By Jason Kolbenheyer, Chief Product Officer, Edenred Pay

Few technologies have generated as much excitement as artificial intelligence (AI). Using machines to solve problems, make decisions, and perform other tasks that typically require human intelligence has the potential to transform back-office functions across the corporate enterprise. This is especially true when it comes to the way that organizations process and pay the invoices they receive from suppliers. AI has the potential to reinvent what has historically been one of the most paper-intensive, labor-intensive, and time-consuming finance and administration functions.

The 5 biggest invoice-to-pay challenges

Manually processing and paying invoices submitted by suppliers is a major headache for organizations. And the pain of manual invoice processing grows as a company grows.

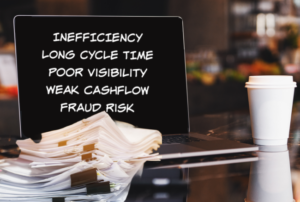

Here are the five biggest invoice-to-pay challenges.

- High cost and inefficiency. AP staff often waste most of their workday on manual, repetitive tasks such as keying data, shuffling paper and emails, fixing errors and mistakes, chasing down information, and responding to inquiries from stakeholders and suppliers. These manual tasks drive up an AP department’s overhead and keep staff from focusing on high-value activities such as analyzing data and collaborating with stakeholders.

- Long cycle times. Manually processing and paying invoices, especially in large volumes, can take a lot of time. An invoice exception, such as a missing purchase order (PO) number, might require days or weeks of back-and-forth calls and emails between stakeholders. Delays in paying suppliers can result in late-payment penalties, missed opportunities to capture early payment discounts, calls and emails from suppliers about their payment status, potential supply chain issues, and difficulty forecasting cash.

- Poor visibility. Manually processing and paying supplier invoices can make AP departments feel like they are flying blind. In a manual AP environment, key information is not captured, captured data is often incorrect, information is not timely, and data is poorly organized. Making matters worse, a lack of integration between invoice-to-pay processes and the accounting or enterprise resource planning (ERP) systems that a global business uses across different regions can lead to data siloes, inefficiencies, and errors in financial reporting.

- Weak cash flow management. Balancing the timing of outgoing payments with incoming revenue can be complex in a manual AP environment, especially with varying payment terms and cycles. And there’s no telling when a check payment will settle. Poor cash management can lead to liquidity issues that affect a company’s ability to meet its financial obligations.

- High risk of fraud. From phishing schemes and account takeovers to Business Email Compromise attacks and phony invoices, high-tech con artists target sophisticated fraud schemes at AP departments. Even the most seasoned AP professional can have difficulty distinguishing a legitimate bank account change request from a phony. On top of it all, paper checks can be intercepted in the mail, whitewashed, and deposited into a fraudster’s account.

It’s for these reasons that more AP departments are deploying AI-powered solutions.

Benefits of AI-powered invoice-to-pay solutions

AI systems use computers and robots to behave in ways that mimic and go beyond human capabilities. Columbia Engineering notes that AI can analyze and contextualize data to provide insights or trigger actions without human intervention. AI is often used interchangeably with machine learning. However, machine learning is a subset of AI that uses technologies and algorithms to identify patterns, make decisions, and improve performance over time.

AI uniquely addresses the invoice-to-pay challenges that AP departments face.

- Reduced costs. AI-powered invoice-to-pay solutions eliminate the manual, repetitive keying tasks that drive up the cost of AP. Natural Language Processing (NLP), a form of AI, uses contextual intelligence and other cognitive tools to extract data from invoices with a higher degree of accuracy than traditional approaches to data capture. AI assists with general ledger coding, and it can match invoice line-item details to PO information in a system of record.

- Accelerated workflows. AI-powered invoice-to-pay solutions digitally route invoices for approval based on pre-defined business rules and historical patterns. Approvers are notified that they have an invoice awaiting their review and are alerted when the invoice is approaching its due date or the expiration of an early payment discount offer. Machine learning understands the actions taken on an invoice to deliver better performance over time. AI can determine the optimal method and date for paying an approved invoice based on factors such as supplier preference, the invoice due date, and whether card rebates are available.

- Autonomous exceptions resolution. AI algorithms can detect anomalies such as mismatched POs, discrepancies in amounts, or missing information and apply pre-defined rules to resolve these exceptions and route them to the appropriate individual for review. Over time, machine learning models learn from past exceptions and resolutions, improving the accuracy and efficiency of handling similar issues autonomously in the future.

- Smart insights at your fingertips. AI-powered invoice-to-pay solutions augment the knowledge of seasoned AP professionals by identifying opportunities for early payment discounts and recommending the optimal time to pay suppliers by analyzing cash flow, invoice terms, and supplier behavior. AI can predict future cash flow needs. AI-powered solutions can drill down into historical invoice data to identify opportunities for process improvement, uncover the source of exceptions, and predict AP staffing needs.

- Mitigate the risk of fraud. AI-powered AP solutions analyze historical transaction data to establish normal patterns and flag any future deviations, such as unusual payment amounts, irregular supplier details, or duplicate invoices. AI models also predict potential fraud by assessing risk factors and identifying high-risk transactions before processing. AI-powered solutions alert AP managers in real time when anomalies are detected.

It’s no wonder more AP departments are embracing AI-powered solutions. According to the Institute of Finance and Management (IOFM) 2023 Benchmarking Reports, twenty-seven percent of AP departments already use AI and machine learning. The adoption of AI in AP is sure to grow as 36 percent of the AP pros surveyed by IOFM say they are learning about the technology.

Why use AI for invoice-to-pay

AI-powered invoice-to-pay solutions bring new efficiency, accuracy, and strategic insight to AP departments, transforming how they process and pay invoices they receive from suppliers. For organizations looking for ways to do more with less, AI offers a compelling solution.

About the Author

Jason Kolbenheyer is the Chief Product Officer at Edenred Pay. Over the last 14 years since joining Edenred Pay (formerly CSI), Jason has spearheaded the development and delivery of several of the company’s key digital payment products, including the virtual card and Edenred Pay’s payment automation platform for accounts payable.

As the Managing Director of Global, Jason collaborates with international business executives, building and nurturing banking relationships in Europe and Asia to service multinational customers. Jason’s always future-focused and dynamic leadership style guides his team in developing award-winning, next-generation, and cross-border payment products at Edenred Pay.Jason frequently speaks at domestic and global financial industry events, sharing insights and best practices on integrated and automated technology innovations in B2B accounts payable.