The supply chain for products around the world, no matter the source country, is stressed and stretched beyond belief. It’s an open question of what the supply chain will actually look like when the pandemic eases. We’ve gathered a collection of insights from experts that provide context, information, and advice for both suppliers and logistics operators as well as businesses dependent on the smooth flow of goods and products.

Let’s start with a look at supply-chain and coronavirus strategies from some of the top experts in supply chain and logistics management.

“This is a time when companies using a distributed workforce can really shine. Beyond that, get creative — how can you expand your normal offerings? Can you adapt your ‘business as usual’ processes to work in a social distancing climate, or will you need to try adding in new products, services or workflows? The truth is that we don’t know how long American life is going to be on pause. Companies that find ways to fit better into this new reality are the ones that are going to thrive right now — and for months, and maybe years, to come,” said Marc Gorlin, Founder, and CEO of Roadie.

Business survival strategies

In the Harvard Business Review, authors Tom Linton and Bindiya Vakil write, “Some companies, such as General Motors, have gone beyond [24 x 7 monitoring] and spent many years extensively mapping their supply chains. Mapping involves engaging suppliers to understand their global sites and subcontractors, as well as knowing which parts originate or pass through those sites. Companies who invest in this type of effort benefit when disruptions happen because they are able to triangulate within minutes or hours how their supply chain could be impacted in the days, weeks, months to come.”

”As COVID-19 spreads globally, we are seeing increased supply chain disruption, but also changes in consumer spending habits,” commented Sarah Watt, senior director analyst with the Gartner Supply Chain practice. “Supply has been impacted in three primary ways: limited access to employees due to quarantines, factory closures or manufacturing slowdowns and limited access to logistics to move goods. Most supply chain organizations are in crisis management, assessing impacts and response on a daily, if not hourly basis.”

Dan Khasis, founder and CEO of global route optimization company Route4Me, says despite the tight margins, logistics companies have always had the tools and technology to get things done even if they’ve been challenged with obsolete software or legacy systems. “On the other hand, other businesses, that are logistics intense, but don’t think that they are, are the ones who will suffer most. That’s because most businesses have much higher margins than the transportation industry and optimizing their vehicle and dispatch operations is not going to move the needle much for them. So, they simply overlook that part of the business, even though they can save 25-40% on their vehicle, fuel, and labor costs.”

Handling the people problem

The next big challenge is people according to Khasis. “Prior to COVID-19, the bottleneck was finding extra people. However, due to speculations that a wave of terminations is forthcoming, the people will become available. That’s when training and onboarding materials will become critical. Businesses will need to onboard people rapidly if they want to survive,” he adds.

Amazon recently said it’s looking to hire more than 100,000 new workers to handle the booming demand for e-commerce purchases. CEO Jeff Bezos said in a recent letter to employees, he hopes, “people who’ve been laid off will come work with us until they’re able to go back to the jobs they had.”

Supply-chain survival tactics

Knut Alicke, Xavier Azcue, and Edward Barriball say actions taken now to mitigate impacts on supply chains from coronavirus can also build resilience against future shocks. In McKinsey & Company’s Operations newsletter they suggest businesses:

- Create transparency on multitier supply chains, establishing a list of critical components, determining the origin of supply, and identifying alternative sources.

- Estimate available inventory along the value chain—including spare parts and after-sales stock—for use as a bridge to keep production running and enable delivery to customers.

- Assess realistic final-customer demand and respond to (or, where possible, contain) shortage-buying behavior of customers.

- Optimize production and distribution capacity to ensure employee safety, such as by supplying personal protective equipment (PPE) and engaging with communication teams to share infection-risk levels and work-from-home options.

- Identify and secure logistics capacity, estimating capacity and accelerating, where possible, and being flexible on transportation mode, when required.

- Manage cash and net working capital by running stress tests to understand where supply-chain issues will start to cause a financial impact.

Kearney consultants also offer five tips to help companies survive during the pandemic. They include a rapid response guide to create a plan and reduce value-chain disruptions. Kearney suggests taking extra care of employees with enhanced healthy work guidelines. For customers, the consultants say transparency and going digital can help convince customers are both loyal and responsive to their needs. In the Pharma and retail industries, they advise creating a more responsive supply chain for faster home delivery of products and services.

Victor Li, professor at Villanova School of Business, says on CNBC that his biggest concern is stagflation post-crisis. “However, there will be a surge in demand as fear abates, customers return to shopping centers and restaurants, and businesses and consumers look to borrow at historically low-interest rates. Ultimately, the imbalance will create a lopsided recovery with slow output growth with accelerating prices and inflation, in other words, stagflation.“

Supply chain news roundup

In addition to the expert advice above, we’ve gathered the roundup of supply chain news stories and resources to help businesses respond and plan for future potential disruptions better. There are already many lessons learned in many steps business can take, especially of operations are mothballed temporarily, to ensure the supply chain is strong for your business survival and success in the future.

Coronavirus impact: Once pandemic ends, businesses may take 6 months to get up and running normally, says CFO survey

The biggest task facing the world right now is stopping the spread of the coronavirus. But even when the global public health crisis is under control and global supply chain disruptions caused by COVID-19 end, many large companies expect that business will not return to normal for between three to six months. That’s according to the latest CNBC Global CFO Council survey, in which 40% of companies that already have or expect supply chain issues said it could take between three and six months to get business back to normal once the issues end (25% said six months). Read more…

Gartner: How supply chains can mitigate coronavirus impact

When pushed to make trade-off decisions, supply chain managers must analyze and forecast the impact of the coronavirus on customer demand and product availability. Companies’ business processes are required to reassess their goods and services in order to mitigate the effects of the deadly virus. “Supply chain organizations need to frequently reassess their supply and demand plans based on the evolution of the virus and consumer sentiment,” said Sarah Watt, senior director analyst with the Gartner Supply Chain practice. Read more…

How your organization can create a pandemic rapid response

Companies are organizing and identifying gaps in their plans, taking immediate actions across the business, and figuring out how to stay responsive to situations as new information about COVID-19 comes out daily. Executive teams must demonstrate leadership to ensure the safety and health of every employee while also focusing on business continuity. You’ll need a rapid response framework to sustain your enterprise during the pandemic and set it on solid footing for what comes after. Read more…

Supply-chain recovery in coronavirus times – plan for now and the future

Many businesses are able to mobilize rapidly and set up crisis-management mechanisms, ideally in the form of a nerve center. The typical focus is naturally short term. How can supply-chain leaders also prepare for the medium and long terms—and build the resilience that will see them through the other side? In the current landscape, we see that a complete short-term response means tackling six sets of issues that require quick action across the end-to-end supply chain. These actions should be taken in parallel with steps to support the workforce and comply with the latest policy requirements. Read more…

Inoculating your business against COVID-19

For supply chains, lessons learned from the disruptions associated with past crises such as the 2003 outbreak of SARS or the 2011 Fukushima nuclear disaster may not be nearly as instructive as many might expect. China’s share of global manufacturing has more than tripled to almost 30 percent since the SARS crisis, and the country has significantly improved its transportation networks. Today its supply chains are more global and more complex than ever. Learn four key steps to take. Read more…

Gartner: How supply chains can mitigate coronavirus impact

When pushed to make trade-off decisions, supply chain managers must analyze and forecast the impact of the coronavirus on customer demand and product availability. Companies’ business processes are required to reassess their goods and services in order to mitigate the effects of the deadly virus. “Supply chain organizations need to frequently reassess their supply and demand plans based on the evolution of the virus and consumer sentiment,” said Sarah Watt, senior director analyst with the Gartner Supply Chain practice. Read more…

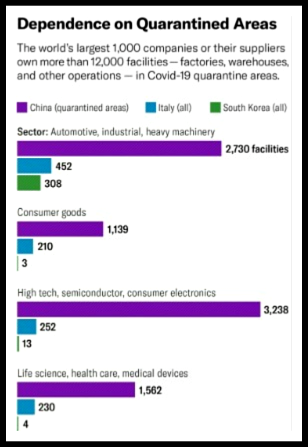

Coronavirus is proving we need more resilient supply chains

As governments and health care agencies work to stop the spread of Covid-19 and to treat those who are infected, manufacturers in more than a dozen industries are struggling to manage the epidemic’s growing impact on their supply chains. Unfortunately, many are facing a supply crisis that stems from weaknesses in their sourcing strategies that could have been corrected years ago. Just how extensive the crisis is can be seen in data released by Resilinc, a supply-chain-mapping and risk-monitoring company, which shows the number of sites of industries located in the quarantined areas of China, South Korea, and Italy, and the number of items sourced from the quarantined regions of China. Read more…

Which tech companies will thrive, survive and suffer in the pandemic

Among the thriving, the obvious candidates are e-commerce companies like JD.com Inc. (down 5%), Amazon.com Inc. (up 3%) and Walmart Inc. (about flat); telecoms that are keeping their pipes from bursting; and food delivery services such as DoorDash and Postmates Inc., which represent “a rare bright spot in harrowing economic times.” The videoconferencing maker Zoom Video Communications Inc. (up 21%) offers a crucial way to collaborate from home and now has the No. 1 app on the Google Play Store. And the social app for neighbors, Nextdoor, has seen an 80% increase in engagement according to CNN. Read more…

Jeff Bezos just posted an open letter to Amazon employees about the coronavirus. Every smart business leader needs to read it

His letter starts: “This isn’t business as usual, and it’s a time of great stress and uncertainty. It’s also a moment in time when the work we’re doing is it’s most critical.” Delivery and logistics people are heroes right now, and Bezos spends the next two paragraphs reminding Amazon employees how grateful people are.

Beyond coronavirus: The path to the next normal

McKinsey & Company consultants Kevin Sneader and Shubham Singhal paint a picture of how leaders can follow a path to the next normal. What will it take to navigate this crisis, now that our traditional metrics and assumptions have been rendered irrelevant? More simply put, it’s our turn to answer a question that many of us once asked of our grandparents: What did you do during the war? Read more…