In today’s payments news we’ve got two blockbuster payments industry acquisitions and other payments industry stories to keep you current. The biggest news is Blackstone/CVC’s $3.86 billion deal to acquire Paysafe. Global Payments will acquire ACTIVE Verticals for $1 billion, giving it access to the fitness and sports payments market.

In today’s payments news we’ve got two blockbuster payments industry acquisitions and other payments industry stories to keep you current. The biggest news is Blackstone/CVC’s $3.86 billion deal to acquire Paysafe. Global Payments will acquire ACTIVE Verticals for $1 billion, giving it access to the fitness and sports payments market.

The Consumer Financial Protection Bureau said US consumers paid more than $15 billion in overdraft fees, up 2.2% from the previous year. Square posted a 26% increase in quarterly revenue, beating analysts’ expectations. During its earnings call, Apple announced plans to introduce Apple Pay to Denmark, Finland, Sweden and UAE before the end of the year.

John and Patrick Collison, young Irish founders of Stripe now find the successful payments company valued at more than $9.2 billion. Card-not-present losses in Australia were more than $417.6 million in 2016 according to the Australian Payments Network.

John and Patrick Collison, young Irish founders of Stripe now find the successful payments company valued at more than $9.2 billion. Card-not-present losses in Australia were more than $417.6 million in 2016 according to the Australian Payments Network.

Amazon and Alibaba are battling for a share of the Asian e-commerce market which is expected to reach $88 billion by 2025 according to VC Temasek Holdings. India’s Bajaj Finance will buy 11% of mobile payments company MobiKwik for $35.36 million. Top Indian payments leader Paytm will launch a WhatsApp-style messaging and payments app in India. China’s UnionPay will partner with Kenya Commercial Bank to introduce payment services in Kenya and East Africa.

Blackstone/CVC agree £2.96 billion ($3.86 billion) deal for Paysafe

The private equity industry’s appetite for blockbuster payment deals shows no signs of abating as Blackstone and CVC agree to a £2.96 billion ($3.86 billion) deal to acquire online payments company Paysafe.

The private equity industry’s appetite for blockbuster payment deals shows no signs of abating as Blackstone and CVC agree to a £2.96 billion ($3.86 billion) deal to acquire online payments company Paysafe.

Under the terms, each Paysafe Shareholder will receive 590 pence per share, a 42% premium over the group’s average value over the past year.

The deal will give Blackstone and CVC exposure to the online gambling industry, a significant business sector for Paysafe whose pre-paid digital wallet facilitates bets without taking money from bank accounts. Via finextra.com

Global Payments Buys ACTIVE Verticals for $1 billion

Global Payments has made a deal that will allow it to provide digital payments technology to the organizers of fitness and sports events, a relatively untapped market.

Global Payments has made a deal that will allow it to provide digital payments technology to the organizers of fitness and sports events, a relatively untapped market.

The company, a leading provider of payment technology services, said Thursday it had agreed to acquire the communities and sports divisions of event management software firm ACTIVE Network from Vista Equity Partners for about $1.2 billion.

As PaymentsSource reports, digital payments technology for fitness, sports and related events “has traditionally lagged behind more traditional retail chains, giving Global Payments an opportunity to introduce services to reside alongside the event management software that ACTIVE provides.” Via ww2.cfo.com

Americans paid $15 billion in overdraft fees last year, CFPB says

In 2016, U.S. consumers paid a total of $15 billion in fees for bouncing checks or overdrafting — which is when a customer tries to make a purchase without enough money in their account to cover the transaction — according to new data released by the Consumer Financial Protection Bureau.

In 2016, U.S. consumers paid a total of $15 billion in fees for bouncing checks or overdrafting — which is when a customer tries to make a purchase without enough money in their account to cover the transaction — according to new data released by the Consumer Financial Protection Bureau.

All banks with assets over $1 billion must report how much money it brought in via bounced check and overdraft fees, according to CFPB. And this year the industry rang up at $11.41 billion. That’s up 2.2% from 2015, which was the first year banks began reporting total overdraft and bounced check fees to the CFPB.

Adding in its best guess for what smaller banks and credit unions charged, and CFPB says $15 billion is roughly the grand total. Via money.cnn.com

Square beats expectations on higher transactions

(Reuters) – Payments company Square Inc (SQ.N), reported a better-than-expected 26 percent jump in quarterly revenue on Wednesday, as larger businesses used its technology to process transactions and it expanded the range of financial products it offers.

The San Francisco-based company, led by Twitter Inc (TWTR.N) Chief Executive Jack Dorsey, posted a loss of 4 cents per share on revenue of $551.51 million. Analysts on average had expected a loss of 5 cents per share on revenue of $536.27 million, according to Thomson Reuters I/B/E/S.

Square’s flagship technology enables small businesses to accept credit card payments through mobile devices. Its product has grown in popularity because it allows smaller merchants to process credit card transactions without a cash register or expensive systems. Via reuters.comare

Apple Pay to launch in UAE, Denmark, Finland & Sweden later this year

Apple announced during yesterday’s earnings call with Wall Street analysts and investors that its contactless mobile payments system is coming to customers in the United Arab Emirates, Denmark, Finland and Sweden before the end of this calendar year.

Apple announced during yesterday’s earnings call with Wall Street analysts and investors that its contactless mobile payments system is coming to customers in the United Arab Emirates, Denmark, Finland and Sweden before the end of this calendar year.

The system could also launch in Belgium, South Korea, Germany and Ukraine, rumor has it.

Apple’s CFO Luca Maestri shared interesting Apple Pay stats on the earnings call: Apple Pay is by far the number one NFC payment service on mobile devices, with nearly 90 percent of all transactions globally. Momentum is strongest in international markets, where the infrastructure for mobile payments has developed faster than in the US. In fact, three out of four Apple Pay transactions happen outside of the US. Via idownloadblog.com

How Two Brothers Turned Seven Lines of Code Into a $9.2 Billion Startup

Every day, Americans spend about $1.2 billion online. That figure has roughly doubled in the past five years, according to the Department of Commerce, and it’s likely to double again in the next five as the internet continues to devour traditional retail. So it might come as a surprise that the web’s financial infrastructure is old and slow. For years, the explosive growth of e-commerce has outpaced the underlying technology; companies wanting to set up shop have had to go to a bank, a payment processor, and “gateways” that handle connections between the two. This takes weeks, lots of people, and fee after fee. Much of the software that processes the transactions is decades old, and the more modern bits are written by banks, credit card companies, and financial middlemen, none of whom are exactly winning hackathons for elegant coding.

Every day, Americans spend about $1.2 billion online. That figure has roughly doubled in the past five years, according to the Department of Commerce, and it’s likely to double again in the next five as the internet continues to devour traditional retail. So it might come as a surprise that the web’s financial infrastructure is old and slow. For years, the explosive growth of e-commerce has outpaced the underlying technology; companies wanting to set up shop have had to go to a bank, a payment processor, and “gateways” that handle connections between the two. This takes weeks, lots of people, and fee after fee. Much of the software that processes the transactions is decades old, and the more modern bits are written by banks, credit card companies, and financial middlemen, none of whom are exactly winning hackathons for elegant coding.

In 2010, Patrick and John Collison, brothers from rural Ireland, began to debug this process. Their company, Stripe Inc., built software that businesses could plug into websites and apps to instantly connect with credit card and banking systems and receive payments. The product was a hit with Silicon Valley startups. Businesses such as Lyft, Facebook, DoorDash, and thousands that aspired to be like them turned Stripe into the financial backbone of their operations.

The company now handles tens of billions of dollars in internet transactions annually, making money by charging a small fee on each one. Half of Americans who bought something online in the past year did so, probably unknowingly, via Stripe. This has given it a $9.2 billion valuation, several times larger than those of its nearest competitors, and made Patrick, 28, and John, 26, two of the world’s youngest billionaires. Via bloomberg.com

Online credit card fraud on the rise as cyber criminals become more sophisticated

Cyber criminals are becoming increasingly sophisticated about credit card fraud as more consumer payments move online, according to a new report.

Cyber criminals are becoming increasingly sophisticated about credit card fraud as more consumer payments move online, according to a new report.

The Australian Payments Network — the industry’s self-regulatory body — has revealed a significant increase in card fraud, with stolen card details accounting for 78 per cent of fraudulent card transactions.

In its annual fraud data report, the network found “card not present” fraud increased in 2016, netting criminals $417.6 million as fraudsters keep pace with consumers moving online. The report found a 13 per cent increase in card skimming through ghost terminals, and that banks and retailers are constantly exposed to new criminal techniques. Via abc.net.au

Amazon and Alibaba battle it out in Asia

As tech giant Amazon launches its Prime Now instant delivery service in Singapore – taking on the mighty Alibaba – the battle for the Asian e-commerce market is hotting up. Will smaller players get swallowed up?

As tech giant Amazon launches its Prime Now instant delivery service in Singapore – taking on the mighty Alibaba – the battle for the Asian e-commerce market is hotting up. Will smaller players get swallowed up?

Data from Google and Singapore-based sovereign wealth fund Temasek show that the e-commerce sector in the region is expected to skyrocket in the next few years, from $55bn (£42bn) in 2015 to $88bn in 2025. And these are just conservative estimates.

All of this activity in the e-commerce space is what convinced US global online retail giant Amazon to launch the Prime Now service in Singapore last month. It has set up a 100,000 sq ft (9,290 sq m) facility in Singapore – its largest warehouse in an urban centre – and is offering the two-hour delivery service for everything from eggs to baby strollers. Via bbc.com

India’s Bajaj Finance takes stake in mobile payments company MobiKwik

India’s Bajaj Finance Ltd said on Wednesday, it would buy nearly an 11 percent stake in mobile payments wallet company One MobiKwik Systems Private Ltd for about 2.25 billion rupees ($35.36 million).

India’s Bajaj Finance Ltd said on Wednesday, it would buy nearly an 11 percent stake in mobile payments wallet company One MobiKwik Systems Private Ltd for about 2.25 billion rupees ($35.36 million).

Bajaj Finance will enter into a subscription agreement with MobiKwik to buy 10 equity shares and 271,050 compulsory convertible preference shares (CCPS), Bajaj Finance said. Post conversion of the CCPS, the company would hold about 10.83 percent of equity in MobiKwik on a fully diluted basis, the company said in a statement. (bit.ly/2f93XDH)

E-payments in India surged after the country banned old, high-value currency notes late last year. Digital payments in India will jump nearly 10 times by 2020 to $500 billion, according to a 2016 report by Boston Consulting Group. Via reuters.com

Paytm, India’s top digital payment firm, plans to rival WhatsApp with messaging and games

WhatsApp is about to get an unlikely competitor in India, its largest global market based on users. That’s because Paytm, the $8 billion-valued company behind the country’s top digital wallet, is in the process of expanding its services into person-to-person communication, games and other mobile content.

WhatsApp is about to get an unlikely competitor in India, its largest global market based on users. That’s because Paytm, the $8 billion-valued company behind the country’s top digital wallet, is in the process of expanding its services into person-to-person communication, games and other mobile content.

The planned update, which was first reported by the Wall Street Journal, will go live in a beta feature that will ship to users before the end of August, a source with knowledge of the plans told TechCrunch.

The Paytm app will start out mimicking WhatsApp with chat app features including text, image, video and audio messaging, but it plans to go beyond the basics to integrate more sophisticated features. The model is something along the lines of WeChat in China, which today covers media, payments, ride-hailing, commerce and much more. Via techcrunch.com

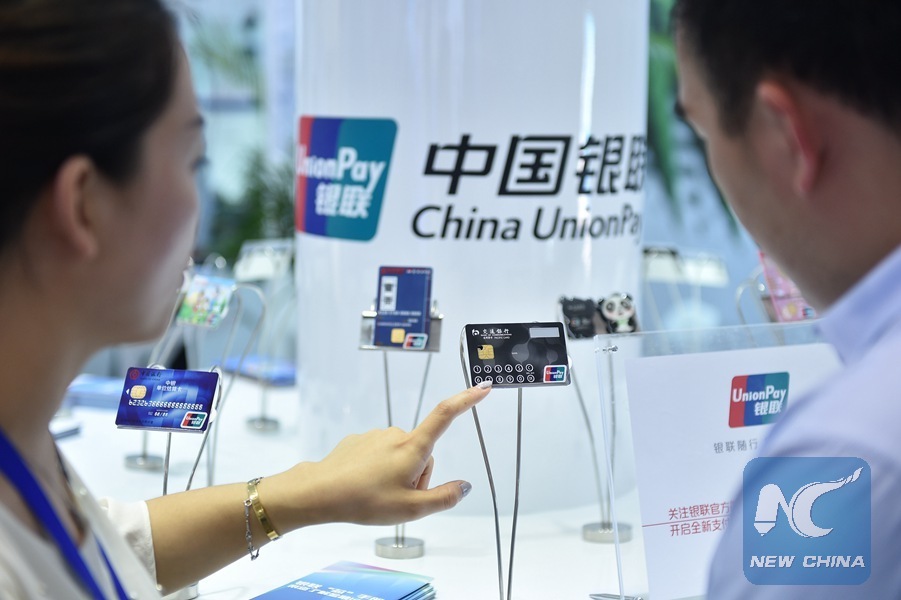

Kenyan bank partners with China UnionPay to boost digital payments in E. Africa

NAIROBI — East Africa’s largest financial institution, Kenya Commercial Bank (KCB) Group and the Chinese financial service giant UnionPay International, on Friday entered into a partnership to boost digital payments in Eastern Africa.

NAIROBI — East Africa’s largest financial institution, Kenya Commercial Bank (KCB) Group and the Chinese financial service giant UnionPay International, on Friday entered into a partnership to boost digital payments in Eastern Africa.

KCB Kenya Head of Channels Dennis Njau said that the collaboration will see the issuance of UnionPay Prepaid Travel Mate cards in the Eastern Africa region.

“The cards will enable the digitalization of payments at retailers, large and small, to take advantage of one of the world’s fastest payment processing networks,” Njau said in a statement released in Nairobi. Via news.xinhuanet.com

LET’S CONNECT