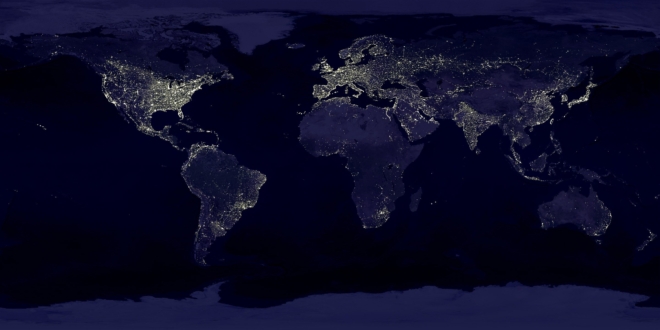

Today, we’re highlighting some of the fintech and other disruptors impacting the payments and financial services industries from the EU and US to Brazil and SE Asia. yStats.com’s new research report said alternate payment methods are outpacing bank cards in global online payments especially in developing markets. E-wallets and digital payment services such as Alipay and Paypal proved most popular.

Netherlands headquartered payments processor Adyen handled $90 billion in payments in 2016, up 80%. Notable are celebrity backers including Facebook’s Mark Zuckerberg and Twitter’s Jack Dorsey. Amazon Payments grew to 33 million users up 43% from the year prior but may have difficulty adding new merchants who perceive it as a competitor in e-commerce.

Netherlands headquartered payments processor Adyen handled $90 billion in payments in 2016, up 80%. Notable are celebrity backers including Facebook’s Mark Zuckerberg and Twitter’s Jack Dorsey. Amazon Payments grew to 33 million users up 43% from the year prior but may have difficulty adding new merchants who perceive it as a competitor in e-commerce.

Alibaba’s Ant Financial is looking to raise $3 billion in debt equity to grow its $75 billion dollar global business. iResearch reports Chinese third-party mobile payments more than tripled in 2016 to $5.5 trillion, more than 50 times the US. In India, Paytm passed more $500 million in payments through its travel group alone. Infibeam will merge with CC Avenue in India to create a company with $300.6 million in online payments.

MercadoLibre’s MercadoPago processed more than 36.8 million transactions in 2016, up 67.7%, making it the clear leader in Brazil. In Jordan, new payments service Cashbasha enables online shopping but allows customers to pay for products and delivery in cash in local currency across numerous Middle East countries.

MercadoLibre’s MercadoPago processed more than 36.8 million transactions in 2016, up 67.7%, making it the clear leader in Brazil. In Jordan, new payments service Cashbasha enables online shopping but allows customers to pay for products and delivery in cash in local currency across numerous Middle East countries.

Alternative Methods Outpace Bank Cards in Global Online Payments, Per yStats.com Report

Payment by credit card no longer dominates the global E-Commerce market, according to the findings of the yStats.com report. Due to the rising contribution of emerging markets to global online retail revenues and changing preferences of online consumers in advanced markets, alternative payment methods collectively accounted for a higher share of E-Commerce sales in 2015 than traditional credit card payments. Through 2020, the share of these alternative payment methods is projected to increase further still, while credit and debit cards are projected to lose several percentage points in their share.

Payment by credit card no longer dominates the global E-Commerce market, according to the findings of the yStats.com report. Due to the rising contribution of emerging markets to global online retail revenues and changing preferences of online consumers in advanced markets, alternative payment methods collectively accounted for a higher share of E-Commerce sales in 2015 than traditional credit card payments. Through 2020, the share of these alternative payment methods is projected to increase further still, while credit and debit cards are projected to lose several percentage points in their share.

E-Wallet has emerged as the top online payment method among the alternatives to bank card. It accounted for close to one-third of worldwide E-Commerce sales and is the second most used payment method in cross-border online shopping, according to a recent survey cited in the yStats.com report. Digital wallet providers such as PayPal and Alipay are preferred by a high double-digit share of online shoppers in countries such as China, Italy, and Mexico. Other prominent alternative payment methods include bank transfer, direct debit, cash on delivery, payment by invoice and in-store payment.

Nevertheless, payment by credit or debit card remains the leading online payment method in multiple advanced markets including the USA, Canada, Japan, Australia, the UK and France. Furthermore, in selected emerging markets, such as Russia, there is a trend towards increased use of payment by bank cards. Overall, the diverse payment method preferences of online shoppers worldwide necessitate offering a range of payment options. Three quarters of online merchants concur with this reasoning by accepting at least 3 different online payment options, according to a 2016 survey cited in the yStats.com report. Via satprnews.com

Mark Zuckerberg & Jack Dorsey-backed Adyen grows transactions by 80% in 2016

A European payments business backed by some of Silicon Valley’s most famous names processed $90 billion (£72.8 billion) worth of payments in 2016.

A European payments business backed by some of Silicon Valley’s most famous names processed $90 billion (£72.8 billion) worth of payments in 2016.

Adyen announced the milestone on Wednesday. It represents 80% growth in volumes on 2015 and the company’s CCO Roelant Prins told Business Insider that Adyen saw “similar” growth in its revenues.

Prins told BI: “The growth is coming from a number of areas but high-level there’s one big push for us that’s driving a lot of the growth and that’s that we continue to expand internationally. Last year we expanded our card processing capabilities in Australia, Brazil, Hong Kong. That means we can sign up local merchants to our platform in those regions.”

Netherlands-based Adyen is a tech-focused payments business that lets businesses manage all their various payments streams from one platform, which covers different geographies and both online and offline sales. It is hugely popular with digital businesses and counts Uber, Airbnb, Netflix, Spotify, and Facebook as key customers. Via businessinsider.com

How Amazon’s payments service could solve its biggest weakness against PayPal

But despite its growth, Amazon Payments is still not available at some of the largest online retailers, including Walmart or Target, giving up a huge chunk of the market to other payment vendors, like PayPal (which now has roughly 200 million users).

Amazon’s biggest weakness against other standalone payment providers is that big online retailers see Amazon as a competitor and fear they might be sharing important sales data by adopting its payments service. It’s why a lot of merchants are still hesitant about Amazon Payments, despite the roughly 300 million accounts stored in Amazon.com. sg.finance.yahoo.com

This $75 Billion Alibaba Business Is Readying to Become Even More of a Global Force of Nature

Ant Financial, the finance affiliate of Chinese e-commerce giant Alibaba, is seeking to raise around $3 billion through a debt issuance to fund its acquisitions, various news outlets reported.

Ant Financial, the finance affiliate of Chinese e-commerce giant Alibaba, is seeking to raise around $3 billion through a debt issuance to fund its acquisitions, various news outlets reported.

Hangzhou, China-based Ant Financial is raising money for future acquisitions and also in part to finance its acquisition of Dallas-based money transfer company MoneyGram International (MGI) . The deal, first announced on Jan. 26, is valued at approximately $880 million in equity but carries an enterprise value of $1.64 billion when you factor in MoneyGram’s debt and cash balances.

“It is the market practice for a globalized company like Ant Financial to raise debt in USD,” said an Ant Financial spokeswoman. The person declined to comment on the amount of debt being raised. Ant Financial’s move to raise funds via debt, instead of selling equity as most Chinese tech firms have usually done in the past, is due to favorable interest rates for bank loans, a source familiar with the matter told Reuters. Via thestreet.com

Research: China FinTech Booms as Mobile Payments Outpace US by 50x

New research has shown that Chinese mobile payments were around 50 times greater than those within the U.S. in 2016, thus illustrating that China’s FinTech market is a strong contender in the market.

New research has shown that Chinese mobile payments were around 50 times greater than those within the U.S. in 2016, thus illustrating that China’s FinTech market is a strong contender in the market.

Research from iResearch in China has found that Chinese third-party mobile payments more than tripled in 2016 to $5.5 trillion. WeChat Pay and Alipay, operated by Ant Financial, dominated the market. Recent research found that Alipay received the biggest investment in 2016 at $4.5 billion as FinTech funding increased in China.

Whereas, in the U.S., mobile payments increased by 39 percent to $112 billion, according to Forrester Research. Continuing the upward trend, Forrester predicts that by 2019, China will continue to lead the mobile payment growth race. In the U.S., it is estimated that this will increase by 2.6 times their 2015 value while China will rise by 7.4 times during the same period. Via cryptocoinsnews.com

Paytm says annualised GMV from travel vertical has crossed $500m

Online payments and e-commerce marketplace Paytm has said that its annualised GMV from its travel vertical has crossed $500 million (Rs 3,342 crore approximately). The platform saw over 10-million tickets across bus, train and air travel booked on the platform.

Online payments and e-commerce marketplace Paytm has said that its annualised GMV from its travel vertical has crossed $500 million (Rs 3,342 crore approximately). The platform saw over 10-million tickets across bus, train and air travel booked on the platform.

The marketplace had launched air ticket booking in June 2016, followed by train reservations. The company had reported bookings of over 1-million tickets in September 2016.

Paytm had announced that it would be investing Rs 300 crore in the vertical to grow the business. The company is also eyeing revenues generated from hotel bookings offering coupons and discounts to users. Via tech.economictimes.indiatimes.com

Infibeam to merge CCAvenue with itself, valuing online payments co at Rs 2,000 crore ($300.6 million)

Infibeam, which already owns a 3.85% stake in CC Avenue through subsidiary NSI Infinium Global, has agreed to acquire another 7.5% stake in it by investing` . 150 crore, it said in a stock exchange filing on Monday .The companies entered also into a memorandum of understanding on the merger.

“CC Avenue subject to regulatory approval by way of amalgamation will merge with Infibeam at the indicative valuation of ` . 2,000 crore,” said CC Avenue chief executive Vishwas Patel. Via timesofindia.indiatimes.com

MercadoLibre: A Unique Growth Opportunity

MercadoLibre’s main markets are Brazil, Argentina, Mexico and Venezuela. The company generates revenues in local currencies, and it reports financial performance in U.S. dollars, so fluctuating exchange rates can have a considerable impact on MercadoLibre’s financial figures. If new economic policies in the U.S. under the Trump administration hurt Latin American currencies, this will materially drag on MercadoLibre’s performance.

MercadoLibre’s main markets are Brazil, Argentina, Mexico and Venezuela. The company generates revenues in local currencies, and it reports financial performance in U.S. dollars, so fluctuating exchange rates can have a considerable impact on MercadoLibre’s financial figures. If new economic policies in the U.S. under the Trump administration hurt Latin American currencies, this will materially drag on MercadoLibre’s performance.

On the other hand, when leaving macroeconomic considerations aside, MercadoLibre is clearly firing on all cylinders. Items sold on the platform reached 47.6 million units during the third quarter of 2016, growing by 40% versus the same quarter in the prior year.

MercadoPago registered 36.8 million payment transactions, an annual increase of 67.7%. Offering a similar perspective, items shipped through MercadoEnvíos grew 86% year-over-year during the quarter, reaching 23.1 million units. Via seekingalpha.com

Jordan Startup CashBasha Localizes The MENA E-Commerce Experience

Here’s a scenario that should sound familiar to those of you in the MENA region: you’re just a few clicks away from completing a purchase on an international e-commerce site on which you’ve found that fashion accessory or favorite book not available in the country you are in, but then, at checkout, you find that either the site does not recognize your credit card, or that the cost of shipping exceeds the product price. Jordanian startup CashBasha’s team observed this emerging market-centric issue to be ripe for a tech solution, and thus built a platform that enables MENA shoppers to buy from global e-commerce portals such as Amazon, and pay for your order with cash.

Here’s a scenario that should sound familiar to those of you in the MENA region: you’re just a few clicks away from completing a purchase on an international e-commerce site on which you’ve found that fashion accessory or favorite book not available in the country you are in, but then, at checkout, you find that either the site does not recognize your credit card, or that the cost of shipping exceeds the product price. Jordanian startup CashBasha’s team observed this emerging market-centric issue to be ripe for a tech solution, and thus built a platform that enables MENA shoppers to buy from global e-commerce portals such as Amazon, and pay for your order with cash.

“We’ve built tools that offer an automated, transparent and all-inclusive service right to your doorstep, as if you’re being served directly by the site itself, but with all the locally preferred emerging market means of transaction, delivery and support,” says Fouad Jeryes, co-founder, CashBasha. CashBasha co-founders Fouad Jeryes and Sinan Taifour’s entrepreneurial pursuits started off in early 2013 after stints in various tech companies, encouraged by the fact that their skills were complementary in nature.

The duo launched PayHyper- a cash collection network, which introduced a creative solution for the issues surrounding cash on delivery (COD) by flipping it as “cash before delivery.” PayHyper was a combination of physical locations and networks of couriers, where customers can shop online and pay for them in cash at trusted locations near them, or at their doorsteps. The decision to pivot from PayHyper and start CashBasha was a result of extensive research by the team, which showed them that 80% of e-commerce retail in the MENA region was flowing from major global e-commerce players. “We believe that one of our success points is that we’ve been able to map how emerging market customers want to be served onto international shopping sites in a manner that hides all the complexities of purchasing from the customer completely,” Jeryes says. Via entrepreneur.com

More payments disruption ahead

We regularly cover fintech, payments and other financial services disruptors. Feel free to subscribe at the top of this page to get regular, free newsletters every Monday – Wednesday – Friday mornings.