Toggle title

+ Mobile is now more than mainstream in payments, banking and financial services. In fact, it’s not just a staple for the young and the restless mobile users, research shows middle-age users are starting to use it as well. According to Salesforce, 31% of millennials use mobile as their primary banking option, followed by 51% of Gen-X and 40% of baby boomers using a combination of mobile and banking.

Mobile is now more than mainstream in payments, banking and financial services. In fact, it’s not just a staple for the young and the restless mobile users, research shows middle-age users are starting to use it as well. According to Salesforce, 31% of millennials use mobile as their primary banking option, followed by 51% of Gen-X and 40% of baby boomers using a combination of mobile and banking.

The top seven payment apps in the world include Paytm (India), Apple Pay (US), Samsung Pay (South Korea), Android Pay (US, UK), Alipay (China, SE Asia), PayPal ( US, UK, Germany, others), M-Pesa (Kenya, Africa). GFK research shows US shoppers are among the highest users of mobile phones in-store but mobile payments are only 2% of total. Gray Owl Network tracked the growth of mobile payments among millennials in 2016. Other research shows 68% of millennials have yet to use P2P payments and only 8% of iPhone users use Apple Pay.

Santander bank customers will soon be able to make payments and transfer funds simply by speaking on their smartphone with the new iPhone SmartBank app. Jeffry Pilcher, CEO of The Financial Brand looks at 19 features consumers want in their banking apps and 19 brands that are delivering on many of these key features.

Santander bank customers will soon be able to make payments and transfer funds simply by speaking on their smartphone with the new iPhone SmartBank app. Jeffry Pilcher, CEO of The Financial Brand looks at 19 features consumers want in their banking apps and 19 brands that are delivering on many of these key features.

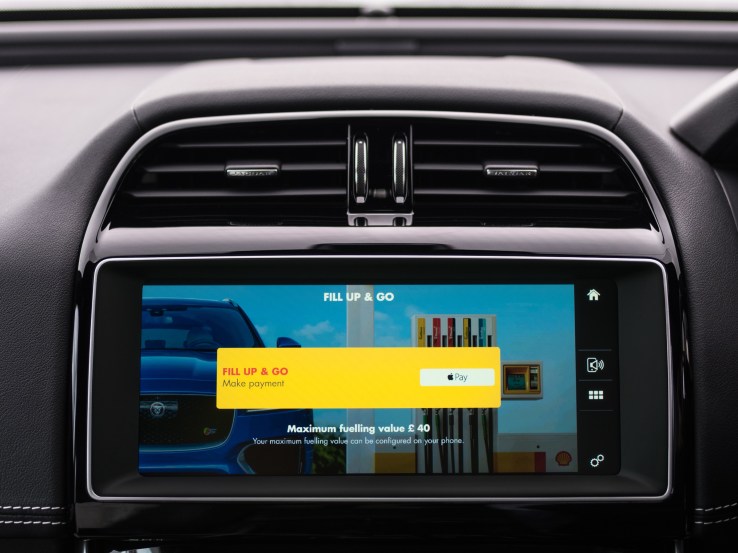

Jaguar and Shell launched an in-car mobile app that lets customers buy gas and snacks using Apple Pay and PayPal. Target is not yet allowing Apple Pay payments, sure to annoy Apple fans. Pay with your shoes? Maybe! IBM and Visa are exploring a wide of potential payments tools including wearables using IBM’s Watson technology

The Rise of Mobile Banking

I once made the mistake of visiting a bank to open a new credit card. After a lengthy wait, the banker began by asking about my plans for the weekend and favorite sports teams. The small talk, while pleasant, wasn’t bringing me any closer to that credit card. I wondered if there was an app I could have used instead.

I once made the mistake of visiting a bank to open a new credit card. After a lengthy wait, the banker began by asking about my plans for the weekend and favorite sports teams. The small talk, while pleasant, wasn’t bringing me any closer to that credit card. I wondered if there was an app I could have used instead.

Turns out, I’m far from the only young consumer looking to escape the in-person process for the ease of mobile banking. According to a January 2017 Salesforce study, 31 percent of millennials use mobile as their primary banking option, nearly double any other channel.

Millennials aren’t the only generation choosing to automate their finances. Fifty-one percent of Gen X and 40 percent of baby boomers also use mobile apps or websites as their primary banking channel. Across all demographics, 62 percent of Americans prefer online banking to any other option, per a 2016 Bank of America survey—an 11 percentage point increase from the previous year. The study found that convenience was the major factor for the uptick. Nearly nine out of 10 surveyed use mobile banking alerts and notifications to stay up to date on deposits made to their account, fraud warnings, or low balances. Via contently.com

The 7 Most Popular Mobile Payment Apps in the World

Everyday we hear about new mobile payment apps, and about how one mobile payment app is attracting millions of new users. In this post, I thought I would highlight some of the most popular mobile payment apps (in no particular order) in the world. As I find new interesting information, I will add/update this post. The reason I call them the most popular mobile payments apps in the world is because of the numbers – simply amazing – check them out.

Everyday we hear about new mobile payment apps, and about how one mobile payment app is attracting millions of new users. In this post, I thought I would highlight some of the most popular mobile payment apps (in no particular order) in the world. As I find new interesting information, I will add/update this post. The reason I call them the most popular mobile payments apps in the world is because of the numbers – simply amazing – check them out.

The apps and the number of users include: Paytm (100 million), Apple Pay (12 million est), Samsung Pay (5 million est), Android Pay (5 million), Alipay (450 million), PayPal (197 million) and M-Pesa (25 million). Via sepaforcorporates.com

US Ranks High in Use of Mobile Devices During In-Store Shopping, but Still Lags in Mobile Payments

New global research reveals that US shoppers are among the world’s leaders in using mobile devices during trips to bricks-and-mortar retail outlets. But in-store mobile payments still account for just 2% of all US transactions – a level dramatically lower than China and other mobile-forward regions.

New global research reveals that US shoppers are among the world’s leaders in using mobile devices during trips to bricks-and-mortar retail outlets. But in-store mobile payments still account for just 2% of all US transactions – a level dramatically lower than China and other mobile-forward regions.

“The opportunity to change US consumer behavior and improve the customer experience through mobile shopping and purchasing is dramatically clear”

When asked where they last used a smartphone or tablet to help them shop, 37% of US shoppers answered “in a store” – one of the highest levels among the 20 countries measured. The United Kingdom recorded the most in-store use of a mobile device (40% of shoppers), with Canada and India also scoring higher than the US. The comparable figure for China was 30%. Via businesswire.com

Millennials Boost Mobile Payment Use in 2016

A new infographic by Gray Owl Network shows that millennials boosted mobile payment use in 2016:

A new infographic by Gray Owl Network shows that millennials boosted mobile payment use in 2016:

1. Most consumers and nearly all millennials are using their phones to shop online.

2. In-store price checking is popular among millennials.

3. Millennials pay by mobile phone regularly.

4. Most millennials receive payment card fraud alerts through their mobile device.

5. Millennials are interested in new forms of mobile convenience. Via letstalkpayments.com

The persistence of traditional payments among digital natives

Marketing strategies devised for millennials by older generations have been based on bad intuition, poorly curated data, and unquestioned, incomplete assumptions. That leads to bad guesses. When you’re designing banking and payment systems for your next generation of customers, bad guesses can be expensive.

Marketing strategies devised for millennials by older generations have been based on bad intuition, poorly curated data, and unquestioned, incomplete assumptions. That leads to bad guesses. When you’re designing banking and payment systems for your next generation of customers, bad guesses can be expensive.

By letting millennials reframe peer-to-peer payments, apps like Venmo seemed poised to disrupt one of the primary roles of banks. Rather than fight shifting tides, the industry sought to be the ones surfing the P2P payment wave. Zelle, the supposed Venmo-killer, looked like the right move for banks to retain millennials,

Certainly, some Gen Y’s have gone all in with phone-based payments. Most, however, are just not that into it. 68 percent of young adults do not use any P2P payment platform at all. And out of the 82 percent of millennial iPhone users who had heard of Apple Pay in another survey, only 8 percent use it. Via mobilepaymentstoday.com

Pay as you speak: Santander revamps voice banking app

Santander customers will be able to make payments with their voice by talking to their smartphone app, in yet another sign of the technological revolution that is transforming the banking industry.

Santander customers will be able to make payments with their voice by talking to their smartphone app, in yet another sign of the technological revolution that is transforming the banking industry.

Under a new pilot scheme, the company has revamped its voice recognition technology to allow customers to make transfers to existing payees by speaking to their iPhone SmartBank app. It is the first high street lender to offer the service and comes after the company launched its so-called “voice assistant banking” technology last year.

“This pioneering technology has huge potential to become an integral part of the future banking experience, playing a transformational role in the industry and redefining how customers to choose to manage their money.” Santander first started to roll out the voice technology last March. Customers could give simple commands to the app, such as asking it to show historic transactions on their accounts. Via telegraph.co.uk

19 Awesome Mobile Banking Apps From Banks and Credit Unions

A great mobile banking app does a lot more than track account balances and send text alerts. Here are 19 features that retail financial institutions should consider integrating into their mobile banking app, along with 19 examples of banks and credit unions that have done so already.

A great mobile banking app does a lot more than track account balances and send text alerts. Here are 19 features that retail financial institutions should consider integrating into their mobile banking app, along with 19 examples of banks and credit unions that have done so already.

1. Intuitive Interface – The design of the interface should be both clean and intuitive. Keep each screen simple, and make buttons, numbers and text large.

2. Visualize Information – Banking is boring, with lots of numbers and text. Good mobile banking apps are functional, while great ones “dress up” otherwise dry information and make it as visually appealing as possible.

3. Quick Balance – Users can “preview” or “peek” at their account balance with a swipe — no login required…. Via thefinancialbrand.com

Jaguar launches in-car payments at Shell gas stations | TechCrunch

In a first for in-car convenience features, Jaguar is teaming up with Shell to launch a new payment feature that lets you use Apple Pay or PayPal (with Android Pay coming later) to easily pay for gas right within their vehicles at the pumps. The feature is coming to the UK first, but will roll out around the world after that.

In a first for in-car convenience features, Jaguar is teaming up with Shell to launch a new payment feature that lets you use Apple Pay or PayPal (with Android Pay coming later) to easily pay for gas right within their vehicles at the pumps. The feature is coming to the UK first, but will roll out around the world after that.

The feature requires installation of the Shell app to make the payments possible, but it’ll show up on your Jaguar’s in-car infotainment touchscreen display once installed, You can then pay using either your PayPal or Apple Pay credentials as mentioned, and all of this is available as of Wednesday in the UK – provided you’ve got a new model Jaguar XE, XF and F-PACE car.

The app lets the driver select how much gas they want, then pre-pay for their fuel. It also shows a receipt of the payment on the display itself, and forwards along a copy to your email address. Via TechCrunch

Target says it has no plans to support Apple Pay in stores

After rumors spread on social media over the weekend that Target planned to finally add Apple Pay to its checkout counters, the company came out with an official statement today saying it doesn’t plan to embrace Apple’s contactless payments anytime soon.

After rumors spread on social media over the weekend that Target planned to finally add Apple Pay to its checkout counters, the company came out with an official statement today saying it doesn’t plan to embrace Apple’s contactless payments anytime soon.

“We have no plans or work underway currently to make Apple Pay available in our stores,” said Target in the statement. Even though the company doesn’t plan to accept Apple Pay in stores, it was one of the first major retailers to embrace Apple Pay in its iOS app.

“We continue to offer Apple Pay for online purchases in the Target app. And while we are exploring mobile wallet opportunities for our stores, we have no updates on our plans to share at this time,” the spokesperson said. Via cultofmac.com

IBM and Visa Eye Wide Mobile Payments Systems

Millions of people already buy things through their phones using systems such as Apple Pay or PayPal every year. But soon you might be able to buy products and pay for services through all kinds of devices — even your shoes.

Millions of people already buy things through their phones using systems such as Apple Pay or PayPal every year. But soon you might be able to buy products and pay for services through all kinds of devices — even your shoes.

IBM wants to make this possible. So it’s teaming up with Visa, the company said Thursday, and using its Watson technology to turn everything from cars to watches to appliances into points of sale. This means any device that connects to the Internet could feature secure payment options. In the next five years, IBM said, it aims to support as many as 20 billion devices.

If it works, a driver could be alerted when an Internet-connect car’s warranty is about to expire or specific parts need replacing, for example. Then the driver could push a button to order new parts or schedule a tune-up. Similarly, a wireless chip could let runners know when they need new shoes, IBM said. Then the technology could recommend a new pair with price information from a preferred retailer. Via time.com

Disruption ahead

Lots more PaymentsNEXT coverage ahead on payments industry news, fintech, mobile, e-commerce, payments research, fraud and chargebacks. Always paying it forward!