The world of mobile payments moves quickly and we’ve got the latest news about mobile payments to keep you current. Big news for app developers from Google as it lets Android Pay users pay with any card inside mobile apps. Now, Android Pay users who link their PayPal accounts can pay at any of 16 million merchants that accept PayPal when they shop via the Chrome mobile web browser. Android Pay will launch in Canada, Brazil, Russia, Spain and Taiwan soon.

New research from Forrester shows the EU mobile payments market will almost triple, rising from $58 billion in 2015 to $165 billion by 2021. 40% of 25 to 34 year olds in the UK prefer to use a mobile app to order food and drink according to research from CGA Peach and Zonal. 67% say they would spend more if able to use mobile payments in apps while 80% prefer to use Apple Pay or PayPal.

New research from Forrester shows the EU mobile payments market will almost triple, rising from $58 billion in 2015 to $165 billion by 2021. 40% of 25 to 34 year olds in the UK prefer to use a mobile app to order food and drink according to research from CGA Peach and Zonal. 67% say they would spend more if able to use mobile payments in apps while 80% prefer to use Apple Pay or PayPal.

While Apple Pay is growing, the company is also expanding its payment services to eventually include online payments using the Safari browser, a prepaid credit card and a partnership with Venmo to share restaurant tabs and send payments to friends. In China, Tencent and its WeChat app are making growth for Apple Pay a challenge.

A new add-on to messaging app Telegram now lets users buy and pay from a chatbot. Hospitality app Rooma aims to make restaurant and hotel payments faster and easier for customers. Washington DC taxis will soon start using Square’s payments platform. Uber’s new pricing system is generating controversy for charging different rates in various neighborhoods. With mobile order and pay systems growing, Apex AnyWhere Flow-Thru Lockers are a potential solution to customer lineups and employee frustration.

A new add-on to messaging app Telegram now lets users buy and pay from a chatbot. Hospitality app Rooma aims to make restaurant and hotel payments faster and easier for customers. Washington DC taxis will soon start using Square’s payments platform. Uber’s new pricing system is generating controversy for charging different rates in various neighborhoods. With mobile order and pay systems growing, Apex AnyWhere Flow-Thru Lockers are a potential solution to customer lineups and employee frustration.

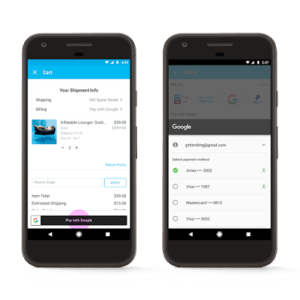

Google will now let users pay with any card they have on file, not just those saved in Android Pay

Google is today making it easier for users to make payments within third-party apps and mobile website, as well as in Google Assistant, when they’re out and about. No longer will the company rely that the card users want to pay with be preloaded in Android Pay – they’ll be able to choose from any payment card they’ve previously used with their Google Account.

Google is today making it easier for users to make payments within third-party apps and mobile website, as well as in Google Assistant, when they’re out and about. No longer will the company rely that the card users want to pay with be preloaded in Android Pay – they’ll be able to choose from any payment card they’ve previously used with their Google Account.

The company says it’s expanding this access to payment options through its Google Payment API – the tool that lets merchants and developers integrate payments in their own sites and applications.

The move makes sense as Android Pay is struggling for traction compared with rival Apple Pay. As one report noted in April, Apple Pay has 86 million users versus just 24 million for Android Pay. Via techcrunch.com he

PayPal And Android Pay Take Commerce To Chrome

Almost exactly one month ago, PayPal and Google made some news with a payment partnership that made PayPal a payment option inside of Android Pay wherever Android Pay is accepted — in-store, in-app and online. Yesterday, they did one better.

Almost exactly one month ago, PayPal and Google made some news with a payment partnership that made PayPal a payment option inside of Android Pay wherever Android Pay is accepted — in-store, in-app and online. Yesterday, they did one better.

Coming soon, to an Android phone near you — Android Pay users who link their PayPal accounts to those Android Pay accounts will be able to pay at any one of the 16 million merchants that accept PayPal today when they shop via the Chrome mobile web browser. Users will need only their fingerprints to authenticate — no user username or password necessary.

“The new facet of the [Android Pay] partnership is really two things,” PayPal COO Bill Ready told Karen Webster yesterday. “The first is that Android Pay inside of Chrome will have tight coupling with PayPal. And importantly, when a user adds PayPal to Android Pay, we are going to allow those Android Pay users to shop at our PayPal merchants.” Via pymnts.com

Android Pay coming to Canada, Spain, Brazil and others, debuts peer-to-peer payments

Even though Android Pay is available in 10 markets now, it’s been a relatively slow, plodding expansion for Google’s mobile payment platform. At Google I/O 2017, the company announced that it is expanding to a further five markets in the coming months, launching in Canada, Brazil, Russia, Spain and Taiwan. There have been numerous hints that Android Pay was imminently launching in Canada and Russia, so it’s nice to finally see the plan put on paper.

Even though Android Pay is available in 10 markets now, it’s been a relatively slow, plodding expansion for Google’s mobile payment platform. At Google I/O 2017, the company announced that it is expanding to a further five markets in the coming months, launching in Canada, Brazil, Russia, Spain and Taiwan. There have been numerous hints that Android Pay was imminently launching in Canada and Russia, so it’s nice to finally see the plan put on paper.

At the same Google I/O session, Google also detailed some interesting new ways that people will be able to make payments, both to vendors and retailers, and to one another through its first peer-to-peer operation.

There’s the Google Payment API, which saves verified credit and debit cards to a Google account and allows users to quickly make payments in-app or on the mobile web. This is different to Android Pay because it’s not platform-specific — you can likely use it on iOS in addition to Android — and is not tied into Android Pay, so it can be used in all countries Google operates. Via androidcentral.com

EU mobile payments market to triple by 2021

Over the next five years the European mobile payments market will almost triple, rising from 2015’s total of $58 billion to $165 billion by 2021.

Over the next five years the European mobile payments market will almost triple, rising from 2015’s total of $58 billion to $165 billion by 2021.

Mobile in-person payments as well as remote payments, such as via an app, will drive growth, says Forrester in its latest report. Mobile in-person will lead growth, increasing almost fivefold between last year and 2021, accounting for nearly 16% of all mobile payments.

Meanwhile, remote mobile payments will increase more slowly across Europe, but will remain the largest segment of the market by a sizable margin. The value of remote mobile transactions is projected to climb at a CAGR of 20% and make up two-thirds of mobile payments by 2021. Payment buttons placed in apps and within mobile websites will claim a growing share of these remote sales. Via bizreport.com

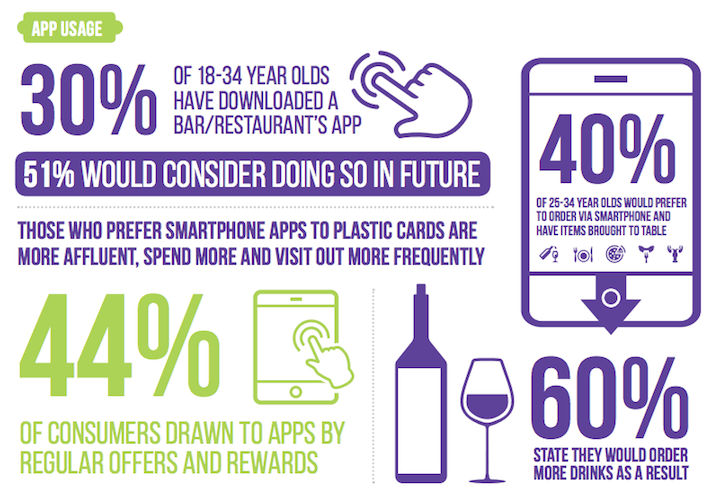

Mobile payment options in apps promote more spending among 25 to 34-year olds

A high percentage of those people willing to use a mobile payment app in a restaurant or bar, would actually spend more money. This is according to the Go Technology report from research company CGA Peach and Zonal, in which 5,000 U.K. adults were polled on habits related to the use of technology when eating and drinking out.

A high percentage of those people willing to use a mobile payment app in a restaurant or bar, would actually spend more money. This is according to the Go Technology report from research company CGA Peach and Zonal, in which 5,000 U.K. adults were polled on habits related to the use of technology when eating and drinking out.

It’s the preference of 40% of 25 to 34 year olds to use a mobile app on their smartphone to order food and drink, and 67% say they would spend more, if they can do so. Avoiding queues at the bar, and getting table service, is mentioned as the major motivator. Trusted, commonplace payment solutions from Apple and PayPal are the preference for 80% of those individuals.

Clive Consterdine, Zonal’s sales and marketing director, said: “The rise of smartphone technology over the last 10 years has changed the way in which we communicate, shop and pay for things. Our latest report demonstrates a growing appetite from consumers to use smartphones as a digital wallet to order and pay for food and drink. These consumers clearly value the improved speed of service and avoiding the hassle of queuing at a bar or waiting for table service.” Via businessofapps.com

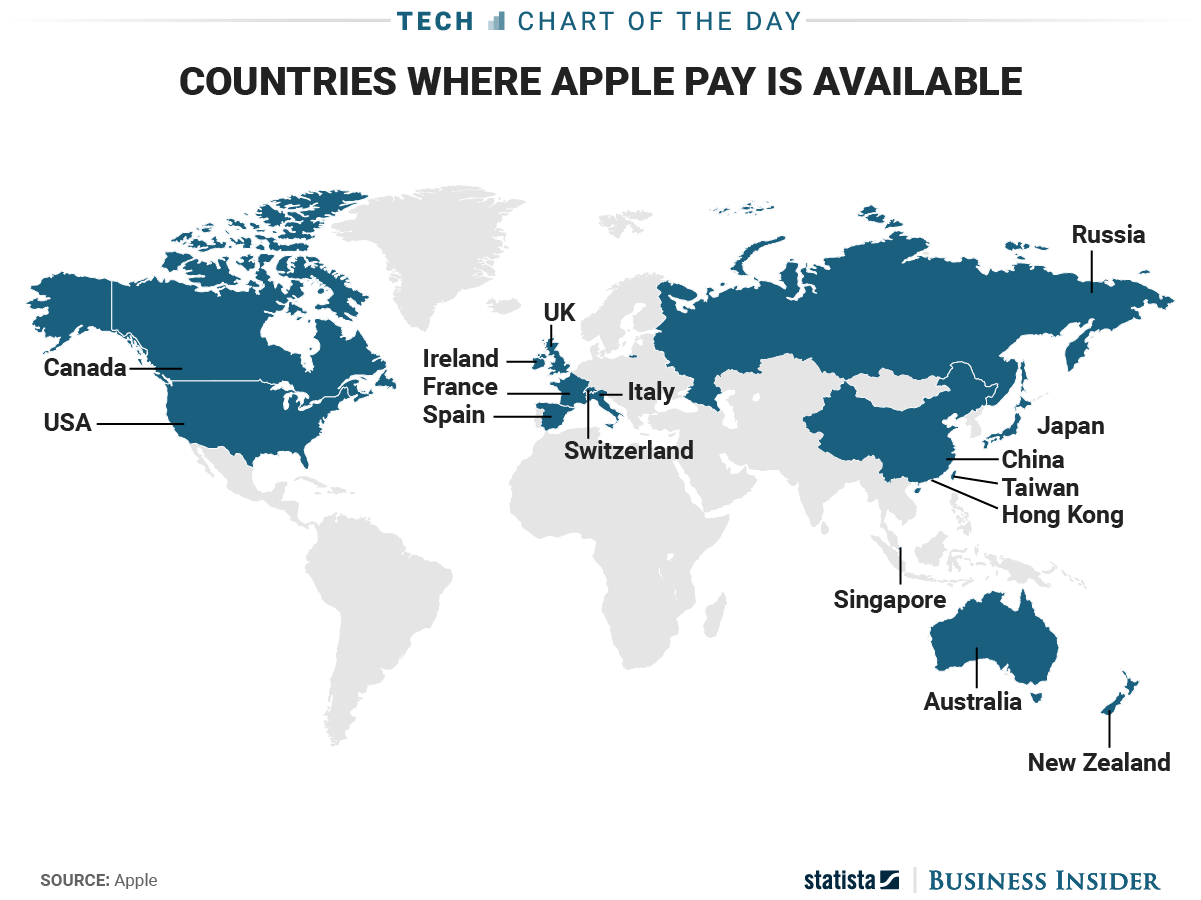

What countries support Apple Pay?

Apple Pay can be really easy to use — if you can find a retailer that accepts it. Apple’s service, which allows you to store your credit cards on an iPhone and pay for goods at retailers by just tapping your phones on a payment terminal, is gradually becoming available in more countries, as this chart from Statista shows. But it’s still nowhere to be found in wide swaths of the iPhone-using world. And even in the countries where Apple Pay is available, it’s still a long way from being universally accepted.

Apple Pay can be really easy to use — if you can find a retailer that accepts it. Apple’s service, which allows you to store your credit cards on an iPhone and pay for goods at retailers by just tapping your phones on a payment terminal, is gradually becoming available in more countries, as this chart from Statista shows. But it’s still nowhere to be found in wide swaths of the iPhone-using world. And even in the countries where Apple Pay is available, it’s still a long way from being universally accepted.

The iPhone maker has a fine line to walk with Apple Pay, balancing the interests of merchants, credit card networks, banks (from whom Apple collects a fee), and its customers. It’s likely to take a while longer before retailer support for Apply Pay and mobile payments in general becomes ubiquitous.

In the meantime, Apple is starting to move its payments service beyond in-store transactions. Apple Pay users can already make purchases with it on the web via the company’s Safari browser. Meanwhile, Apple is considering supporting pre-paid debit cards and is working on a service that would compete with Venmo, whose app allows users to share restaurant tabs and send payments to their friends, Recode recently reported. Via businessinsider.com

App wars: Tencent takes on Apple in China

In most of the world, the success of Apple’s “walled garden” of proprietary software has two elements. First, its attractive services: users tend to be addicted to its iTunes music shop and iBooks store. Second, the complexities involved in switching from an iPhone to another device without losing music files or having to re-download apps.

In most of the world, the success of Apple’s “walled garden” of proprietary software has two elements. First, its attractive services: users tend to be addicted to its iTunes music shop and iBooks store. Second, the complexities involved in switching from an iPhone to another device without losing music files or having to re-download apps.

Neither factor works as well in China. There, many of Apple’s services have not taken off. The American giant missed the boat on music sales in the country, reckons Matthew Brennan of China Channel, a technology consultancy. Its sales of books are blocked by the government.

In addition, few would disagree that its messaging service is a flop and that Apple Pay, its mobile-payment offering, is irrelevant—its market share on the mainland is only 1%. A “genius” employee at an Apple store in Shanghai admits sheepishly that “iCloud doesn’t work very well in China.” Via economist.com

Telegram now lets users buy things from chatbots in its messaging app

Messaging app Telegram has dropped a major update today that sees its service gain support for chatbot payments. It has also added short video messages and new design options for its Instant View reading mode.

Messaging app Telegram has dropped a major update today that sees its service gain support for chatbot payments. It has also added short video messages and new design options for its Instant View reading mode.

Telegram, which puts a focus on security, introduced chatbots nearly two years ago, and now it is bringing support for payments for chatbots. That’s likely to open up a whole series of commercial opportunities for companies that want to use the chatbot platform to connect with consumers.

The most obvious is e-commerce, but real-life commerce through bots — for example, buy a coke in a shop by interacting with its bot — is a possibility that other companies beyond Telegram are considering. Kik CEO Ted Livingston recently told TechCrunch that the introduction of payments is key to making chatbots live up to the hype.

“Imagine a world where you can order pizza, pay for a pair of shoes, hire a cab, or refill your subway pass — all in a few button taps on Telegram,” Telegram explained in a blog post. Via techcrunch.com

Rooam sees opportunity for mobile payments in hospitality industry

One of consumers’ biggest pain points in the hospitality industry over the years has been the process of closing out a bill.

One of consumers’ biggest pain points in the hospitality industry over the years has been the process of closing out a bill.

That process can take anywhere from 10 to 12 minutes, according to one industry estimate. One payment platform provider sees that time frame as an opportunity for mobile payments and is addressing this area differently than other companies have in the past with the hopes of gaining a national following.

Rooam earlier this month officially launched a mobile app for Android and iOS that enables users to open, view and close a bar tab right from their smartphone. Several major restaurant groups in the Washington, D.C., area have adopted the app, including including José Andrés’ ThinkFoodGroup, Neighborhood Restaurant Group, Mike Isabella Concepts and Passion Food Hospitality. Via mobilepaymentstodaywriting.com

DC taxis to feature Square payment system

The Department of For-Hire Vehicles in Washington, DC announced the addition of new digital meter products in taxis, with payments powered by Square. Square technology will support the shift to an all-digital platform on a smartphone or tablet, eliminating outdated traditional meters, streamlining the taxi experience and ensuring equitable rates for consumers and drivers.

The Department of For-Hire Vehicles in Washington, DC announced the addition of new digital meter products in taxis, with payments powered by Square. Square technology will support the shift to an all-digital platform on a smartphone or tablet, eliminating outdated traditional meters, streamlining the taxi experience and ensuring equitable rates for consumers and drivers.

“With the move to an all-digital platform from the legacy taximeter and Square’s payment technology, we’ll be able to provide better service for both our customers and drivers who deserve fair rates and the advanced features they have come to expect in our new digital environment,” Ernest Chrappah, the organization’s director, said in a statement.

Drivers will be invited to download one of the approved meter apps by the Department of For-Hire Vehicles. Riders can use whichever payment method they choose and simply swipe, dip, or tap at the end of their ride. For tipping, riders can choose a preset or custom tip. When the transaction is completed, riders receive an electronic receipt via email or text. Via mobilepaymentstoday.com

Is Uber ripping you off? App is introducing new pricing

Uber revealed it’s charging some of its customers more despite complaints from drivers who say they’re not seeing that money end up in their pockets.

Uber revealed it’s charging some of its customers more despite complaints from drivers who say they’re not seeing that money end up in their pockets.

Daniel Graf, Uber’s head of product, said the company is now charging what it thinks its customers are willing to pay through a new system dubbed ‘route based pricing’, Bloomberg reported.

Based on the new system, a rider traveling between wealthy neighborhoods will be presented with a higher fare than someone heading to a poorer area, even if the time, distance and demand are the same.

But drivers argue they aren’t seeing any of that extra money. In fact, drivers have noticed the fares that show up on their end are lower than what the riders actually pay – a discrepancy Uber finally acknowledged on Friday. Via dailymail.co.uk

Apex Redefines Mobile Order & Pay Programs With AnyWhere Flow-Thru Lockers

By the end of 2017, research predicts mobile order and pay programs will be available at more than 50 percent of QSR locations across North America. This explosive growth has created an array of line-related issues that are frustrating QSRs as much as their customers. The most prominent examples of these issues show how one QSR is redoubling efforts to fix its mobile order and pay program to reverse a directly-related sales decline.

By the end of 2017, research predicts mobile order and pay programs will be available at more than 50 percent of QSR locations across North America. This explosive growth has created an array of line-related issues that are frustrating QSRs as much as their customers. The most prominent examples of these issues show how one QSR is redoubling efforts to fix its mobile order and pay program to reverse a directly-related sales decline.

The AnyWhere Flow-Thru Locker is designed to eliminate the need for employees to interact with mobile order customers, giving them more time to assist in-store customers. It offers employees rear-loading access and an easy-to-use order bump bar and status monitor to process orders fast and efficiently. The lockers are available in standalone and modular, built-in configurations. This makes it easy, fast and affordable to rollout a chain-wide solution that is custom-fit to each location.

Using AnyWhere Flow-Thru Lockers, a customer is automatically sent a unique code on their mobile device when their order is placed in a locker compartment. The secure compartment holding their order opens automatically when the customer scans their code. After grabbing their order, the customer closes the locker door and can leave without waiting in line. This fast and simple process takes less than 10 seconds—no lines, no waiting, no hassles for customers or QSR staff. Via businesswire.com

LET’S CONNECT