Mobile is now baked into our payments and banking structure. But it’s always useful to look over the horizon and see what’s coming, what’s trending and who’s likely to disrupt or redirect the industry. So, here’s the latest in mobile payments.

Alipay plans to introduce its mobile payments platform to the US in partnership with First Data. HSBC launched Apple Pay in Australia for its Visa and MasterCard holders as well as another 20 US banks. Adding loyalty points using facial recognition or selfies could be coming sooner rather than later to Android Pay. Starling Bank introduced a UK payments app using Pay by Bank.

Alipay plans to introduce its mobile payments platform to the US in partnership with First Data. HSBC launched Apple Pay in Australia for its Visa and MasterCard holders as well as another 20 US banks. Adding loyalty points using facial recognition or selfies could be coming sooner rather than later to Android Pay. Starling Bank introduced a UK payments app using Pay by Bank.

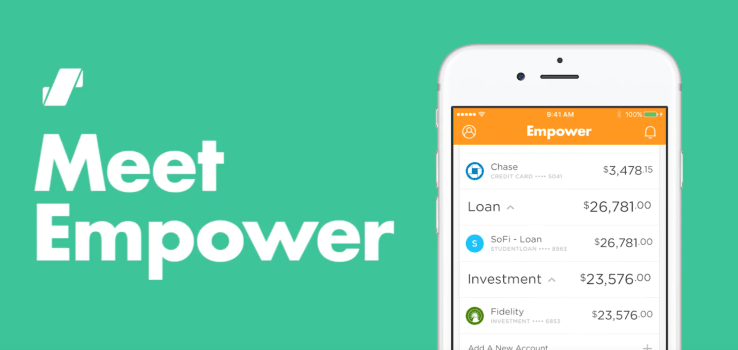

In the UK, mobile apps for current accounts are everywhere and The Independent looks at the leading apps including Triodos, Coconut, Monzo, Atom. DiPocket and  Tandem. New iOS mobile payments and savings app Empower, hopes to attract consumers who want to replace limited bank apps with a more full-featured tool. It looks like Samsung Pay will launch shortly in the UK and in France in September as it continues its global rollout.

Tandem. New iOS mobile payments and savings app Empower, hopes to attract consumers who want to replace limited bank apps with a more full-featured tool. It looks like Samsung Pay will launch shortly in the UK and in France in September as it continues its global rollout.

PayPal’s Venmo keeps growing. Venmo processed $6.8 billion in mobile payments, more than double the volume processed in Q1 2016. 38% of Americans and 34% in the EU are willing to give up cash in favor of digital payments according to research by eZonomics.

Alipay, China’s top mobile payment service, expands to the US

China’s dominant mobile payment service is making its move in the US.

China’s dominant mobile payment service is making its move in the US.

Ant Financial, the Alibaba spin-off that operates Alipay, has inked a deal with payment processor firm First Data that will allow its service to be used at point-of-sale with more than four million retail partners in the U.S.. The deal is the first of its kind for Alipay in the US. The two companies previously partnered for a rollout with high-end retailers last year.

Alipay claims 450 million users worldwide. The lion’s share of that number are located in China, but the service has a growing footprint in Southeast Asia and is particularly popular in markets frequented by Chinese tourists because it represents an easier payment method. That’s almost certainly where First Data partners, who now support Alipay, will find significance from this tie-in. Local alternatives such as Apple Pay and traditional credit cards are unlikely to be heavily impacted by this new-found support for Alipay.

The deal itself fits in line with a series of expansions that Ant Financial is undertaking as it looks to grow its business outside of China. Ant has done deals and made investments in Korea, India, the Philippines, Singapore, Indonesia and Thailand in an effort to claim early mover advantage in markets where digital payments and banking are just starting out. Via techcrunch.com

Apple Pay Launches for HSBC Australia and 20 US Banks

HSBC has launched Apple Pay support for customers in Australia for the first time, enabling any Visa and MasterCard branded credit card issued by the bank to be added to Apple’s mobile wallet.

HSBC has launched Apple Pay support for customers in Australia for the first time, enabling any Visa and MasterCard branded credit card issued by the bank to be added to Apple’s mobile wallet.

HSBC said the majority of its customers’ credit card payments are already contactless and it expects Apple Pay will be quickly embraced as part of the wider shift towards tap-and-go payments. The bank has set up a new Apple Pay web page on its site to guide users through the steps needed to add a credit or debit card into the Wallet app on iPhone and iPad.

HSBC joins a growing number of banks in Australia which support Apple Pay, including American Express, ANZ and Macquarie. However, several major issuers such as Commonwealth Bank of Australia, Westpac Banking Corporation, NAB, and Bendigo and Adelaide have resisted supporting the payment system during their failed attempts to collectively negotiate with Apple over gaining access to the NFC chip in iPhones. Via macrumors.com

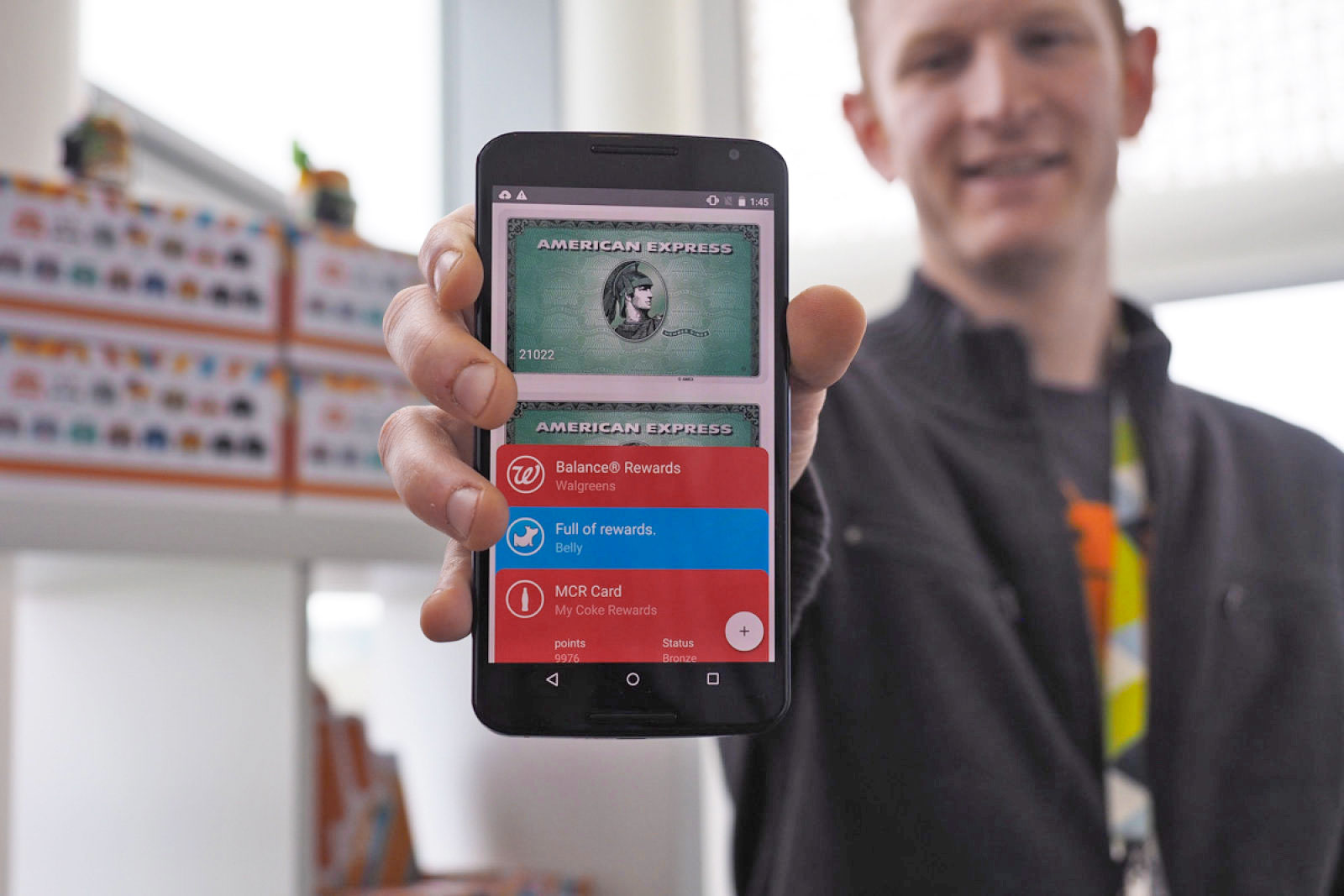

Android Pay could use your face to authenticate loyalty programs

It’s not that hard to add points to your loyalty cards on Android Pay, but it looks like Google is mulling on an experimental feature to automate the process. 9to5google has torn the latest version of the app apart and found lines of code that hint at a feature called “Visual ID,” which authenticates your loyalty points by using facial recognition. Based on the strings the publication found, you’ll have to create a “face template” when you activate the feature. Participating stores that have Visual ID cameras installed will then confirm your identity when you walk in. Once the system determines that it’s you, and it ascertains your location using Bluetooth, Google will send them your loyalty details.

It’s not that hard to add points to your loyalty cards on Android Pay, but it looks like Google is mulling on an experimental feature to automate the process. 9to5google has torn the latest version of the app apart and found lines of code that hint at a feature called “Visual ID,” which authenticates your loyalty points by using facial recognition. Based on the strings the publication found, you’ll have to create a “face template” when you activate the feature. Participating stores that have Visual ID cameras installed will then confirm your identity when you walk in. Once the system determines that it’s you, and it ascertains your location using Bluetooth, Google will send them your loyalty details.

The fact that a camera in store can take your picture and identify you sounds like a cause for concern when it comes to privacy. It’s totally different from a CCTV that only captures you on cam without identifying who you are. According to the codes in the app, though, the images Visual ID cameras capture can’t be accessed by the store and are deleted shortly after they’re taken Via engadget.com

Starling to launch Pay by Bank app

Starling BankPay by Bank app has announced a partnership with Starling Bank that will launch its market leading mobile payments service to Starling Bank’s customers. Starling Bank is the first challenger bank to commit to Pay by Bank app’s innovative technology, which enables customers to make real-time payments directly from their existing mobile banking app on their smartphone or tablet.

Starling BankPay by Bank app has announced a partnership with Starling Bank that will launch its market leading mobile payments service to Starling Bank’s customers. Starling Bank is the first challenger bank to commit to Pay by Bank app’s innovative technology, which enables customers to make real-time payments directly from their existing mobile banking app on their smartphone or tablet.

Making payments in this way gives customers complete control over their spending with minimal effort – there is no need to download anything, no new passwords or logins to remember and customers can see their current account balance every time they pay. Customers also benefit from a high level of security as their personal details are never passed to the merchant and remain safe within their banking app.

Pay by Bank app is powered by VocaLink and supported by the UK’s leading banks and acquirers. It is the only service to offer seamless and secure integration between mobile banking apps, current accounts and the Faster Payments Scheme. Via finextra.com

Current accounts: How fintech is revolutionising personal banking

It’s taken a long time for those challengers to be ready to offer such accounts but now several have come to market within a short period. Of course, getting people to change their current account is notoriously tricky; even with the seven-day switching service many customers are nervous about the hassle and potential for frustrating mistakes.

It’s taken a long time for those challengers to be ready to offer such accounts but now several have come to market within a short period. Of course, getting people to change their current account is notoriously tricky; even with the seven-day switching service many customers are nervous about the hassle and potential for frustrating mistakes.

Yet the numbers suggest more people are making the switch, often chasing better rates, perks and introductory bonuses. Data collated by the payments body Bacs shows that almost 96,000 switched accounts last month and 90,000 in February, compared with less than 62,000 in January.

Many current account customers won’t look beyond the big high street banks, if they are prepared to switch at all. And that is why the newly launched challenger current accounts feel they need to offer something different. Via independent.co.uk

Sequoia-backed startup Empower aims to replace your bank’s app

Empower, a startup looking to help millennials better manage their finances, is today launching its mobile app for iOS devices. The new application combines the ability to see an overview of your day-to-day transactions and spending behavior, with other tools to transfer money between accounts, automate your savings, and soon, pay bills and pay down your debt.

Empower, a startup looking to help millennials better manage their finances, is today launching its mobile app for iOS devices. The new application combines the ability to see an overview of your day-to-day transactions and spending behavior, with other tools to transfer money between accounts, automate your savings, and soon, pay bills and pay down your debt.

The goal, explains Empower’s founder Warren Hogarth, is to have Empower be able to fully replace your bank’s app.

“We want to help you take action to get ahead – without you having to exit the app, go to your bank app, remember you password, move money around…[with Empower] from one place, you have control of everything,” he says Via techcrunch.com

Samsung Pay launch in France might take place this September

Samsung continues to expand its mobile payments service in more markets across the globe. Samsung Pay went live in Hong Kong, Sweden, Switzerland and the United Arab Emirates just last week. There’s mounting evidence to support the claim that Samsung Pay will finally be launched in the United Kingdom on May 16.

Samsung continues to expand its mobile payments service in more markets across the globe. Samsung Pay went live in Hong Kong, Sweden, Switzerland and the United Arab Emirates just last week. There’s mounting evidence to support the claim that Samsung Pay will finally be launched in the United Kingdom on May 16.

According to a new report, Samsung is also planning to launch its mobile payments service in France this year. The report claims that Samsung Pay will launch in September for users in France.

A local retailer claims that Samsung wants to launch Samsung Pay in France along with a new smartphone. If that really is the case, the launch might be tied up with the Galaxy Note 8 which is normally launched around the same time every year. Samsung has already confirmed that a new Galaxy Note handset is coming later this year. Via sammobile.com:443

Data Suggests That Venmo Is Winning Mobile Payments

I’ve written about PayPal quite actively in the past. I believe that PayPal’s dominance in the mobile payments industry is underappreciated by the market. Mobile payment technology has come so far in the last decade. Rapid smartphone adoption, alongside a large unbanked population, makes the theme of mobile payments an attractive investment. And in my opinion, there is no better way to invest in mobile payments than to invest in PayPal.

I’ve written about PayPal quite actively in the past. I believe that PayPal’s dominance in the mobile payments industry is underappreciated by the market. Mobile payment technology has come so far in the last decade. Rapid smartphone adoption, alongside a large unbanked population, makes the theme of mobile payments an attractive investment. And in my opinion, there is no better way to invest in mobile payments than to invest in PayPal.

Each quarter I watch anxiously to see the company breakout it’s Venmo user data. Until recently, I believe that the market hadn’t noticed the jewel inside PayPal’s portfolio of payment technology. If you are unfamiliar, Venmo was founded in 2009 as a way to easily transfer money for small goods. In 2012, Braintree acquired Venmo for $26.2 million. In 2013, PayPal acquired Braintree for $800 million. In short, Venmo makes it easy to send and receive money from friends and family.

In the first quarter, Venmo processed $6.8B in mobile payments, more than double the volume processed in the first quarter of last year. Via seekingalpha.com

Square, a futuristic payments company, is rolling out an old-school plastic debit card

As Silicon Valley looks towards a cashless, card-less future, Square’s latest move is a bit of a throwback.

As Silicon Valley looks towards a cashless, card-less future, Square’s latest move is a bit of a throwback.

The mobile payment company is launching a debit card — or rather, a prepaid balance card — that connects to the company’s app rather than a bank account, Recode first reported.

The slick, all-black Visa gives customers a new way to unload the balance accrued from exchanges within Square’s money-transfer service. It also lets holders forgo the one-day delay — or one percent instant-access fee — that otherwise restricts access to freshly received funds. Via mashable.com

Does the Mobile Payment Market Still Have a Security Problem?

It’s not hard to be concerned about the state of mobile payment security these days; after all, we’re living in a world where data breaches are only more common and the credit card we swiped at Home Depot today could be buying someone else drugs tomorrow.

It’s not hard to be concerned about the state of mobile payment security these days; after all, we’re living in a world where data breaches are only more common and the credit card we swiped at Home Depot today could be buying someone else drugs tomorrow.

Mobile payments systems, however, have known about the security issues inherent in their operation since their inception, and have been frantically working under an onus of distrust in order to be popularly accepted at all.

A string of new developments have emerged to address mobile payments security, ranging from tokenization—the practice by which card payment information is replaced with a “token” of random letters and numbers and sent for decryption to the payment receiver—to biometrics, using certain portions of the human anatomy as a unique identifier.

Even the comparatively simple two-factor authentication system, which requires two levels of security clearance, have contributed to protecting mobile payments systems. Via paymentweek.com

Study reveals we’re getting closer to a cashless society

More than a third of Europeans and Americans would be happy to go without cash and rely on electronic forms of payment if they could, and at least 20 percent already pretty much do so, a study showed on Wednesday.

More than a third of Europeans and Americans would be happy to go without cash and rely on electronic forms of payment if they could, and at least 20 percent already pretty much do so, a study showed on Wednesday.

The study, which was conducted in 13 European countries, the United States and Australia, also found that in many places where cash is most used, people are among the keenest to ditch it.

Overall, 34 percent of respondents in Europe and 38 percent in the United States said they would be willing to go cash-free, according to the survey conducted by Ipsos for the ING bank website eZonomics. Via nypost.com

What matters in mobile

That’s what mattered in mobile payments this week You can get free payments industry news briefs every Mon-Wed-Fri morning by subscribing at the top of this page. If you’ve got payments news and research to share, connect with our editor through our contact page.

LET’S CONNECT