay requested two delays from United Kingdom competition regulators to announce a formal bid as it haggled with Vantiv, which is based in the Cincinnati suburb of Symmes Township, Ohio, over better terms for Worldpay shareholders, according to reports in the British financial press.

The combo will create a behemoth in merchant acquiring and other processing services. The new Worldpay will process $1.5 trillion in global merchant-acquiring volume and 40 billion transactions annually, and serve “hundreds of thousands of merchants,” Jansen said on a conference call Wednesday morning. Via digitaltransactions.net

Looking to Expand Its Lending Capacity, PayPal Strikes a Deal to Buy Swift Capital

The financial crisis of 2007-09 forced many banks to retreat from small-business lending, leaving a gap that digital-payments companies have rushed to fill. The latest move in this direction came Thursday, when PayPal Holdings Inc. said it has a deal to buy Swift Financial Corp., a Wilmington, Del.-based lender founded in 2006. The parties refuse to disclose the price.

The financial crisis of 2007-09 forced many banks to retreat from small-business lending, leaving a gap that digital-payments companies have rushed to fill. The latest move in this direction came Thursday, when PayPal Holdings Inc. said it has a deal to buy Swift Financial Corp., a Wilmington, Del.-based lender founded in 2006. The parties refuse to disclose the price.

The acquisition, which is expected to close later in the year, will bring to PayPal a company whose platform makes both conventional loans and cash advances based on data it crunches on its clients’ business performance. In an announcement on its Web site, Swift founder and chief executive Ed Harycki said the company has extended loans to 20,000 companies over the years.

Like PayPal, Swift specializes in fast turnaround. It can make cash advances up to $500,000 with same-day funding, according to its site. “By joining forces, we’ll accelerate our efforts to provide expedient access to working capital that keeps America’s small businesses moving forward,” says Harycki in the announcement. “We look forward to continued growth and success in fulfilling this mission as a part of the PayPal team.” Via digitaltransactions.net

Lending Club Q2 2017 Earnings

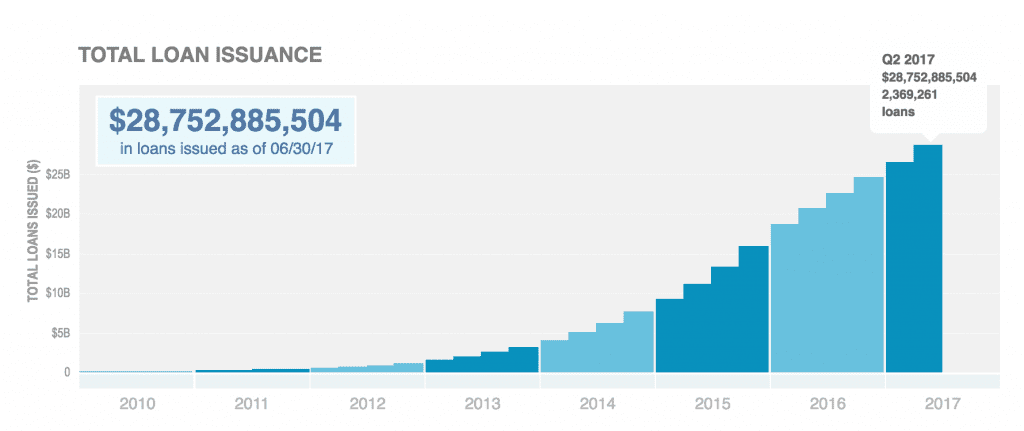

Lending Club’s second quarter earnings marked an important milestone for the company – a return to growth. It seemed as though there was a general consensus that this was a make or break quarter for the company. Originations have been hovering around $1.9 billion since Q2 of last year. This quarter Lending Club announced originations of $2.15 billion for the quarter, up 10% from the prior quarter of $1.96 billion. While this is still down from their previous highs, it shows that the company is back on a growth trajectory.

Lending Club’s second quarter earnings marked an important milestone for the company – a return to growth. It seemed as though there was a general consensus that this was a make or break quarter for the company. Originations have been hovering around $1.9 billion since Q2 of last year. This quarter Lending Club announced originations of $2.15 billion for the quarter, up 10% from the prior quarter of $1.96 billion. While this is still down from their previous highs, it shows that the company is back on a growth trajectory.

Also of significance was net revenue of $139 million, up 35% year over year. The second quarter marked the second highest revenue generating quarter for the company. Lending Club anticipates that the third quarter will be their best quarter yet from a revenue perspective. Below are the other financial highlights for the company. Via lendacademy.com

Fellow Finance launches invoice financing for SMEs

Crowdfunding service Fellow Finance is opening a business invoice funding service for companies to receive funding from investors against their invoices. The new service means small and medium-sized business can get financing sooner, the company said. Companies wishing to get loans can upload their invoices to the service and will receive a funding offer immediately.

Crowdfunding service Fellow Finance is opening a business invoice funding service for companies to receive funding from investors against their invoices. The new service means small and medium-sized business can get financing sooner, the company said. Companies wishing to get loans can upload their invoices to the service and will receive a funding offer immediately.

“Financing a trade receivable is one of the easiest and most reasonable ways for companies to acquire working capital,” said Jouni Hintikka, CEO of Fellow Finance. “By financing an invoice, a firm immediately receives its money, which accelerates money circulation and supports the growth of the business. The invoice finance service by Fellow Finance is technologically a forerunner compared to traditional services and operators in Europe.”

The new product is part of a broader trend of SMEs using alternative forms of financing as it becomes more difficult to get financing through more traditional means, such as bank loans. Fellow Finance entered into the small business lending space in September of last year . Via altfi.com

RailsBank raises $1.2 million in funding

RailsBank, a fintech startup led serial entrepreneur Nigel Verdon that promises to provide access to global banking services with 5 lines of code, has raised $1.2 million in a funding round led by Firestartr. RailsBank says it will enable banks to digitally deliver the services fintech companies desperately need at a low cost; and with a lower compliance risk as conformance with anti-money laundering rules is baked into the platform.

RailsBank, a fintech startup led serial entrepreneur Nigel Verdon that promises to provide access to global banking services with 5 lines of code, has raised $1.2 million in a funding round led by Firestartr. RailsBank says it will enable banks to digitally deliver the services fintech companies desperately need at a low cost; and with a lower compliance risk as conformance with anti-money laundering rules is baked into the platform.

Customers will have access to a core digital ledger banking platform and a complete range of ‘Product Rails’, including Iban creation, issuing cards, sending, receiving and converting money, and accessing credit, provided by financial service partners.

Arkéa Banking Services, a subsidiary of Credit Mutuel Arkéa, has signed up to be first on the platform to deliver Sepa payment services and Ibans across Europe. Via finextra.com

Sberbank invests $500 million in e-commerce joint venture

Sberbank is to spend $500 million to take a 50% stake in Yandex.Market, the e-commerce venture operated by the Russian search engine. The companies will own equal stakes in the joint venture, which will combine the online savvy of Yandex with Sberbank’s digital payments and fulfillment capabilities.

Sberbank is to spend $500 million to take a 50% stake in Yandex.Market, the e-commerce venture operated by the Russian search engine. The companies will own equal stakes in the joint venture, which will combine the online savvy of Yandex with Sberbank’s digital payments and fulfillment capabilities.

“Sberbank’s banking and payments infrastructure will help us develop simple and secure payment solutions on the Yandex.Market platform and will allow us to introduce new features, such as consumer lending,” says Maxim Grishakov, CEO of Yandex.Market. “The proposed investment will strengthen Yandex.Market’s position in the e-commerce segment allowing us improve our logistics capabilities, accelerate the wide-scale introduction of “Checkout on Yandex.Market” and enhance our value proposition to domestic and international merchants.”

Yandex.Market is one of the largest players in the Russian e-commerce market, providing access to over 20,000 domestic and international merchants and 150 million product offerings to an audience of 20 million users. Via Finextra.com

TransferMate to Operate B2B Payments Biz in US

B2B payments company TransferMate has secured regulatory approval to operate in the U.S., according to a press release issued on Monday (Aug. 7).

B2B payments company TransferMate has secured regulatory approval to operate in the U.S., according to a press release issued on Monday (Aug. 7).

Based in Ireland, TransferMate said that upon Britain’s exit from the EU, it will be the only EU payment company that can operate both across Europe and the U.S. The B2B payments company also announced news of two new additions to its executive team.

Former Realex Payments Managing Director Gary Conroy will join the executive team as chief commercial officer, while former Intuit Director of Global Partnerships Rafael de la Vega has been appointed North American board advisor. Via pymnts.com

China Goes Cashless With Consumers Spending $5.5 Trillion Via Mobile Payments, 50 Times More Than Americans

Chinese consumers spent US$5.5 trillion via mobile payment platforms last year, about 50 times more than their American counterparts. By the end of 2016, Tencent alone saw both its active mobile payment accounts and average daily payment transactions exceed 600 million, according to a new report released by Tencent Research Institute, The Chongyang Institute for Financial Studies at Renmin University of China, and research firm Ipsos.

Chinese consumers spent US$5.5 trillion via mobile payment platforms last year, about 50 times more than their American counterparts. By the end of 2016, Tencent alone saw both its active mobile payment accounts and average daily payment transactions exceed 600 million, according to a new report released by Tencent Research Institute, The Chongyang Institute for Financial Studies at Renmin University of China, and research firm Ipsos.

Specifically, 52% of Chinese use cash for 20% or less of their monthly consumption. Around 74% of people stated that they could live for more than a month with only RMB100 (US$15) in cash, and 84% said that they could accept a totally cashless lifestyle.

Fast-food chains conduct 74% of their transactions via mobile payments, with 16% and 6% conducted via cash and credit cards. For street food stands, where mobile payment is the least utilized, around 40% transactions are conducted via mobile payments, with 56% in cash and 1% in credit card, according to the report.

Mobile payment is also the preferred payment option across the retail sector. Convenience stores conduct 68% of their transactions via mobile payments, with 27% and 4% conducted in cash and via credit cards. The mobile payment percentage for supermarkets, shopping malls, brand retailers, appliance stores are 63%, 62%, 57% and 51%, respectively. Via chinamoneynetwork.com

Apple Pay, Mobile Wallet Adoption Usage Stats

Here’s one thing that the last three years hasn’t done: increase the consumer’s appetite to turn their smartphones into a digital payment form factor when they check out in a physical store.

Here’s one thing that the last three years hasn’t done: increase the consumer’s appetite to turn their smartphones into a digital payment form factor when they check out in a physical store.

In fact, the results from the latest PYMNTS/InfoScout Mobile Payments Adoption and Usage study over nine quarters concludes what now sounds like the same song, different verse: Consumers largely haven’t been given a good enough reason to remember to use them, even though when they whip out their plastic cards to pay for something in a store, they often have their phone in their other hand.

Let’s be clear what we mean by usage: It is the percent of people who have the payment method on their phone, who pay at a terminal where they could use that method and then who actually use it to make a purchase.

That reluctance to ditch the leather wallet for the digital version is despite the proliferation of NFC-enabled terminals for the [Fill-in-the Blank] Pays that need NFC to initiate a payment, which is a pretty sobering reality for the “granddaddy” of all the Pays — Apple Pay — despite Apple CEO’s Tim Cook’s ebullient shout-out to Apple Pay in its latest earnings report last week. Via pymnts.com

LET’S CONNECT