By Andy Newman, VP of Business Development, Wildfire Systems

In 2024, PayPal demonstrated a forward-thinking approach to truly adding value for customers, launching a series of features designed to enhance user experience and further expand the company’s role in payments. These innovations – PayPal Everywhere, FastLane, and Money Pooling – are all part of PayPal’s strategy to address constantly rising customer expectations and regain investor confidence. What does this mean for banks and other players in the payments industry? We’ll explore how each feature adds meaningful benefits for PayPal’s users and discuss what banks can take away from PayPal’s innovations to improve their approaches and expand wallet share for their own payments solutions.

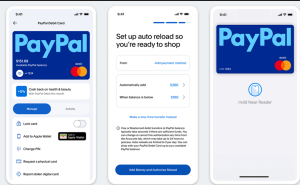

PayPal Everywhere: Increasing convenience while delivering savings

PayPal Everywhere is, in effect, designed to make PayPal the ubiquitous payment tender – even in non-digital transactions. Everywhere is PayPal’s attempt to secure market share and become the omnichannel payments provider of choice. With PayPal Everywhere, customers can pay in physical stores by linking their PayPal Debit MasterCard with Apple Pay. They can also earn 5% cashback rewards on those purchases in the spend category they define. And not to mention, those rewards can stack on top of other rewards enabled by the PayPal Honey shopping rewards program integrated into the PayPal app.

PayPal Everywhere builds on PayPal’s long history of providing reliable, secure transactions that fit naturally into the shopping journey and extend it into the physical shopping realm, creating a consistent omnichannel payment experience. The Everywhere rewards functionality also means value-seeking customers benefit with savings – e.g., cashback rewards – not just on e-commerce transactions and creates a new baseline expectation for rewards. The customer value PayPal’s Everywhere drives may make PayPal hard to beat.

The banking industry can take a cue from PayPal’s approach by thinking about ways to make their payment options more convenient and rewarding. Today’s shoppers are pressed for time and money, and thinking about those concerns for their customers means that banks need to get creative with how they can add value by improving both time and money savings for their customers.

FastLane Guest Checkout: Improving conversion and saving time

PayPal’s FastLane feature, also launched in 2024, aims to create a smoother guest checkout on e-commerce sites. With FastLane, non-members can complete a guest checkout purchase more quickly, helping merchants reduce cart abandonment rates. FastLane helps merchants recognize shoppers early in the checkout process, allowing customers to fill in their saved information from PayPal into the merchant guest checkout process with a one-time passcode.

PayPal leveraged its strategic partnership with Fiserv by expanding the FastLane benefits to Fiserv merchant clients with a single connection point to the FastLane feature. This feature means a faster, hassle-free guest checkout experience for PayPal customers. However, merchants benefit too – PayPal cites up to 50% higher guest shopper conversion rates than non-Fastlane users.

Banks and payment providers can look to this new feature as an example of prioritizing checkout speed and security and streamlining the payment process by reducing extraneous identifying fields from the customer. At the same time, introducing streamlined checkout flows like FastLane also shows payment providers how to create benefits for their merchants. Finally, PayPal’s expansion of its existing partnership with Fiserv provides an excellent example of working with strategic partners who can create win-win solutions benefiting both customers and brands.

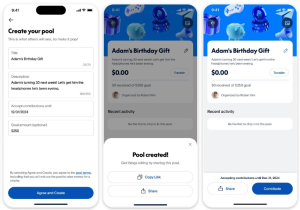

Money Pooling: Enhancing collaboration and flexibility

The Money Pooling feature allows PayPal users to pool funds for shared expenses. It was announced in November 2024 – perfect timing as we head into the gifting season. PayPal notes that some of the popular use cases include group-funded gifts, group travel, and special events like concerts or sporting events. Money Pooling delivers customer value in the form of convenience and simplicity.

Banks can look to features like Money Pooling as an example of listening to customers and paying attention to trends, and in turn, offering payment products and features that align with how people want to use payments products in new, not-yet-anticipated ways. Banks should be talking to their customers regularly, whether by conducting focus groups or surveys or simply analyzing customer service interactions for recurring patterns of inquiry. Gathering insight from departing customers can be helpful as well. Then (easier said than done), they should use what they learned to figure out how to prioritize and implement the most recurrent themes.

Key Takeaways: Learning from PayPal’s customer-centric strategy

Each of these new PayPal features underscores the recurring theme of creating customer value. PayPal demonstrates a deep understanding of its users’ pain points, from the need for convenience and accessibility to features that simplify collaborative payments. It has clearly followed a roadmap of doubling down on creating even more value for its customers.

The derivation of more and more value from a brand ultimately leads to greater customer loyalty and retention. Over one-third of customers report they switched brands over the past year. Providing convenience, financial benefit/savings, and consistency delivers customers the right value-added services to customers. That can be the key to longer relationships and reduced customer attrition.

About the Author

At Wildfire, Andy Newman develops strategic revenue-enhancing partnerships with financial institutions and fintechs, helping them incorporate value-adding customer loyalty features powered by Wildfire’s platform. He has deep experience in partnerships in the payments and loyalty space, having held leadership positions at Cardlytics, Truaxis (acquired by MasterCard), and then at MasterCard itself as Vice President of Loyalty Solutions. Andy founded his retailer consulting firm in 2018, counseling early-stage Series A companies on business development and vertical account management, generating fast-track growth and market expansion for his clients through the use of fintech technology.