McKinsey’s new research report, with insight on shifting consumer sentiment over a five-week timeframe of the global pandemic in 42 countries is an eye-opener.

Researchers gauged consumer sentiment between the week of April 2 through the week of May 3 and what they found was consumer sentiment varied greatly across countries impacted by COVID-19.

Overall, consumers were tentative and not overly optimistic leading into May. “Consumers increasingly expect a lengthy impact on their routines and finances, and most report a reduction in income over the past two weeks,” the report said.

Spending habits may now be locked in

Spending intent was down in two-thirds of the countries during the timeframe of the survey. “While spending on staples and stay-at-home entertainment has always been elevated, spending on other categories such as food takeout and delivery, snacks, personal care, skincare, non-food baby products, fitness and wellness, and gasoline is slowly picking up in regions that are emerging from the crisis.”

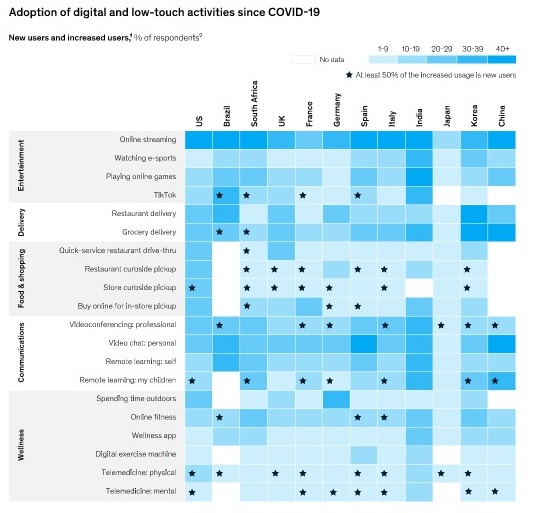

As consumers spend more time at home or work from home, they’ve adopted many new digital and low-touch solutions like videoconferencing, curbside pickup for groceries, and telemedicine. “Looking ahead to the next “normal,” around 40 to 60 percent of surveyed consumers who adopted these new products and services intend to continue.”

Those are key implications for the payments industry, e-commerce retailers.

Checking the temperature for optimism

The report notes that European consumers were the least optimistic, perhaps because they were among the earliest and hardest hit by the coronavirus crisis.

China and India have remained consistently more optimistic and in recent weeks trended upward while Korea and Japan remained less optimistic.

“Although US consumers were more optimistic in the middle of March, optimism has continued to drop and is now 6 percentage points below its level in mid-April, despite the reopening of some parts of the country.”

I can’t imagine this has improved in the US in the last few weeks even though parts of the US have opened up somewhat despite the increase in deaths and incidences in states that failed to implement tighter stay-at-home directives.

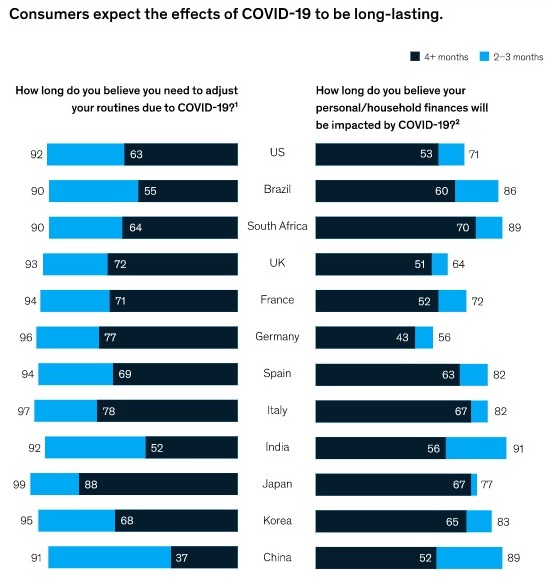

COVID-19 duration expectations

When it comes to how long the pandemic could affect them, 90% of those surveyed expect the impact to last more than two months with 70% in many European countries and Japan expecting an impact for four months or more.

In Brazil, India, and China, residents expect a somewhat shorter duration of impact despite a slight shift towards a longer duration. 45% of Germans expect their finances will recover within two months.

Whose income dropped most?

The degree of income lost “in the past two weeks” varied considerably from Japan (27%), Germany (30%), UK and France (38%), and the US (41%) to hard-hit countries of Brazil and South Africa (70%), India (65%) and China (59%).

Interestingly, while most countries had a small 2%-3% of income growth during the same timeframe with India (17%), China (9%), US (7%), and the UK and South Africa (5%) showing some income growth. Interesting to speculate how and why.

Spending plans

Consumers were planning to decrease spending across most product or service categories in most countries. In many cases, more than 50% of those surveyed planned spending cuts in just about all categories.

Notable, and understandable exceptions included food and groceries, household supplies, personal care products, and home entertainment which all were expected to see modest to stronger spending. China was the only country where many categories showed a small to modest increase in spending plans.

Asian and US consumers plan to increase online spending at least modestly in most product categories. India, Korea, and China appeared ready to spend somewhat more across most categories online.

Time well spent?

The report concluded with several interesting insights into where consumers were spending their time. Online streaming, playing games online, personal video chat in videoconferencing for professional reasons, and remote learning all showed high intent.

In numerous countries, several activities involve many new users including use of social media channel Tik Tok, grocery deliveries, curbside restaurant deliveries, curbside store pickup, and physical and mental telemedicine all showed more than 50% new users in their categories in many countries

“Looking ahead to the next “normal,” consumers are hesitant to resume in-person activities, but they expect to continue some of the digital and low-touch solutions they have adopted during COVID-19.

Of particular concern to retailers are the almost across the board plans not to go to a shopping mall in countries including Germany (-5%), US (-17%), Italy (-20%), UK (-21%), Spain (-25%) France (-26%), and India (-30%). Similarly, in-store shopping plans (excluding grocery stores) were also trending negative in Italy (-7%), Spain (-8%), UK and India (-12%), and France (-15%) while the US was neutral.

“New normal” not looking so normal

In a nutshell, what we consider the “new normal” is going to look much different than before the pandemic. Less in-store shopping, less domestic travel, and fewer plans to visit a shopping mall are likely to continue after COVID-19 passes. Retailers and landlords beware.

The digital and low-touch activities and habits adopted during the pandemic are likely to continue even after the reopening of the economy whenever that happens.

There’s more valuable insight into the psychology behind the pandemic, consumer habits, and spending plans in 12 of the individual countries highlighted in the global research by McKinsey and you can find more information here.