A busy week in payments news already. We’ve got a roundup of the latest global payments news to keep you in the know and out in front of the latest industry developments. The Merchants Payments Coalition says the Credit Card Competition Act could save merchants and consumers more than $15 billion yearly in card payment costs.

PlayUSA shares new research that says US consumers prefer technology over face-to-face payments, talking to people or human checkouts. Bring on the bots! A Yooz study shows only 15% of US businesses use full end-to-end AP automation though interest is growing. Research by MoneyLIVE-Smart Communications-Salesforce says 88% of banks and lenders believe digital transformation is the best way to rebuild customer trust. With growth plans, Chargebacks911 signs up a former Bank of America exec and the previous Apple Pay director of business development. Fraudsters beware.

Winds of change – the Bottomline Business Payments Barometer found 82% of UK and 88% of US businesses added new payment methods in the past year. The same report showed that 39% of UK and 35% of US businesses were hit by fraud in the past 12 months. BNY Melon and MoCaFi plan to extend payment options to the 4.5% unbanked and 14.1% underbanked communities across the US. Umpqua Bank launched a high-efficiency, integrated small business receivables platform with Fiserv. Finally, in the UK, InComm Payments will provide corporate gift cards for Pandora, the world’s largest jewelry brand.

New estimate shows Credit Card Competition Act would save merchants and consumers $15 billion a year

The Merchants Payments Coalition today welcomed a new estimate showing that passage of the Credit Card Competition Act (CCCA) would save merchants and their customers at least $15 billion a year. Payments consulting firm CMSPI last year estimated the CCCA would save merchants and consumers at least $11 billion a year, based on pre-pandemic 2019 credit card spending. CMSPI revised its estimate and now says the savings would “conservatively” amount to $15 billion. Merchant Payments Coalition

62% of Americans prefer using technology over face-to-face interactions

New Play USA report offers data-rich payment insights and preferences: 60% use self-service kiosks and mobile to avoid talking to people; 20% will continue using mobile apps for curbside pickup even with fees; 71% feel human-run checkouts take longer than self-serve and mobile checkouts; 66% would choose a self-serve kiosk over human-run checkouts; three in five have bought online to avoid the human interaction; and nearly one in six would wait for a self-service kiosk even if a human run checkout had no lineup. PlayUSA

Yooz launches third annual report into the State of Automation in Finance

New research reveals how finance leaders can drive positive change in times of instability. Key findings: only 15% of US businesses use full end-to-end AP automation, while 37% use digital AP invoice payments, and 47% will do so in the next 12 months; US businesses spend 30.25 hrs managing vendor invoices compared to the global average of 20 hrs; 47% of US businesses say remote/hybrid work impacts invoice processing; and 48% are concerned about the availability of accounting talent. BusinessWire

STUDY: 88% of banks and lenders see crisis-driven uncertainty as opportunity to rebuild customer trust through digital transformation

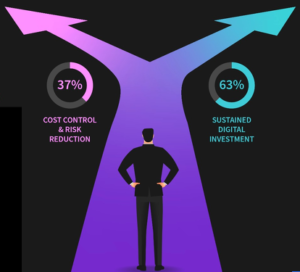

88% of respondents agreed that the current era of uncertainty presents the best opportunity for banks and lenders to regain customer trust since the 2008 financial crisis. The Smart Communications-Salesforce study found a discrepancy among the respondents, with 37% seeking to limit technology spending due to the uncertain future, while 63% are committed to sustained investment in new digital technologies to capitalize on future opportunities. Smart Communications

Bank of America and Apple executives join Chargebacks911 to drive rapid expansion

Chargebacks911announced the appointment of payments industry leaders Guy Harris as its Chairman of the Board and Eric Hoffman as President of Interbank Solutions and board member. Harris was previously head of merchant services at Bank of America before his retirement. Hoffman was the Director of Apple Pay Business Development and one of the first hires by Apple in 2014 to scale Apple Pay during eight years at Apple. BusinessWire

Changing payment preferences and rising fraud create a tough operating environment for finance leaders

Over 80% of businesses (82% in the UK and 88% in the US) were forced to accept new payment methods in the past 12 months. Financial decision-makers are also continuing to tackle a rise in fraudulent activity, as 39% of UK and 35% of US businesses suffered payments fraud in the past year. The Bottomline Business Payments Barometer also noted real-time payment adoption by UK businesses rose from 48% to 55%. GlobeNewswire

BNY Mellon & MoCaFi bring digital payments innovation to US underserved communities

BNY Mellon and MoCaFi, a Black-founded fintech platform leading financial empowerment for traditionally underserved communities, have formed a strategic alliance to extend payment options to unbanked and underbanked communities in the US. A recent FDIC survey estimated 4.5% of US households (~5.9 million) were “unbanked” in 2021, meaning that no one in the household had a checking or savings account at a bank or credit union. Further, an estimated 14.1% of US households (~18.7 million) were “underbanked” in 2021. Cision

Empowering entrepreneurs to build, grow and protect their business

Five startups join the inaugural Mastercard Start Path Small Business cohort to uncover joint innovation opportunities and scale solutions that drive global simple, secure digital experiences for SMEs. Companies included Cumplo, DigiAlly, PayGoal, Tribe Fintech, and Uome. Each startup will get help identifying innovation opportunities and provide forums to pitch their products and solutions to prospects. To date, 360 companies from 49 countries have participated in Start Path. Mastercard

Umpqua Bank launches integrated receivables to save businesses critical time by automatically matching payments with invoices

Umpqua Bank today announced the rollout of Integrated Receivables, a powerful cloud-based platform for business customers that will help accounting departments streamline the processing of high volumes of invoiced payments each month, strengthening companies’ cash flow management and overall efficiency. Developed in partnership with Fiserv, it uses algorithms, machine learning and AI to sift through invoices, emails, and checks to match a payment to its payer, eliminating typical errors and delays.

InComm Payments to become exclusive UK distributor of Pandora corporate gift cards

Pandora, the world’s largest jewelry brand, has selected InComm Paymentsas the exclusive supplier and distributor of Pandora Corporate Gift Cards in the UK. Redeemable across Pandora locations in the UK, the digital gift cards will be available in denominations ranging from £20 to £200. Copenhagen-headquartered Pandora jewelry is sold in more than 100 countries through more than 6,500 points of sale, including more than 2,500 concept stores. Cision

Recent PaymentsNEXT news:

Speeding up chargeback resolutions reaps dividends for business, FIs